Apparently the negotiations were taken well down the road and an agreement was deemed possible and even plausible. So what is happening now? We actually do not know. Perhaps someone in China found that they could not live with some aspect and moved to force a change hoping to have the advantage.

It is actually worse than that for China. The tariffs have been pressing for a good ten months for China and i do not think that they are actually sustainable. This is actually the right time to ratchet up the tariffs and pressure.

The real horse trading has begun.

It is actually worse than that for China. The tariffs have been pressing for a good ten months for China and i do not think that they are actually sustainable. This is actually the right time to ratchet up the tariffs and pressure.

The real horse trading has begun.

.

Why Trump Has All The Leverage In China Trade Negotiations, In 3 Charts

Those

curious who is more impacted by the sudden re-escalation in trade

hostilities between the US and China can get a quick answer by looking

at the market reaction to Sunday's unexpected news: while the S&P is

down barely 1%, overnight Chinese stocks plunged nearly 6%, their

biggest drop in over three years, indicating just how much more

sensitive to every twist and turn in trade relations Chinese stocks are.

Of course, one can counter just how smaller - and far less relevant - the Chinese stock market is in comparison to the S&P500, which is also the basis for the vast majority of household net worth for Americans, and global investors (whereas in China, it is the local housing that is far more critical and accounts for roughly 70% of household net worth).

But it's not just the stock market that shows why China should tread very lightly in its ongoing negotiations with Trump, or why the US president has decided suddenly to re-escalate. Below we lay out [ ] charts showing just why the US indeed continues to have the upper hand in negotiations with China, starting with the relative importance of the US and European economies to China rather than vice versa.

Of course, one can counter just how smaller - and far less relevant - the Chinese stock market is in comparison to the S&P500, which is also the basis for the vast majority of household net worth for Americans, and global investors (whereas in China, it is the local housing that is far more critical and accounts for roughly 70% of household net worth).

But it's not just the stock market that shows why China should tread very lightly in its ongoing negotiations with Trump, or why the US president has decided suddenly to re-escalate. Below we lay out [ ] charts showing just why the US indeed continues to have the upper hand in negotiations with China, starting with the relative importance of the US and European economies to China rather than vice versa.

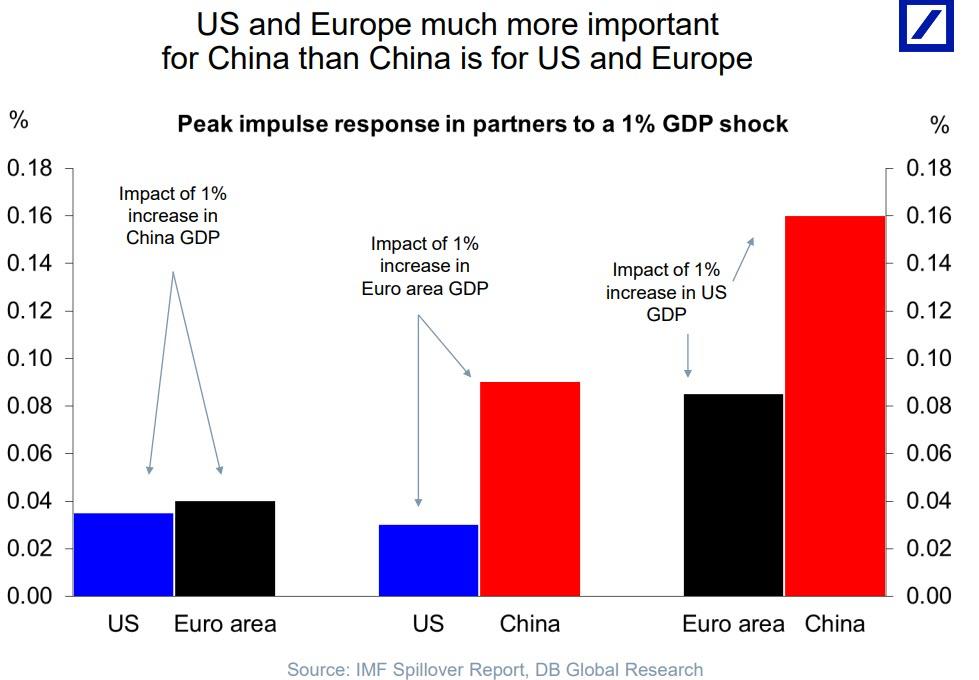

As the first chart below from Deutsche Bank shows, the US and Europe

are "much more important for China than China is for US and Europe" as

China remains the nation with the highest beta, or the highest relative

impact, from a 1% move in either direction for either the US or the Euro

area.

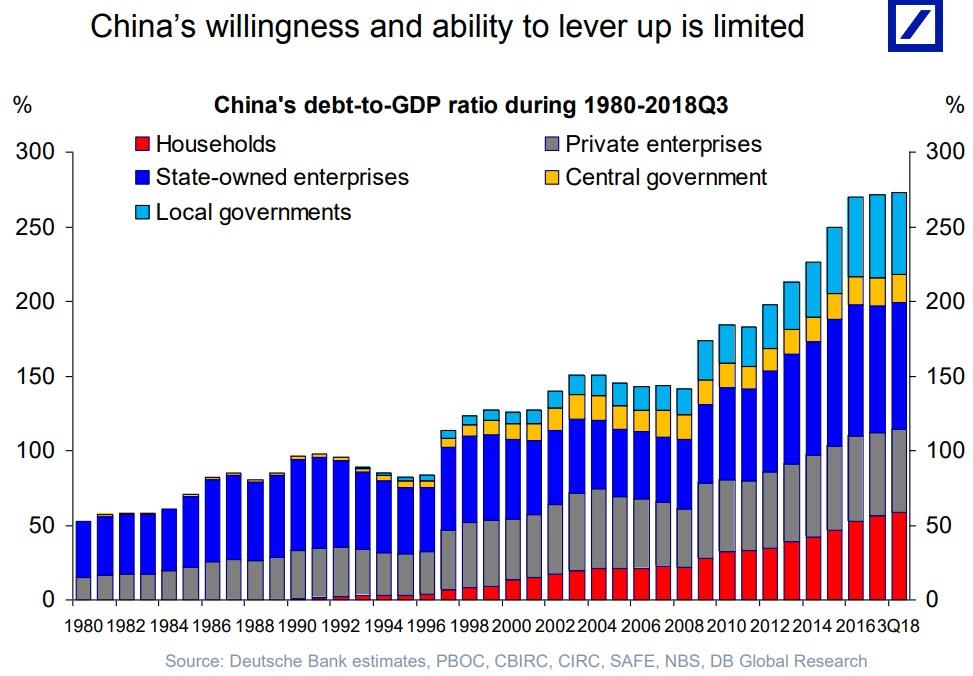

Second, whereas the US is now actively contemplating the launch of

MMT, and exploding the US twin deficit by issuing virtually unlimited

amounts of debt - which it ostensibly can do as long as the US Dollar is

the world's reserve currency - China is already near its leverage peak.

In fact, as shown in the chart below, both China's willingness and

ability to lever up is now quite limited according to Deutsche Bank's

Torsten Slok.

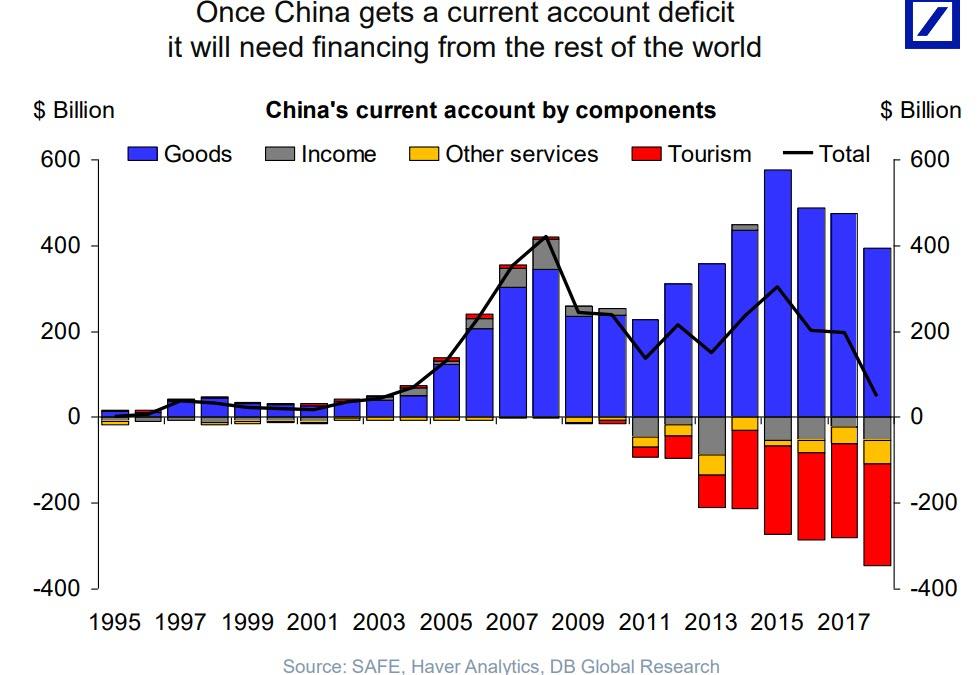

Last, and certainly not least, is what we said back in January represented a "tectonic shift" in

China's economy, when we observed that this year, for the first time in

history, China's current account deficit will turn negative meaning

that China will henceforth need financing from the rest of the world, and specifically the US.

Which is why, as we said five months ago, it is not Beijing that has

leverage over the US, but rather the US whose ability - and desire - to

allocate capital to China could mean all the difference for China's

economic growth, or lack thereof.

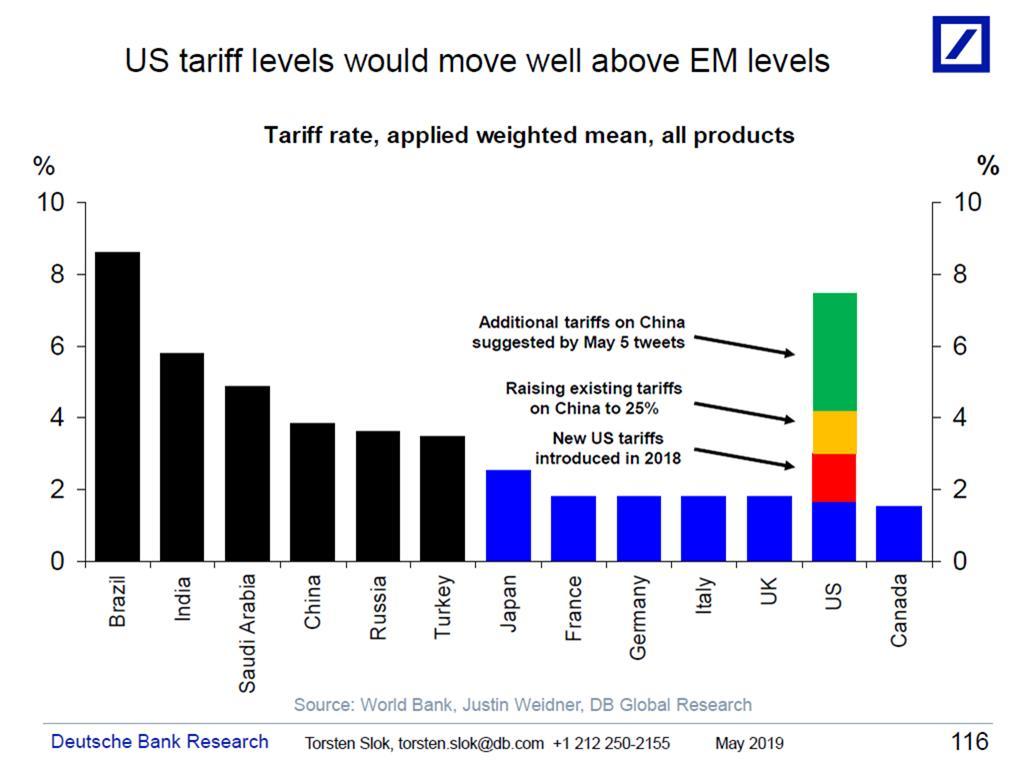

Finally, and tangentially, assuming trade talks collapse and Trump

follows through on his threat of hiking taxes on Chinese imports, it

would, as Torsten Slok shows in his latest chart, push US tariffs -

which are already higher than most advanced economies - higher than many

emerging market countries making the US one of the leading

protectionist countries in the work.

That alone would cripple China's economy, and is perhaps the main

reason why Trump decided to once again flex his muscles, if so far only

on twitter.

Trump Doubles Down: 'We're Not Going To Lose To Beijing Anymore'

Just

when US equity futures were finally starting to move higher after Dow

futures had lingered around the -500 level for most of the morning,

President Trump doubled-down on his antagonistic stance toward Beijing,

tweeting that the US was done losing "500 billion dollars" a year in

trade to China.

The message was clear: Trump isn't backing down from his threats to hike tariffs and impose new ones, even after sending global markets into paroxysms with a series of tweets on Sunday.

The message was clear: Trump isn't backing down from his threats to hike tariffs and impose new ones, even after sending global markets into paroxysms with a series of tweets on Sunday.

Trump latest tweet follows reports that Beijing was still planning to send a trade delegation to the US this week,

but that Vice Premier Liu He, the official who has led the Beijing side

during the now ten rounds of talks that have been held over the past

year, might either delay a trip to Washington by a few days, or not go

at all.

It supports the view that, given the market's robust performance

since the start of the year, Trump feels he has the latitude to ratchet

up the pressure on Beijing, given the strength of the labor market and

Q1 GDP.

No comments:

Post a Comment