First off, fiat money is always collapsing and then been reborn. The reason is that it is the way in which governments pay for services. Neither gold or bitcoin does that and of course taxpayers do not want to pay gold or bitcoin.

We have three separate commodities. Gold is supplied by mining and hoarding demand drives that market. Yet it is mostly government hoarding. Think about that. Bitcoin is driven now by individual hoarding, not least in an effort to legally avoid or evade taxation or criminal consequence or bank charges as well. Unlike gold, it is easy to change legal jurisdiction. fiat money is always facing continous dilution. This dilution accomadates loan generated interest charges. Under stand that i borrow $10,000, i need to pay back almost $20,000 over a decade or two. that extra is ultimately printed folks.

The central bank woke up to the direct need for around a 3% annual inflation rate some time ago. unfortunately we have had a run on the printing presses for the past several years and the system is readjusting of course.

Gold vs. Bitcoin: The Winner Is…

https://internationalman.com/articles/gold-vs-bitcoin-the-winner-is/

The ultimate competition to become the world’s dominant money will have only one winner.

Anything else would amount to an inefficient barter system, which is why international monetary networks tend to converge on one thing as dominant money at the base layer.

Previously, the dominant base layer money was gold. Today, it’s the US dollar and Treasuries. In the future, I think it will either be Bitcoin or gold.

Over the long term, billions of people through trillions of transactions—in other words, the free market—will ultimately decide whether gold or Bitcoin will win.

I am all for free-market competition in money.

I say let the best money win.

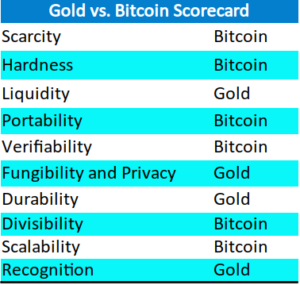

In a recent article, I analyzed the ten most decisive monetary attributes and examined whether gold or Bitcoin has an advantage. The table below summarizes the results.

Bitcoin wins in 6 out of the 10 categories, including hardness (resistance to debasement), which I believe will be the most decisive factor.

While gold has an advantage over Bitcoin in durability, that advantage will only be relevant in the case of an inescapable, global return to the Stone Age that lasts into eternity. Such an unlikely outcome is not relevant to investment decisions today.

Gold also has a fleeting advantage in liquidity, fungibility and privacy, and recognition. However, Bitcoin is eroding those advantages every day.

If current trends continue, I believe Bitcoin will overtake gold in these categories in the years ahead.

Putting it all together, gold’s advantages over Bitcoin are either irrelevant or melting away.

The inescapable conclusion is that Bitcoin has superior fundamental characteristics that make it a better tool for sending value through time and space.

Digital gold is better than analog gold.

In short, Bitcoin is likely to win the ultimate competition and become the world’s dominant money.

Allow me to explain how I see it playing out…

I am not saying it is 100% certain Bitcoin will demonetize gold.

What I am saying is this: over the long term—measured in years, likely decades—there is a good chance Bitcoin will demonetize gold because it has superior monetary properties.

However, the vast majority of humanity does not understand that Bitcoin has the potential to become the world’s dominant money… yet.

What we have here is an enormous information asymmetry.

With Bitcoin, it’s as if you discovered gold before most of the world understood that gold was useful as money.

Think about it.

You have the chance to front-run major investors, large multinational corporations, and even nation-states by getting in on this trend before they do.

Bitcoin’s potential ascent to the world’s dominant money—a megatrend I like to call The Bitcoin Supremacy—is an enormous once-in-a-lifetime opportunity and the biggest investment story I’ve ever seen.

There are a couple of necessary clarifications to this analysis.

Clarification #1: Black Swans

Any number of events with currently inconceivable and impossible-to-foresee effects—the arrival of quantum computing, asteroid mining, nanotechnology, etc.—could tip the scale in either direction.

Clarification #2: Timing

I do not believe Bitcoin is an immediate threat to gold.

Most likely, gold will be remonetized as the fiat currency system collapses, only to be demonetized by Bitcoin in the following years and decades.

Although Bitcoin has better monetary attributes than gold, it may take many years—potentially decades—for most people to recognize this.

A big factor in timing is how fast the fiat currency system collapses.

If I had to guess when that would happen, I would say the collapse of the fiat system should be evident by around 2030.

If the fiat currency system collapses faster than expected, it will likely benefit gold. Gold has better recognition, and more people will gravitate toward what they are familiar with. Bitcoin is novel and misunderstood.

If the collapse of the fiat currency system drags out longer, it could benefit Bitcoin. That’s because as time goes on and Bitcoin’s recognition grows, people become more comfortable with it as an alternative to fiat currency. They’ll skip gold and jump directly from fiat to Bitcoin.

In any case, I believe that Bitcoin won’t start to potentially demonetize gold in earnest until after the collapse of the fiat currency system is complete. My guess is that could happen around 2030, and then it could be many years—possibly decades—before Bitcoin fully demonetizes gold.

That said, a Bitcoin standard could spontaneously emerge faster than anyone expects. That’s a risk to gold and an excellent reason to have exposure to Bitcoin.

Clarification #3: Portfolio Allocation

I do not think it makes sense to go “all in” on Bitcoin… or anything.

100% exposure to any asset is not prudent risk management because nothing in life is 100% certain. With exponential increases in technology, not even death is certain, but that’s a story for another day.

What I can say with the highest confidence is that—for the first time in over 5,000 years—gold has a serious competitor that could demonetize it in the coming decades.

At a minimum, I view gold as a hedge if Bitcoin does not emerge as the world’s dominant money in the long term.

In the immediate future, gold is a superior monetary alternative to fiat currency. I believe it will be the primary beneficiary as the current fiat monetary system collapses in the years ahead.

In my opinion, the prudent thing to do is to allocate capital to gold and Bitcoin and update that allocation as time goes on and facts change.

In the short and medium term, I believe both gold and Bitcoin will do very well as the fiat currency system crumbles.

Right now, I want to have exposure to both, and the stocks of companies that benefit from higher gold and Bitcoin prices.

No comments:

Post a Comment