What is poorly understood is that Teslas persistent rise is driven by the rapid adoption of computer driven manufacturing capability. Their competators simply dragged their feet and that killed them.

what is most amazing is actual consumer acceptance

Tesla Completing Not Just a Car Company Transformation

January 28, 2026 by Brian Wang

https://www.nextbigfuture.com/2026/01/tesla-completing-not-just-a-car-company-transformation.html#more-208250

– Most important earnings call in Tesla history – not just for Tesla, but any company

– Stock hit $450 briefly, pulled back to $440 post-call

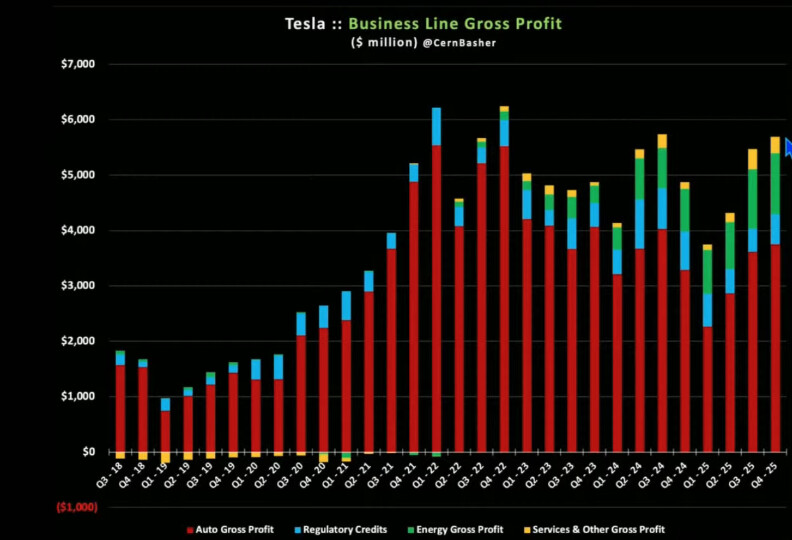

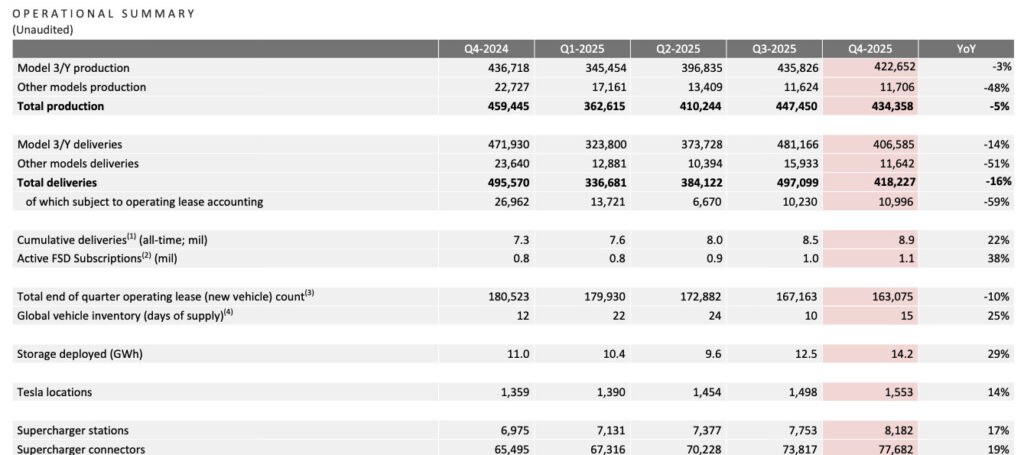

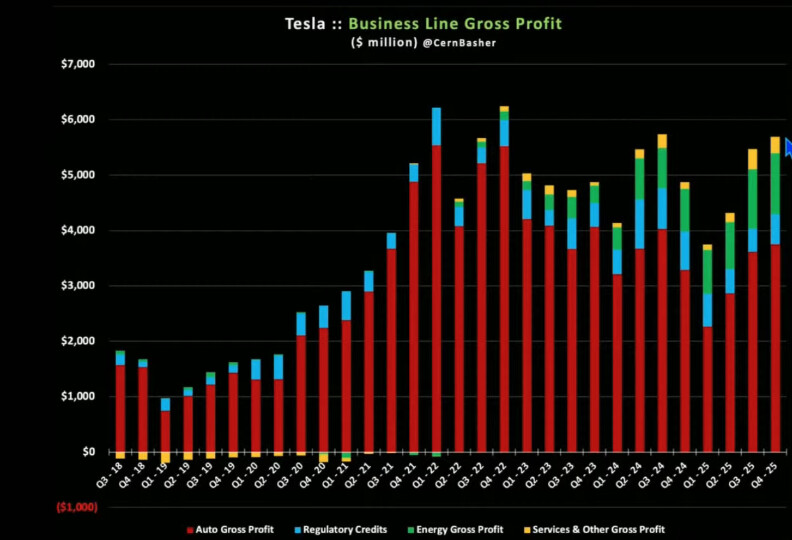

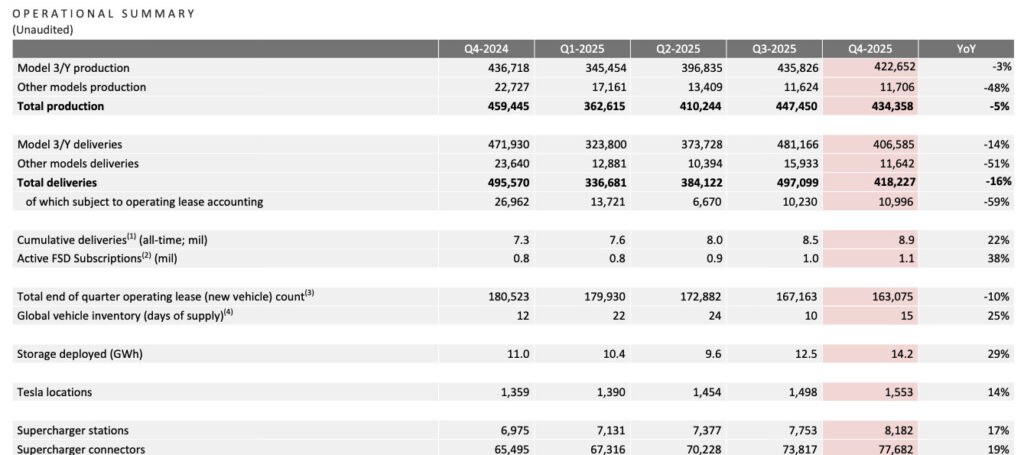

– Strong profitability despite 16% fewer deliveries Q3→Q4

– Higher profit margin: 18% → 21% gross margin

– Beat expectations: 50¢ vs 44¢ expected EPS

Quarterly Deck Transformation – AI Company Recognition

– First time quarterly deck reflects Tesla as AI company, not car company

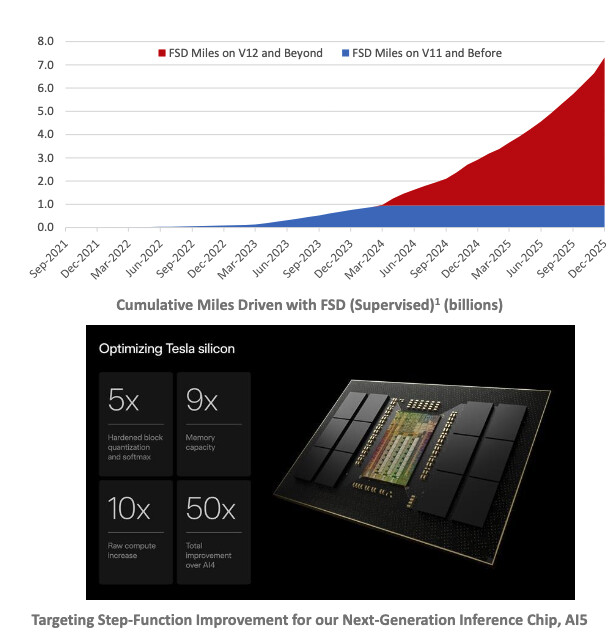

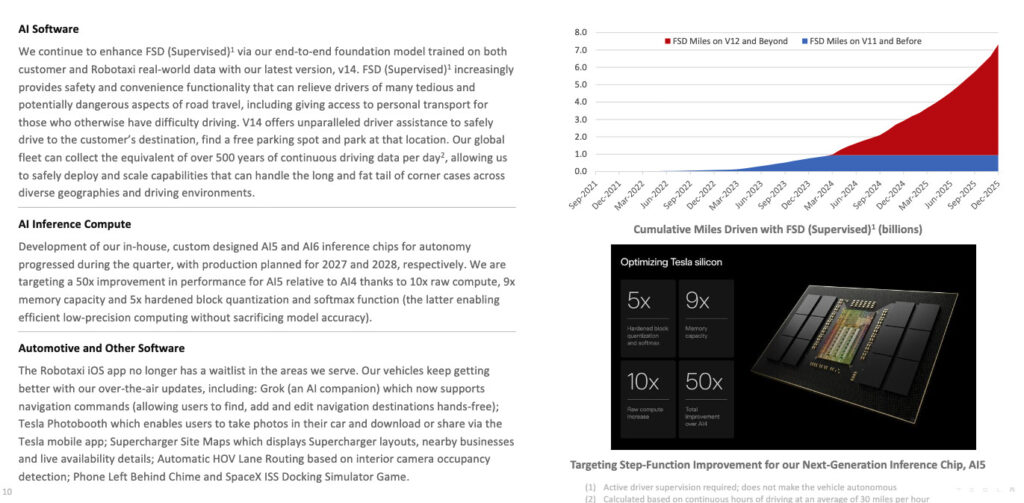

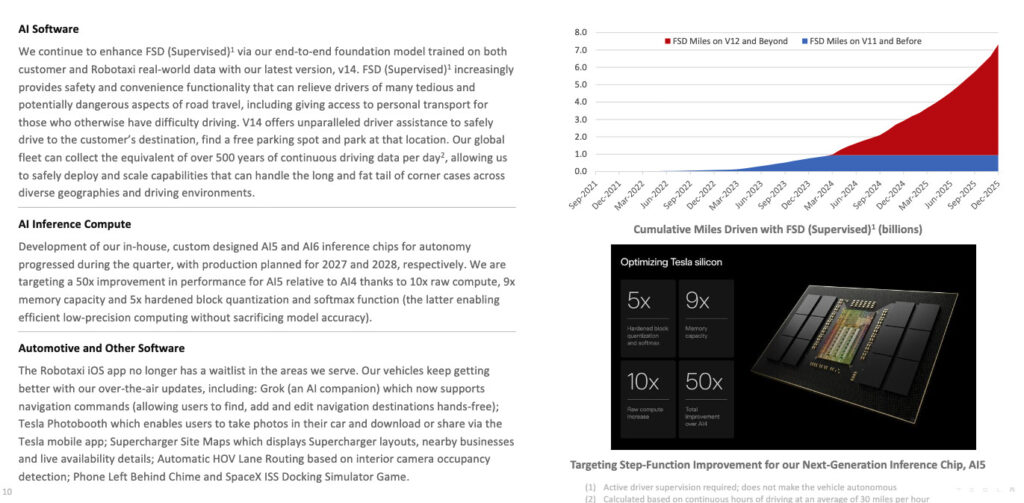

– Page 4: Active FSD subscriptions now tracked (800K → 1.1M)

– Forces analysts to acknowledge AI metrics

– 80-90% US market, expansion to China/Europe coming

– 75-80% of company presentation now non-automotive

– AI training/compute, robotics, energy dominate narrative

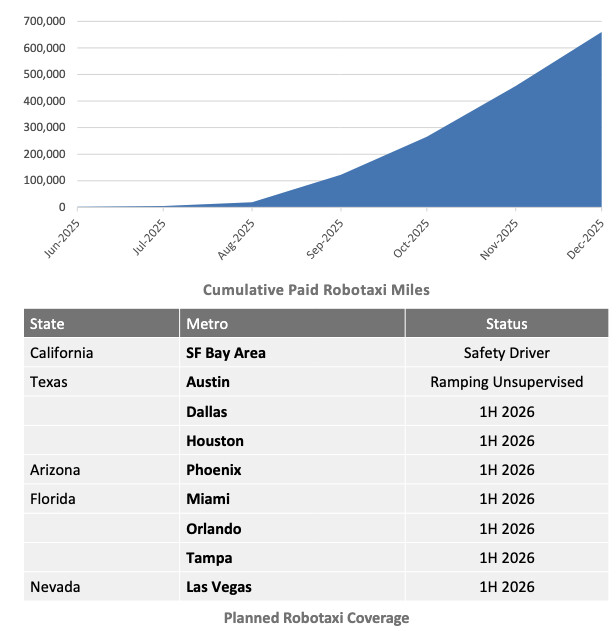

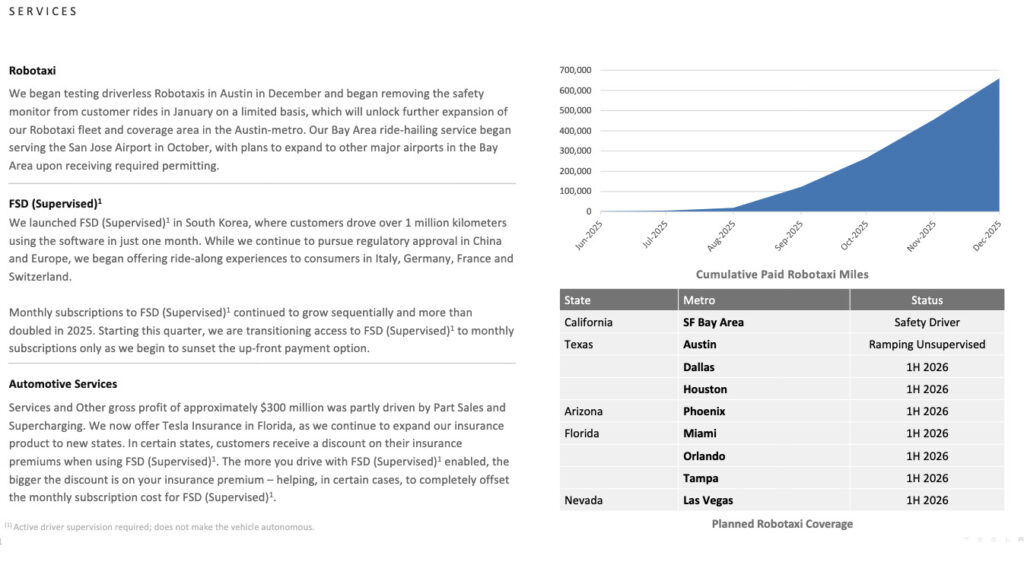

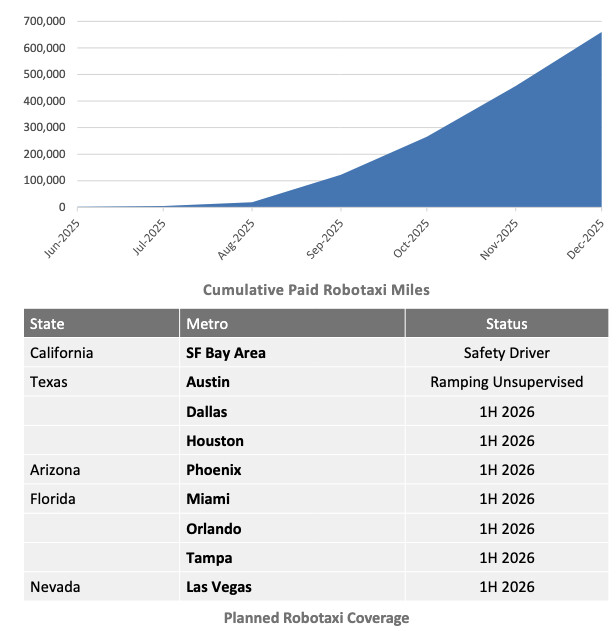

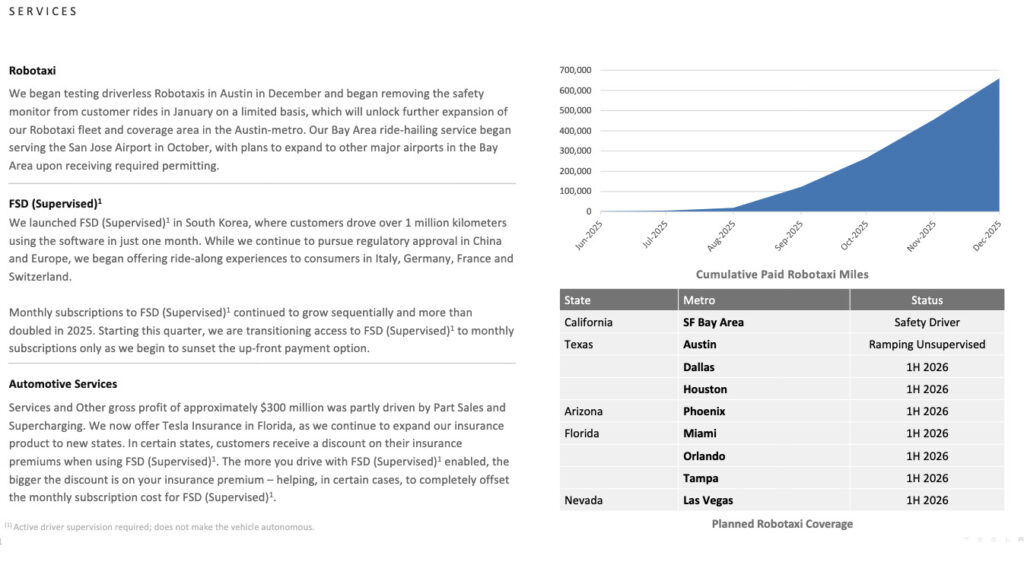

– Cumulative paid robotaxi miles now tracked metric

FSD Revenue Surge

– 70% of Q4 vehicle sales included upfront FSD purchases

– ~100K FSD sales at $8K each = equivalent profit to 100K additional cars

– 518K total “unit profits” (418K cars + 100K FSD)

– Final opportunity for $8K purchase before subscription-only model

– Potential Q1 windfall: 4-5% of 8.3M non-FSD vehicles could purchase

– Could reach 400-500K sales = doubling car profits Screenshot

Screenshot Screenshot

Screenshot Screenshot

Screenshot Screenshot

Screenshot Screenshot

Screenshot Screenshot

Screenshot

Screenshot

Screenshot Screenshot

Screenshot Screenshot

Screenshot Screenshot

Screenshot Screenshot

Screenshot Screenshot

ScreenshotRobotaxi Deployment Reality Check

– Current fleet over 500 vehicles (tracking sites missed 50%+ of cars)

– Doubling every month target

– 2 months: Pass Waymo

– 10 months: 500K vehicles if sustained

– Infrastructure challenges caused delays

– Airbnb model still targeted for 2026, possibly sooner

Manufacturing & CapEx Explosion

– Doubling CapEx spend: $10B → $20B annually

– Excludes chip/solar fab investments

– Six factories building simultaneously

– Model S/X production ending in Fremont

– Space for 1M+ Optimus bots annually

– Potentially 10M bot capacity with full conversion

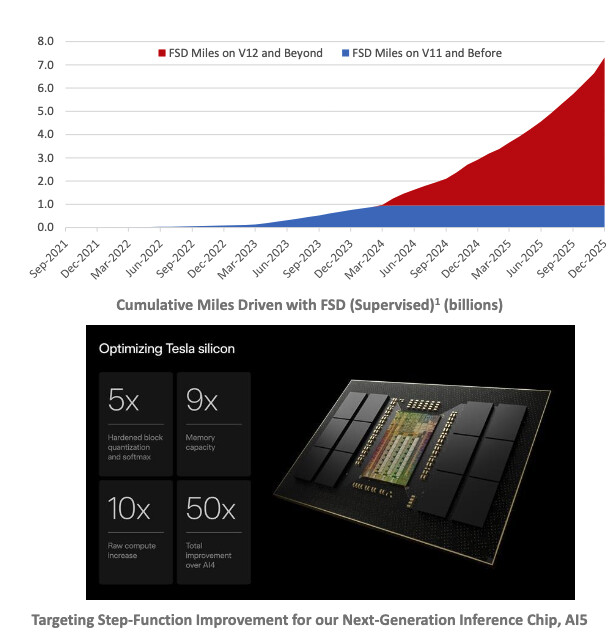

Chip & Memory Strategy

– Memory shortage bigger constraint than chip shortage

– Vertical integration: dirt → solar cells → panels

– Tesla 10x more memory efficient than competitors

– AI5 chip production for internal use first

– Learning curve for lunar manufacturing capabilities

Financial Projections & Debt Strategy

– 100K robotaxis = $4B annual profit potential

– 2M vehicles by 2027 at $100K profit each = $200B revenue

– Debt financing viable with robotaxi cash flows

– Amazon-style growth model: temporary losses for massive scaling

Insurance & Subscription Bundling

– Lemonade projecting 50% risk reduction already

– 10x safer by FSD v15-17 (2-3 years)

– Insurance could drop to $30-50/month vs current $250

– Bundled FSD + insurance packages coming

– Transportation-as-a-service becoming dominant model within 3 years

No comments:

Post a Comment