This is one hell of a slap down. It also forces the US markets to consolidate which was highly overdue as well. Most likely the Chinese were preparing their own drama to claw back consessions and this is meant to snap them back.

Chinese growth has been fueled by unfettered access to the USA market and this has made them progressively more vulnerable to just this. It is completely reasonable for the USA to demand reciprocity and an absolute end to the Chinese military weaponizing the trade relationship. that is not how partners carry on.

The Chinese knew this was coming of course. It is Xi's misfortune that he has to handle it while his own people still live under the momentum of past dealings..

.

"This Was Totally Out Of The Blue": Global Stocks Crash As Trade Talks Collapse

The

S&P closed on Friday at a new all time high, with hardly a concern

in the world and nothing but blue skies ahead... and then just two

tweets from Donald Trump shortly after noon on Sunday afternoon

shattered the market's idyllic picture, when the US president admitted

that trade talks with China are not only not going "optimistically", but

have effectively collapsed and tariffs on Chinese imports would be

hiked.

The result, discussed overnight, was a "sea of red" as risk assets

and currencies across the globe collapsed, offset by a flight into safe

assets including Treasuries and the US dollar. The MSCI world index fell

half a percent.

Trump sharply escalated tensions between the world’s two largest

economies with tweeted comments on Sunday that trade talks with China

were proceeding “too slowly”, and that he would raise tariffs on $200

billion of Chinese goods to 25 percent on Friday from 10 percent. The

tweets stirred up the near-record calm market mood arising from signs of

improving economic growth in China and the United States, and from

comments from Trump and other senior U.S. officials that trade talks

were going well.

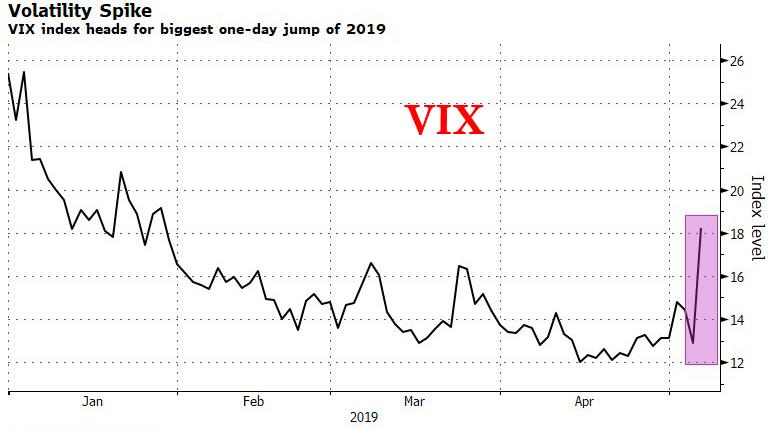

As risk reeled, the VIX headed for its biggest increase in 2019 (something we discussed as a distinct possibility on Sunday afternoon)...

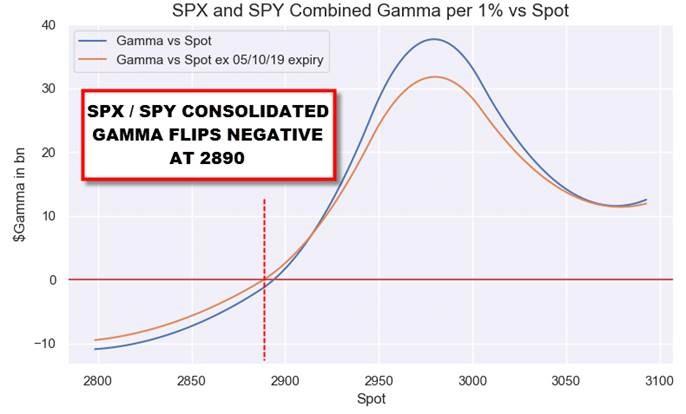

... while futures on the S&P 500 index sank as much as 2.2

percent, tumbling back below 2,900 and approaching the 2,890 level where

dealer gamma turns negative, and any continued selloff will only lead to further selling.

European stocks tumbled to a one-month low, suffering their biggest drop of the year...

... as German bond yields slipped back into negative territory.

Germany’s DAX was down 1.8% while the Stoxx 600 tumbled 2% to its

lowest level since early April. Moves were slightly exaggerated, with

Japanese markets still on holidays while London markets shut for a local

holiday. Losses in equities translated into gains for bonds with

benchmark government bond yields in Germany retreating to a shade below

zero and not far from a 2-1/2-year low of minus 0.09 percent hit in late

March.

Even as Beijing tried to salvage some clam, when China’s foreign

ministry said on Monday a delegation was still preparing to go to United

States for trade talks, but was unable to confirm when amid signs that a

delay is now being considered, the benchmark index in Shanghai crashed

5.6%, with the Shanghai Composite suffering its worst day since February

2016 and sliding back under 3,000 even after Chinese state-backed funds

were said to have been active in an effort to limit the sell-off.

Kweichow Moutai Co. and China Life Insurance Co. were among the

biggest drags. The S&P BSE Sensex Index dropped 0.9%, driven by

Housing Development Finance Co. and HDFC Bank Ltd. The Straits Times

Index retreated 3%, its biggest drop in about seven months.

Chinese risk tumbled even though the PBOC announced just before 9:30am Monday morning (Beijing time) that the

reserve requirements (RRR) for selected small banks will be lowered

from May 15, 2019, a move expected to release liquidity of RMB 280

billion. While the PBOC may have already been working on

introducing this measure in an effort to ease funding costs for small

enterprises, the exact timing of the release may have been accelerated

by heightened trade tensions with the US.

Elsewhere in Asia stocks sank, driven by financial and communication

firms, even as markets in Japan, South Korea and Thailand remained

closed.

Wall Street strategists, until last week worryfree and optimistic, "suddenly" but predictably turned apocalyptic:

- “The market was caught on the wrong foot as everyone expected talks were heading in the right direction and almost close to finishing,” said Daniel Lenz, a rates strategist at Commerzbank. “This was totally out of the blue and the reaction is that we have more risk aversion today.”

- "It’s making the outcomes more binary, with everybody focused on the Friday deadline -- there doesn’t seem to be much leeway now to much go past that," Joyce Chang, chair of global research at JPMorgan Chase & Co., said on Bloomberg Television. "It’s going to mean that investors will be very focused on the trade issues even beyond China,” with a review of U.S. auto-import tariffs still pending.

- "We have continued to warn that U.S.-China talks could still break down, and have ascribed a 30% probability to this risk scenario,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. "If this latest exchange were to halt progress and create a series of escalating tariffs as we head into the U.S. election season, it could lead to further declines for global risk assets"

- "If we do see a breakdown in negotiations and the Chinese team doesn’t go to Washington then we will see some really significant downside corrections to the Aussie and kiwi, and a massive upturn in volatility," said Nick Twidale, chief operating officer at Rakuten Securities Australia Pty in Sydney.

The latest episode in the trade war comes on the back of weeks

of low market volatility across asset classes and a growing swathe of

tepid but steady economic data with little negative surprises lulling

investors into a sense of calm.

Adding to a complex global picture, North Korea carried out a weapons

test that potentially included its first ballistic missile launch since

2017, challenging Trump’s bottom line in nuclear talks, while the US

reportedly sailed two aircraft carriers to Iran to send a "clear

message" that any attack on US interests or allies will be met with

unrelenting force.

In FX, Bloomberg USD index is 0.3% higher, with most major pairs

trading sideways in the European morning, with USD/CNH up 0.7%, after yuan earlier sank by the most since January 2016.

The yen led gains among the Group-of-10 currencies amid renewed trade

concerns, while emerging market currencies and commodity-linked

currencies were the hardest hit with the Australian dollar falling half a

percent against the greenback while the offshore yuan swooned nearly a

percent.

In commodity markets, Trump’s tweets sparked a plunge in oil prices.

WTI dropped as much as 3.1% to a more-than-five-week low, before

bouncing to $60.69 per barrel - still off 1.3% on the day. Brent crude

was 1.8% lower at $69.59 per barrel. Meanwhile, the selloff in risky

assets burnished the lure of gold with spot gold up 0.25 percent to

trade at $1,282.20 per ounce. Cryptos were largely unchanged.

Air Canada, AIG, and Qiagen are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 1.9% to 2,893.00

- STOXX Europe 600 down 1.4% to 384.90

- MXAP down 1% to 161.39

- MXAPJ down 1.8% to 531.42

- Nikkei down 0.2% to 22,258.73

- Topix down 0.2% to 1,617.93

- Hang Seng Index down 2.9% to 29,209.82

- Shanghai Composite down 5.6% to 2,906.46

- Sensex down 0.9% to 38,608.08

- Australia S&P/ASX 200 down 0.8% to 6,283.73

- Kospi down 0.7% to 2,196.32

- German 10Y yield fell 1.8 bps to 0.007%

- Euro down 0.09% to $1.1188

- Italian 10Y yield rose 0.9 bps to 2.19%

- Spanish 10Y yield fell 1.2 bps to 0.972%

- Brent futures down 1.5% to $69.79/bbl

- Gold spot up 0.3% to $1,283.07

- U.S. Dollar Index up 0.1% to 97.59

Top Overnight News

- Talks between the U.S. and China to resolve their year-long trade standoff appeared to have stalled after Trump’s threat to raise duties. China’s foreign ministry said officials were still planning to travel to the U.S. for the next round of talks, but didn’t confirm when amid signs that a delay was being considered

- Chinese state-backed funds were active in selected stocks on Monday, people familiar with the matter said, seeking to cushion the blow from a sudden escalation in trade tensions with the U.S. Among the funds’ targets were two large oil companies, the people familiar said

- Adding to the mix, North Korea carried out a live-fire military exercise Saturday that potentially included the country’s first ballistic missile launch since 2017, challenging Trump’s bottom line in nuclear talks

- The Turkish lira weakened past a key psychological level against the dollar as traders braced for the prospect of prolonged political turmoil and a global market rout piled pressure on emerging-market currencies

- Economic activity in the euro area showed signs of stabilization in April - both the composite and services Purchasing Managers’ Index for April were higher than the initial estimate which a separate report showed investor confidence in the region rose this month to its highest since November

Asia-Pac indices and US equity futures began the week with heavy losses as US-China trade tensions flared

up after President Trump tweeted that the US will raise the 10% tariffs

on USD 200bln of Chinese goods to 25% and suggested they will soon

extend 25% tariffs to an additional USD 325bln of Chinese goods which

are currently untaxed. Furthermore, China’s potential cancellation of

this week’s trade discussions in Washington added to the pressure for

equity futures and in turn wiped out all of Friday’s gains from the

Goldilocks jobs report. ASX 200 (-0.8%) was negative with the index led

lower by underperformance in tech and with the top-weighted financials

sector also pressured amid losses in ‘Big 4’ bank Westpac after it

reported a 24% drop in H1 statutory profit. Elsewhere, all components in

the Hang Seng (-3.5%) were negative and the Shanghai Comp. (-5.2%)

slumped heavily due to the renewed tariff threats which reportedly could

shed 1.5% off China’s GDP growth, while a PBoC liquidity injection and

targeted RRR cut for small and medium-sized banks, as well as mixed

Caixin Services and Composite PMI data did little to brighten the

sentiment in China. As a reminder, Japan and South Korea remained shut

for Children’s Day.

US President Trump stated over the weekend that the US will raise the

10% tariffs on USD 200bln of Chinese goods to 25% beginning on Friday

and suggested that USD 325bln of additional goods from China which

remain untaxed, will be shortly at a rate of 25%, while he suggested the

trade agreement with China is proceeding too slowly and firmly rejects

efforts to renegotiate. Furthermore, there were also reports that

President Trump was told by aides that significant hurdles remain to

reaching a trade agreement with China and a source familiar with

President Trump’s thoughts on tariffs said that China have been backing

away from agreements the US negotiating team believed they had already

made. (Newswires/Twitter/Axios) This follows comments from President

Trump on Friday that the US is doing fine with China regarding talks and

that progress towards a deal are going "pretty well", while he added

that a deal may happen in a couple of weeks although US will be fine if

it doesn't happen.

China is said to be mulling cancelling trade discussions this week

following US President Trump's tariff threats. It was also reported that

some working level Chinese officials have postponed their flights to

the US and may fly as late as May 8th which is the date of the

negotiations and that Chinese Vice Premier Liu He is very unlikely to go

to the US this week, However, reports later suggested that Vice Premier

Liu could delay his trip by 3 days and shorten it to only 1 day for

trade talks.

Subsequently, Chinese Foreign Ministry state that they hope the US

can meet China halfway on trade talks the delegation is making

preparations to go the US, and Ministry refrained to answer if Vice

Premier He will partake in the delegation. Addeed that their Navy has

instructed US ships to leave the South China Sea and refrain from such

provocative acts.

Top Asian News

- Bharti Is Said to Kick Off IPO of $5 Billion Africa Arm in May

- Japan Set for Golden Week Hangover as Trade War Roils Markets

- Tencent-Backed DouYu Is Said to Delay Launch of $500m U.S. IPO

- Philippines Targets $500M From First Euro Bond Sale Since 2006

Major European Indices [Euro Stoxx 50 -2.0%] have begun the week with heavy losses in-line

with their Asian counterparts and US equity futures as markets move

back into risk-off mode following US President Trump tweeting that the

US will raise tariffs on USD 200bln of Chinese goods from 10% to 25% and

indicated that they will consider extending the scope of tariffs to

include an additional USD 325bln of goods which are currently not taxed.

However, subsequent comments from China’s Foreign Ministry, that they

hope the US can meet China halfway on trade talks and that the

delegation are preparing to go to the US, did generate a glimmer of

positivity across markets. Although, it is still unclear if Vice Premier

Liu He will feature in this delegation. Losses across European indices

are broad based with no standout under/out performer, and a similar

scene is present across sectors. Although, luxury names such as

Christian Dior (-3.7%) and Kering (-3.0%) are heavily weighed on by the

increased US-China trade tensions. Similarly, auto names are lower due

to their supply chains being particularly vulnerable to trade tensions,

Volkswagen (-3.5%) have been hit the hardest, with the Co’s CEO

previously stating that import tariffs from the US on the EU could cost

the Co. billions of euros each year. Other notable movers this morning

include ThyssenKrupp (-4.2%) amidst reports that EU anti-trust

regulators are likely to block the Co’s proposed merger with Tata Steel

due to concerns over potential price increases and the impact on

competition; the proposed merger would create Europe’s second largest

steel producer and follows comments from Tata Steel’s European Works

Council that they do not believe the merger is in the best interest of

the Co’s workers. At the other end of the Stoxx 600, and today’s only

notable mover in positive territory are Telenor (+4.0%) following

reports that the Co. and Axiata have initiated discussions to merge

their Asian operations with the Co. likely to own 56.5% of the merger.

Top European News

- Euro-Area Order Growth Signals Some Hope as Economy Stabilizes

- May Is Said to Draft New Customs Law for Brexit Deal With Corbyn

- Race to Replace Draghi Spurs ECB Calls for Fed-Style Rethink

- Costa Stakes Re-Election Claim as Portugal’s Biggest Fiscal Hawk

In FX, while the Usd holds above Friday’s

post-NFP lows and the DXY pivots around 97.500, safe-haven positioning

in wake of latest US-Chinese trade developments and a diplomatic spat

between the 2 nations over naval vessels in the South China Sea has

heightened demand for the Yen and Franc. Following Trump tweets

threatening to imposes higher tariffs on Usd200 bn worth of Chinese

goods this Friday with a further Usd325 bn possibly subject to increased

levies, Usd/Jpy reversed through 111.00 and all the way down to circa

110.30, while stops are said to have been tripped in Eur/Chf on a break

of 1.1370 pushing the cross towards 1.1350 and the 200 DMA (1.1345).

However, some respite has tempered aversion as China’s Foreign Affairs

Ministry says a delegation is still preparing to head to Washington this

week and subsequently seen rebounds to around 110.70 and 1.1375

respectively.

- GBP/AUD/CAD/NZD/NOK/SEK - The main G10 underperformers and casualties of the broad risk off start to the new week, as Cable probes support ahead of 1.3100 amidst ongoing Brexit uncertainty and the UK public holiday, while the Aussie, Loonie and Kiwi are all trying to stabilise following declines to 0.6963, 1.3493 and 0.6601. Aud/Usd and Nzd/Usd are also maintaining a defensive stance in the run up to RBA and RBNZ policy meetings that are both expected to be ‘live’ in terms of easing prospects, while the deterioration in US-China relations has also undermined oil to the detriment of the Cad and Nok (latter down near 9.8000 vs the Eur). Back down under, hefty option expiry interest may provide support and resistance in Aud/Usd given 1.1 bn at the 0.6950 strike and 1 bn at 0.7000-15. Elsewhere, Eur/Sek is elevated around 10.7200 on the back of another soft Swedish PMI as the services headline dips, albeit still comfortably above the 50.0 threshold unlike manufacturing.

- EUR - Conversely, an upward revision to the final pan Eurozone services PMI despite mixed national surveys, slightly firmer than expected retail sales data and an encouraging Sentix Index have all helped the single currency contain losses within a 1.1200-1.1160 range vs the Dollar. Note also, decent option expiry interest could be keeping the headline pair rangebound as 1.6 bn runs off between 1.1150-60 vs 1.1 bn from 1.1185-1.1200.

- EM - Widespread losses vs the Greenback amidst the aforementioned generally sour sentiment, as Usd/Cnh rallies through 6.8000 at one stage vs the PBoC’s official 6.3744 Usd/Cny fix, while Usd/Zar tests offers ahead of 14.5000 in advance of Wednesday’s SA elections and Usd/Try peers over 6.0000 on the ongoing and well documented Turkish, plus CBRT concerns about (higher) PPI cost pressures exerting and increasingly stronger influence on CPI.

Brent (-1.0%) and WTI (-1.3%) have also succumbed to the general risk tone, although

are currently trading within a relatively thin band with prices having

recovered from overnight lows which were just a shade below USD 69/bbl

and just above the USD 60/bbl levels respectively. Aside from the

all-encompassing US-China story news flow for the complex has been

somewhat thin, notably Saudi Aramco raised their OSP for all crude

grades to all regions (ex-US) for June, with Arab Light’s price falling

by USD 0.10/bbl for the US. Gold (+0.3%), along with other safe havens,

has benefitted from the increased US-China tension and the resulting

risk off sentiment, with the yellow metal now trading towards the middle

of a USD 7/oz range which did see it reach USD 1287/oz. Copper, has

suffered as the metals largest buyer China returned to market, after a

3-day Labour Day holiday last week, with China playing catchup and

sentiment being impacted by updates regarding the potential increase or

imposition of tariffs on China. Iron ore port holdings in China fell

1.8% to 133.6mln tons which is the lowest since October 2017.

(Newswires)

No comments:

Post a Comment