This makes for sobering reading. Worse it is were a miscall can produce real damage. And I am seeing such miscalls taking place here and there and in Canada in particular, but only because i am watching that closely. the mind set is the same in the USA.

Are we really understanding California and New York?

The USA needs to desperately unleash a housing boom and Trump needs to massively reform the USA government which he has thankfully begun, but begun only. All this needs to be wrapped around ending poverty before our civilization crumbles and starts shedding the living..

Are we really understanding California and New York?

The USA needs to desperately unleash a housing boom and Trump needs to massively reform the USA government which he has thankfully begun, but begun only. All this needs to be wrapped around ending poverty before our civilization crumbles and starts shedding the living..

Here Comes The Yield Shock---The Beltway Borrowers Are Going Berserk

By David Stockman. Posted On Thursday, February 8th, 2018

http://davidstockmanscontracorner.com/here-comes-the-yield-shock-the-beltway-borrowers-are-going-berserk/

You can say this for the swamp creatures: Their gall knows no limits.

Apparently, the two government lifers running the US Senate----Mitch McConnell and Chuck Schumer (hereafter "Mitchels & Chuckles")----have reached a deal to bust the already red-ink soaked budget by $400 billion over the next two years and by upwards of $3.5 trillion over a decade.

Consequently, bond yields have continued their upward march.

Consequently, bond yields have continued their upward march.

While the above yield surge is surely not surprising, here's the galling part. Mitchels & Chuckles christened their baleful deal: "The Government Shutdown Prevention Act".

That's right. The taxpayers and future generations be damned. Apparently, it doesn't matter how many small businesses, farmers and entrepreneurs get elbowed out of the capital markets by Uncle Sam's $1 trillion per year borrowing spree: Mitchels & Chuckles intend to keep the Washington Monument open and the Imperial City's 3.7 million employees paid in full come hell or high water.

This is just another way of saying that the swamp creatures have become so inured to big deficit numbers that they have literally gone berserk on the borrowing front. For instance, before they passed their utterly asinine tax bill, the GOP was told by CBO that the baseline deficit over the next decade was $10 trillion, meaning that the already baked-in-the-cake public debt would reach $30 trillion by 2027.

No matter. They passed a temporary tax cut for individuals and a permanent $1.4 trillion inducement for more stock buybacks, dividends, M&A deals and other corporate engineering ploys as a Christmas Eve present to the K-street lobbies.

Soon thereafter, of course, the CBO was out with an update. They computed that the post-tax bill baseline deficit would now cumulate to nearly $12 trillion over the decade.

That produced no alarm bells, either. As shown below, the most recent handiwork of Mitchels & Chuckles will balloon the 10-year deficit to $15 trillion and thereby guarantee that the public debt will top $35 trillion by 2027----a level that we estimate would amount to about 135% of GDP.

Yes, that's the fiscal math from piling on top of the massive deficits that were already there nearly$150 billion annually from busting the sequester caps on appropriated defense and domestic spending (see below); $90 billion for disaster aid that is not offset with cuts elsewhere; and $20 billion for infrastructure and $6 billion to fight another "crisis" (the opioid one).

Implicitly, that $15 trillion of new red ink also includes funding the $2.5 trillion per year entitlement sector that the deal leaves untouched and on automatic pilot; and also straining out the rest of the Kentucky windage embedded in the CBO baseline. That is, "expiring" tax breaks that always get "extended" at the last minute and future year spending "cuts" that always get deferred before they happen.

In short, our friends at the Committee for a Responsible Budget (CFRB) calculate that Mitchels & Chuckles have now outdone even Barry's bottom of the recession eruption of red ink. Their plan will have Washington on track to hit a $2.1 trillion annual deficit by 2027.

But here's the thing. The CFRB projection below is based on Rosy Scenario!

To wit, it assumes that the US goes 219 months (thru FY 2027) without a recession. That's nearly double the longest one in history during the far more propitious circumstances of the 1990s; it's 3.6X the average post-1950 recovery (61 months); and its just plain nuts when you look at the storm clouds gathering everywhere----not the least of which is rapidly rising bond yields that have now nearly touched 2.90% on the benchmark 10-year treasury note.

The chart below, therefore, should be enough to scare the living bejesus out of the denizens who function on both ends of the Acela Corridor. We will get back to the beltway pols in a moment, but it is important to note that the drastic, sustained falsification of interest rates and financial assets prices by the Fed and other central banks has basically destroyed the signaling system that used to keep both Washington and Wall Street reasonably honest.

Thus, the punters on Wall Street have been so addled by years of Fed monetization of the public debt that they now think rising yields are a "good thing" and reflect rebounding economic growth.

No they don't!

The US economy is still bumping along the flaccid trajectory of the weakest recovery in modern history; and with each passing month, it gets closer to its sell-by date.

Therefore, the only possible way to accelerate growth in a 104 month old business cycle---where household consumers are impaled on a record $15 trillion of debt and other liabilities---is through an outbreak of capital spending.

So far, however, the corporate sector has responded to the 21% tax rates by announcing $86 billion of new stock buybacks and some ill-disguised PR ploys with respect to year-end "bonuses" that they would have largely paid anyway.

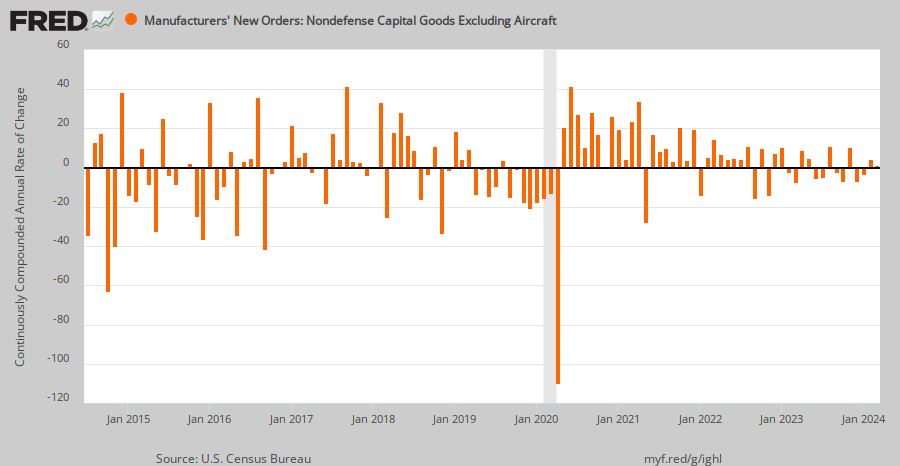

In the meanwhile, here is the trend in core CapEx orders. This does not a break-out signify.

In fact, behind the random ups and downs in the monthly number shown below, the flat-line remains fully in tact. During December 2007, nondefense CapEx orders ex-aircraft came in at $67.6 billion. Ten years of inflation in the interim notwithstanding, orders came in at just $66.9 billion in December 2017.

The truth of the matter is that whatever expansionary impulses that do remain in the US economy are about to get smothered by the impending collision between soaring debt issuance by the US Treasury just as the Fed prepares to dump upwards to $2 trillion of existing debt securities into the bond pits.

For instance, we have had the weakest housing recovery in history----despite the fact that the mortgage rates have been slammed to the floorboard by the Fed's cheap debt policies. In fact, the rate on 15-year variable rate mortgages averaged about 3.0% between 2012-2017, which is hardly 1% after inflation.

Now yields are ratcheting up smartly, yet single family housing completions actually stand at a level your editor happened upon exactly 35 years ago. That is, as we prayed for "green shoots" of recovery in the Reagan White House in early 1983, the single family completion rate was just 817,000 units at an annualized rate.

And that's also precisely where it stood---after 9 years of the Fed's awesome recovery---in December 2017 (818,000). At that point, of course, the hammer of soaring mortgage rates had not even hit the completion end of the construction pipeline. So we don't expect the blue line in the chart below to be breaking out to the upside, either.

On the other end of the Acela Corridor, the busted signalling system has done even more damage down in the Great Dismal Swamp.

That's because during the years since the 2011 debt ceiling showdown, the GOP pols have suffered what they perceive to be severe political fallout from government shutdowns over the debt ceilings and continuing resolutions. Yet until the last few months--- aside from the short-livid Taper Tantrum in mid-2013---- interest rates kept going down even as the public debt climbed higher and higher.

Indeed, the veritable X on the chart below might someday be seen as the mark of the monetary devils at the central bank. Attempting to levitate the US economy by crushing honest price discovery on Wall Street, they unleashed a wave of fiscal profligacy that eventually became irreversible.

So apart from a few dozen Freedom Caucus members in the House, who are about to be sold down the river by the Great Fiscal Faker who sits in the Speaker's chair, Paul Ryan, the chart below might as well be reporting the average temperature on the dark side of the moon.

In fact, we actually heard today a Republican politician from Illinois (Rep. Adam Kinzinger) explain to Morning Joe that the deficit problem was owing to an insufficiently long budget calendar!

You can't make this stuff up. Kinzinger actually averred that there was no near term fiscal problem and that he supported the Mitchels & Chuckles budget-buster. But what Congress really needed to do was to get serious about the "budget window" beyond 2027 where the long term deficit apparently resides.

As for the chart below and the $400 billion of pork being laid on by the Senate, it's the price that must be paid, Rep Kinzinger claimed, in order to keep the DOD's ships, planes and tanks operating and the armed services trained, ready and paid.

That's right. Even without the $85 billion defense increase for next year, the DOD would still have $631 billion to fund its operations, which is more than the next 10 countries of the world spend for defense on a combined basis, and 10X more than the allegedly nefarious Russkies in the Kremlin.

What is happening, of course, is that the generals have taken over national security policy lock, stock and barrel, including the absolute war-loving lunatic, General "Mad Dog" Mattis, who runs the Pentagon.

So doing, they have not bothered to tell the clueless occupant of the Oval Office that by drastically escalating the pace of military operations all around the world---from the Korea/Pacific through Afghanistan, the Iraq-Syrian theatre, Yemen, North Africa, the Baltics and the Black Sea---he is consuming fuel, material, spare parts, logistics and contractor support---like there is no tomorrow.

That is to say, by foolishly attempting to Make America Great Again via sword-rattling on a planetary basis, the Donald is actually making the Pentagon go broke again, thereby generating the same old "readiness" horror stories that are used time and again to panic Capitol Hill into huge defense increases.

Young Mr. Adam Kinzinger, for example, claimed in his AM appearance that more soldiers are dying from faulty equipment than combat. Then again, exactly what is being accomplished to make America more safe and secure by rattling the sword in all of the aforementioned redoubts---when the US Imperium shouldn't be meddling in any of them in the first place?

Absolutely no one in Rockford Illinois is threatened by Russia's non-aggression in the Baltics or its naval bases in its own backyard on the Black Sea. The same is true regarding the god-forsaken expanses of the Hindu Kush, the deserts of Yemen, the rubble of what used to be the grand cities of Mesopotamia and the Levant, the impoverished regions of north and central Africa or even the Korean Peninsula----were it to be left to the Koreans to settle a pointless 65-year old war.

Worse still, the totally unnecessary defense increases to fund these completely unnecessary operations and occupations all around the planet have also given rise to the typically noxious Warfare State/Welfare State bargain. It appears that to get the $80 billion and $85 billion increases in DOD funding for FY 2018 and FY 2019, respectively, Mitchels ponied up $63 billion and $68 billion for domestic add-ons in order to get Chuckles' to sign-off.

And don't take our word for it. Here is what one of the Senate's allegedly most conservative budget hawks had to say on the matter:

“I’d rather we didn’t have to do as much on non-defense, but this is an absolute necessity, that we’ve got these numbers,” said the Senate Armed Services Committee’s No. 2 Republican, Sen. Jim Inhofe, of Oklahoma.

Needless to say, when you start marching toward a $2.1 trillion deficit before even factoring in the next recession, and when you recall that today's 60 million social security recipients will be 80 million by 2027 due to the massive baby boom retirement wave, you are just plain sunk fiscally.

Indeed, there is literally no way out of the fiscal trap now rapidly unfolding in Washington---short of a thundering financial collapse which blows both ends of the Acela Corridor sky high.

That gets us back to the numbers problem, but the real offender in that category happens to be a small number that is the epitome of the Swamp: Namely, 97-0.

The former figure (97) represents the combined years that Mitchels & Chuckles have spent on the public payroll. By contrast, the latter figure (0) represents the number of combined years they spent working in the private sector----to say nothing of actually meeting a payroll.

For his part, Mitch McConnell is the very epitome of the gang of self-perpetuating careerist pols who turned the conservative party of Ronald Reagan into essentially a beltway racketeering operation.

Indeed, McConnell was born and bred in the Swamp insofar as his career is concerned. He went to Washington DC 53 years ago at age 22 as an intern for Senator John Sherman Cooper from his home state of Kentucky and never really left.

In fact, insofar as we can tell he's never had an honest job in his life outside of drawing a stipend from the public till. Thus, after a succession of jobs on Capitol Hill and in the Ford Justice Department, he got himself elected county commissioner back home. And then shortly thereafter to the U.S. Senate in 1984---- where he now holds the title of the longest serving Majority Leader ever.

Thirty-three years in the most polluted part of the Swamp---the U.S. Senate---is a long time. The Senator is veritably pickled in its politically putrid brine.

Except Schumer is worse. No sooner than he had matriculated from Harvard Law School than Chuckles got himself elected state assemblyman from Brooklyn. From there he grabbed a US House seat in 1980 at age 30, where he became the Dems errand boy to Wall Street.

Indeed, when we joined Salomon Brothers in 1986 one of the bi-monthly rituals was a visit to the Partners Dinning Room by Chuckles Schumer, who invariably had some new scheme or another to help the underprivileged of Wall Street.

And then after tapping the keys to tens of millions in Wall Street campaign lucre, he was on to the US Senate. At length, Chuckles reached the very top of the greasy pole, replacing, mercifully, the insufferable Harry Reid as Minority Leader of the Senate.

In all, 44 years suckling on the public teat and counting; and like Mitchels, Chuckles has spent zero years making a living in the real world.

But no matter. The Donald never drew a dime from the public till, either. Yet he appears to be enthralled with debt in a manner that can only be achieved after 40 years as a leveraged real estate developer. That's why, we suppose, that during the entirely of his 80 minute SOTU bloviation he only mentioned the deficit once, and that was with reference to one that does not even exist!

Every federal dollar should be leveraged by partnering with state and local governments, and where appropriate, tapping into private sector investment, to permanently fix theinfrastructure deficit. And we can do it.

As the Mises Institute noted recently, there is no infrastructure deficit whatsoever. Spending for public transportation, for example, increased from $18 billion per month in the early 2000s, to over $25 billion a month to fund Obama's shovel unready stimulus plan, to upwards of $30 billion per month thereafter.

Call it what you will, but "deficit" is not a word that comes to mind.

In any event, it is probably all over except the shouting. Still, at least a few straggling members of the House Freedom caucus can be expected to do just that:

“This spending bill is a debt junkie’s dream,” Alabama Republican Rep. Mo Brooks, who voted for the GOP tax cuts, said Wednesday. “I’m not only a ‘no.’ I’m a ‘hell no.’” Rep. Justin Amash, a Michigan Republican who also voted for the tax cuts, tweeted: “This spending proposal is disgusting and reckless—the biggest spending increase since 2009. I urge every American to speak out against this fiscal insanity.”

"This spending proposal is disgusting and reckless — the biggest spending increase since 2009," conservative Rep. Justin Amash Mich.) tweeted after the meeting. “I urge every American to speak out against this fiscal insanity."

Perhaps it would be well for the dip buyers, who seemed to have taken a vacation today, to ponder the observation of Chris Krueger of the Cowen Washington Research Group"

“The irony here is palpable, he wrote. “A heavily Tea Party Congress … is going to tack nearly $2,000,000,000,000 onto the government credit card. The sequester relief package combined with the three tranches of disaster relief is more than half the Obama Stimulus, which was the Bunker Hill of the Tea Party movement in 2009. On the Road to Washington, the Tea Partiers experienced a religious conversion to supply siding fiscal doves. We suspect they will re-convert to fiscal hawks once they eventually return to the minority party in Congress.”

Let's see. A roaring fiscal crisis. Soaring yields. And a Democratic landslide in 2018 hell-bent on repealing the Trumpian/GOP's tax cut gift to the wealthy and corporate America.

Yes, indeed, nothing has changed from the all time highs of two weeks ago. And that's exactly why the danger in the casino is so palpable.

No comments:

Post a Comment