This sets the stage for a ten fold ramp up of Canadian lithium prpduction as exploration will rocket. That is always the answer to those who wish to plasy monopoly.

Throw in the real risk of outright replacement and this rewally promises to be a crash and burn and much quicker than is obvious. Lithium has lasted so long because it was first into the battery optimization market against good old Lead zinc battery tech.

There are ample alternatives to pursue and optimize and this is how you do it..

Chile Stuns Markets And EV Makers By Nationalizing Lithium Industry Overnight

BY TYLER DURDEN

FRIDAY, APR 21, 2023 - 09:25 AM

The weaponization of commodities in a world that is increasingly turning multipolar and where legacy trade links and commercial bridges are burning down metaphorically (and in some cases literally) is accelerating.

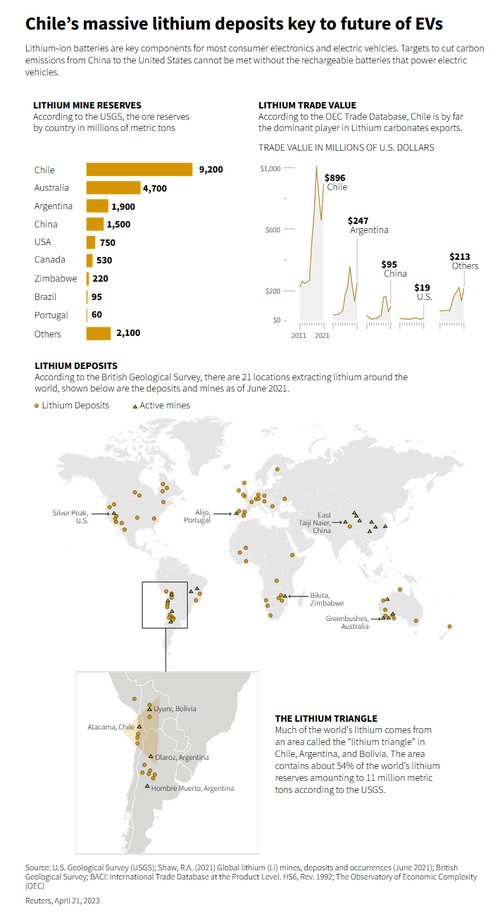

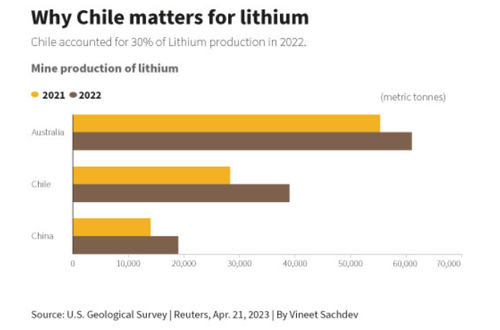

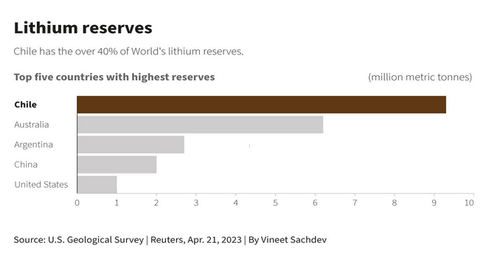

Chile's President Gabriel Boric stunned the world on Thursday when he said he would nationalize the country's lithium industry, the world's second largest producer of the metal essential in electric vehicle batteries, to boost its economy and protect its environment.

The shock move in the country with the world's largest lithium reserves would in time transfer control of Chile's vast lithium operations from industry giants SQM and Albemarle to a separate state-owned company.

The nationalization poses a fresh challenge to electric vehicle (EV) manufacturers scrambling to secure battery materials, as more countries look to protect their natural resources. Mexico nationalized its lithium deposits last year, and Indonesia banned exports of nickel ore, a key battery material, in 2020.

"This is the best chance we have at transitioning to a sustainable and developed economy. We can't afford to waste it," Boric said in an address televised nationwide.

Future lithium contracts would only be issued as public-private partnerships with state control, he said, hoping to extract far more profits from lithium demand by EV giants such as Tesla and well, everyone else these days.

The government would not terminate current contracts, but hoped companies would be open to state participation before they expire, he said, without naming Albemarle and SQM, the world's No.1 and No.2 lithium producers respectively. In other words, they can volunteer to hand over control of their assets. SQM's contract is set to expire in 2030 and Albemarle's in 2043.

SQM, formally called Sociedad Quimica Y Minera de Chile, and Albemarle supply Tesla Inc, LG Energy Solution Ltd and other EV and battery manufacturers.

Albemarle said the announcement would have "no material impact on our business" and it would continue talks on investing in further growth and using new technologies in Chile. SQM was not immediately available for comment.

South Korean battery maker SK On, which has a long-term supply contract with SQM, said it would monitor the development and respond with a long term view.

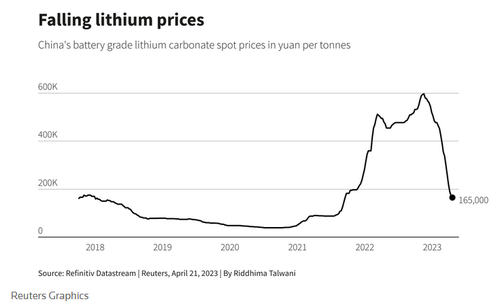

The announcement by Chile did not trigger a reversal in lithium prices which as we noted previously, have plunged more than 70% from a November peak due to weakening EV demand in China, the world's biggest auto market. The most-traded lithium carbonate futures on the Wuxi Stainless Steel Exchange in China fell 3.4%.

"When or if battery makers renew their contracts with lithium firms in Chile, contract conditions would likely become more difficult than what they saw in the past when there was no state involvement," said Cho Hyunryul, an analyst at Samsung Securities.

The move is likely to spur a shift in future investment in lithium to other countries including Australia, the world's biggest producer, analysts said.

"Policy stability is very important for any mining project ... Mining-friendly jurisdictions like Australia would be places where incremental funds get invested," said Harsh Bardia, an analyst at National Australia Bank's private wealth arm JBWere.

Boric said state-owned Codelco, the world's largest copper producer, will be tasked to find the best way forward for a state-owned lithium company and he would seek approval from Congress for the plan in the second half of the year. Congress has - or rather had - been a check on many of Boric's more ambitious proposals and shelved a proposed tax reform bill in early March.

Codelco and state miner Enami will be given exploration and extraction contracts in areas where there are now private projects before the national lithium company is formed.

A division will be dedicated to advancing technology to minimize environmental impacts, including favoring direct lithium extraction over evaporation ponds. Privately held Summit Nanotech Corp, which is developing direct lithium extraction technology, welcomed the announcement.

Boric said the country would look to protect biodiversity and share mining benefits with indigenous and surrounding communities.

"Today we present a national lithium strategy that's technically solid and ambitious," the president said, adding it would build "a Chile that distributes wealth we all generate in a more just way".

No comments:

Post a Comment