The immediate take home is that we will enter a period of hyper growth. Right now, tjhis will bebled by Canada with a potential 8%+ growth factor running f9or at least five years. Canada will attract 10,000,000 workers, mostly from the USA as the whole manufacturing infrastructure migrates to the St Lawrence valley in order to secure aluminium supply systems.

The current TRADE WAR merely woke everyone up and it will certainly end with any political change in Washingtom. In the meantime, Canada will cotinue to decouple and manufacturing and workers will tend to follow.

This is an era of super investment which will still keep the USA humming.

First Principles GDP – REAL GDP Growth Via Massive Investment

February 16, 2026 by Brian Wang

The basics of Real GDP growth from first principles

https://www.nextbigfuture.com/2026/02/first-principles-gdp-real-gdp-growth-via-massive-investment.html

Real GDP measures the inflation-adjusted value of all goods and services produced in an economy. Its growth comes from three sources (the Solow growth accounting identity):

More labor (hours worked or workers).

More capital (machines, buildings, infrastructure).

Higher productivity (total factor productivity, or TFP—output per unit of labor + capital, from tech, efficiency, organization).

Real investments (spending on productive assets like factories or data centers) DIRECTLY boost the capital stock. If those assets are high-return (they enable more output), they generate SUSTAINED growth. Unlike consumption (which just uses resources), capital investment compounds because it raises the economy’s potential output. WWII proved this at scale. Massive government-directed investment in factories, ships, and planes turned idle resources into production, driving 15-20% annual real GDP growth in 1941-43.

There is and will be trillions in AI data centers, chips, power, and R&D, funded partly by foreign capital (Middle East sovereign wealth, etc.). There is economically measured low US unemployment ~4%, BUT AI creates a new capital stock that multiplies everything.

WWII as the benchmark—similarities in mobilization

WWII GDP surged because there was an investment explosion. Defense spending hit 40% of GDP. Car factories → tanks; steel → ships. Real output grew because resources were redirected to war goods.

No immediate inflation drag. Price controls and rationing suppressed it. Growth was real because supply scaled via new production. There was a lesser effect and lesser but large spending for the Korean War with one peak year of 13% real GDP growth.

WW2 Flywheel start. Wartime tech (radar, computing, nukes) spilled over, sustaining 4%+ postwar growth.

Today’s AI Superbuild Scenario

Similar redirection, but private-led + foreign trillions. US hyperscalers (Microsoft, Google, Amazon, Meta) spent $400B+ capex in 2025 and $700B+ in 2026 and $1+ trillion per year in 2027, 2028, 2029. AI spending is already over $2 trillion per year including all spending.

Add Middle East deals (UAE’s $1.4T commitment, Saudi’s $600B, DataVolt’s $20B US data centers) and negotiated inflows.

This is 3-4% of US GDP (~$31T nominal in 2025) directly as investment, BEFORE multipliers.

Unlike WWII’s one-off war push, AI is iterative. Data centers train models that design better chips/power plants faster.

How REAL investments create REAL Growth (no grift, just output)

Capital deepening. Each $1T in AI infra adds servers, cables, substations. This isn’t paper growth—it is physical, 100GW+ new capacity by 2030, doubling global data centers.

US share is dominant due to talent (Silicon Valley) and policy (deregulation for builds).

Multiplier effects inculde construction (steel, concrete, labor) ripples. There is a 1.5-2.5x GDP boost via supply chains. AI capex already added ~1% to 2025 H1 growth per the St Louis Federal reserve statistics.

Scaling to trillions? 3-6% direct lift and can be MORE.

No competence gap with WWII. Today: Musk/xAI, OpenAI, hyperscalers execute at speed (xAI’s Memphis supercluster). Foreign cash (UAE/Saudi) flows to US projects because returns are highest here—AI moat (data, models, chips). Trump-era deals accelerate this without throttling private R&D (which dwarfs government spending anyway).

Critic’s stock market focus misses the Markets prices future AI earnings. Tariffs and trade policy? Partially protect US leads in tech race.

The AI productivity flywheel—sustained and accelerating

This would be the main game-changer, unlike WWII’s finite war output.

The TFP (total factor productivity) explosion. AI automates 40%+ of tasks (coding, design, logistics). McKinsey foredcast GenAI can add $2.6-4.4T annual global value by 2030s.

US concentration. The US has 70-80% of AI investment/funding.

Self-reinforcing loop: More data centers → more compute.

Better models (agents, robotics) → efficiency gains (10x faster R&D, 50% less energy per inference).

AI optimizes itself. Designs next-gen chips (Nvidia), power (space AI), even factories.

Result is TFP growth compounds.

Standard models say AI adds 0.2-0.5% annual TFP BUT my flywheel scenario (trillions + US edge) could hit 5+% sustained, like electricity (doubled US productivity 1880-1930) but faster AND more sustained.

My case is that Wharton projections and other projections under predict what will happen. Wharton sees AI lifting US GDP level 1.5% by 2035, 3.7% by 2075.

With trillions foreign + policy tailwinds? Double that in early years.

Inflation, environment, China—why this sticks

Inflation control: WWII had controls. Today, supply-side boom (AI energy efficiency, robotics for labor shortages) prevents overheating. Foreign capital finances without printing money beyond existing levels of money printing. It is not a money printing wave. Energy? Space based solar will scale with AI-optimized grids. Operating solar in orbit or on the moon is not polluting the earth from the operation of the data centers.

Environment – WWII and WWII construction and factories did cause pollution. AI Data centers use power, but natural gas is half as polluting as coal and the pollution control systems are on all new turbines. Space based solar will have less than 5% of the pollution.

China has 5% growth max now (demographics, debt).

US AI flywheel + alliances (Middle East) outpaces. Robots/AI replace or add to shrinking workforces. US has the models lead.

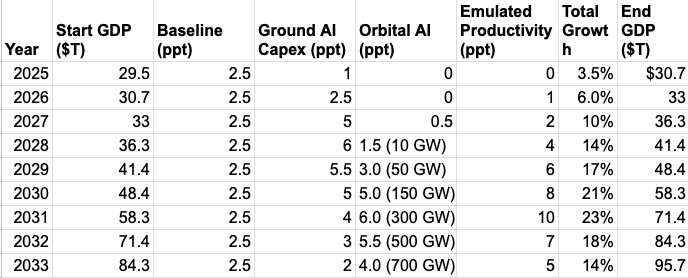

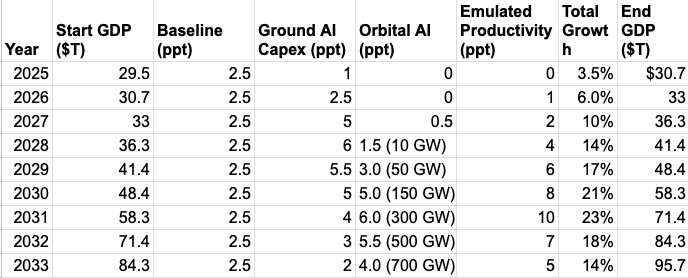

Quantifying 18%+ real growth

US GDP: ~$29T real (2025 est.). 18% = +$5.2T output/year.

Investment alone: $1T annual AI capex (plausible with deals) = 3.5% GDP direct + 3-5% multiplier = 6-8%.

Productivity add: AI rollout (agents in factories, offices) could add 5-10% TFP in peak years (20-50% efficiency in key sectors).

Total 10-18% feasible like WWII’s 18-20%. IF AI surges productivity then growth goes higher.

Sustained? Flywheel makes 8-12% annual plausible decades (compounding to 2-3x economy). AI is general purpose like steam/electricity.

US concentration + productivity compounding makes 18%+ the logical outcome of an economic supercycle.

Space AI Supercharge

Orbital data centers will make tens of trillions of dollars to continue the insatiable demand for AI data centers. AI data centers on the ground are already getting $1+ trillion per year in build. SpaceX is already at $600 cost per kilogram for launches of Falcon 9.

A reusable super heavy booster (already landed three times and reflown twice) gets them to less than $100 per kilogram.

200+ launches this year and possible 50-100 Starship launches.

V4 Starship next year.

200 tons per launch. 10-20 Megawatts per launch.

800 Starship launches (2027-2028).

200 launches per year for all 50,000 V3 communication satellites to launch in 2 year.

This leaves 400 launches for the first V3 AI satellites. 4-8 Gigawatts of AI.

1 Gigawatt of AI data center is currently valued at $50 Billion each. SpaceX deploying 4 Gigawatts (40,000 one hundred kilowatt satellites using 400 launches) would be $200 Billion of AI data center. Just renting out the GPUs would be $160 billion per year based upon estimated spot prices. xAI Grok 4.20 is releasing this week (likely 3-4 days).

Possible in 2026, a reveal of emulated human business using Tesla AI4 chips in 4 million Tesla cars. Screenshot

Screenshot

Screenshot

ScreenshotExogenous inputs are:

Foreign AI capital: $2–4T in 2026–2028.

SpaceX launch schedule and per‑launch AI capacity.

Chip‑level emulation that scales to 10–100 human workers.

Everything else is plumbing investment into a consistent GDP accounting flow.

No comments:

Post a Comment