gold is no longer important except as something really nice to own.

who ever thought that the gold meme would die with a whimper.

This informs us that the whole system is c;leaning up and ultimatelu providing a superior currency, which means that governments and central banks are been slowly driven from the field because they still want to print money and noone will let them.

could it be possible that interest will be capitalized this way? .

It Would Be The Ultimate Irony - A Gold Standard Returning Through The Backdoor Of Crypto Markets

MONDAY, DEC 18, 2023 - 03:30 AM

By Marcel Kasumovich, Deputy CIO, Coinbase Asset Management

Markets forced crypto to clean up, inviting institutional participation. Stablecoin is making its way to the main stage for the most ironic of reasons – its inherent stability.

1. Be clear. Your words may not be welcome. But they also won’t be misunderstood. Elon Musk isn’t the only one who excels in this department. SEC Chair Gensler has that superpower, too. “If Tom or anybody else wanted to be in this field, I would say, ‘Do it within the law.’ Build the trust of investors in what you’re doing and ensure that you’re doing the proper disclosures — and also that you’re not commingling these functions, trading against your customers.

2. “Tom” is Tom Farley, the former President of the New York Stock Exchange, and Chair Gensler was responding to speculation that Tom was interested in rebooting FTX. Almost on the first anniversary of the beginning of the end of FTX, the FTT token more than doubled its value in a day. The market celebrated that serious institutional players were seeing value in the crypto ecosystem – even in assets and brands left for dead like FTT and FTX.

3. It goes without saying, Tom would do it within the law. And Gary might actually accept it. US lawmakers and regulatory bodies may not be first-movers in the crypto space. But it is also not a static position. The 2022 crypto carnage is a gift to policymakers. The ashes of the weakest links formed the launchpad for institutional players to confidently send their rockets into crypto’s orbit. They are fueled and ready for launch – Blackrock, PayPal, MasterCard, and Visa are engaged.

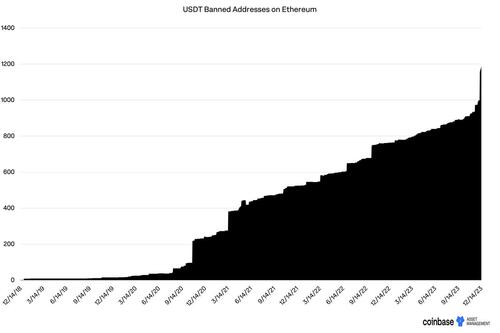

4. Crypto is cleaning up within its ecosystem, too. Not long ago, Tether was considered the greatest systemic threat to crypto. The largest and most active user application in the ecosystem, uncertainty about assets backing USDT and Tether’s commitment to working with law enforcement were routinely called into question. Now, Tether plans to release real-time data on their reserves and has supported the Department of Justice in arresting illegal activity.

Figure 1: USDT Banned on Ethereum

5. The calm after the storm is precisely why institutions feel comfortable exploring. If it didn’t die in 2022, crypto isn’t a fad. US dollar stablecoin and payments dominate attention for an ecosystem keen, almost desperate, to tell positive use-case stories. It’s also where stablecoin shines. Take Argentina. The official peso exchange rate devalued by nearly 50% against the US dollar this week. Crypto asset markets tell us there’s more to come.

6. In openly traded crypto markets, one US dollar yields 25% more Argentinian pesos than the official rate even after the devaluation. Why the difference? Policy. Some economic players are mandated to trade at the official exchange rate. It’s a tax. But it’s also a policy feedback tool, as well-functioning markets ought to be. Argentine policy is compelled to execute reforms with brutal immediate outcomes from currency devaluation for the sake of a brighter future.

7. Skeptical voices ring loudly in our ears – Argentina shows that crypto use cases are fringe scenarios. It’s an understandable criticism, though not compelling. For one, rich countries have shunted the growth of crypto use cases – crypto’s DNA is not the problem. Traditional banking also fails at fat left tails, not crypto. Deposit insurance and CBDCs cease to function in extreme instability, leaving the central bank printing presses – inflation – as the policy of last resort.

8. Fate loves irony, especially in finance. Stablecoin is recognized by its users as the premier narrow bank. A fully reserved stablecoin has virtually no risk of a bank run. And if those reserves are in the form of deposits at the central bank, as now contemplated by the Bank of England yet rejected by the US Federal Reserve, the risk is literally zero. Traditional banks can’t compete – a run leads to a sudden stop of access to deposits and especially foreign currency.

9. But what if the stablecoin or the US dollar were the source of instability? This is exactly where free markets shine, adjusting without intervention.

10. Imagine a confidence crisis in an individual stablecoin. Stablecoin can exchange hands many times in a single day. Its high velocity makes the move to an alternative swift – good collateral migrates to stablecoin where investors are confident. We lived this in 2022. And if the collateral were insufficient to guarantee a 1:1 value, those holding the “bad bank” coin bear the loss. Not surprisingly, proof of reserves is in high demand to guard against this threat.

11. Next, imagine a confidence crisis in the US dollar more broadly. More complicated, you say? Yes and no. The same principles of collateral migration apply – only the collateral changes. In the case of a currency crisis, users are swapping US dollars for hard assets. It’s still a migration from one stablecoin to another, only the other is likely to be an asset like gold to negate the risk of inflation or devaluation. This “flatcoin” would be a move away from fiat currencies.

12. It would be the ultimate irony – a gold standard returns through the backdoor of crypto markets. It’s not a matter of likely or not. It’s a possibility. And creative minds are building in this direction. Like Quorium and its stablecoin backed by gold reserves that stay in the ground. In essence, the owner has a claim on proven reserves, with Quorium transforming an in-ground gold asset into a high-velocity store of value.

13. Pay attention – it’s the price of knowledge.

No comments:

Post a Comment