Sooner or later, when you outsource to an alternate jurisdiction, you become vulnerable to some form of extortion and whatever form it takes it diminishes the original advantage.

Not that you can control extortion at home either. Grateful employees ultimately become ingrates.

The real takehome for management though is surprising. It makes really good sense to build factories in particular on a twenty year cycle after which you move them.

The building themselves are always built to scale and cheaply. that means almost a pole barn with a solid compacted gravel pad and concrete slab. Walls and roofs are installed as needed and equipment brought in and installed. Training crews show up along with new employees and pretty soon all is good.

This means you can move former employees that you want to the new location with a transition allowance.

This gives management ample flexibility and a real counter argument to unions and rapacious local government.

It is a rare plant that cannot move and even extractive industries are built around twenty year cycles

The good news is that rapaciousness is in decline and once poverty is solved ,all that will abate.

The Eyepopping Factory Construction Boom in the US

by Wolf Richter • Dec 2, 2023 • 199 Comments

The supply-chain catastrophe in 2020-2021, the edgy US-China relationship, and the scary dependence on China triggered a big corporate rethink.

By Wolf Richter for WOLF STREET.

https://wolfstreet.com/2023/12/02/the-eyepopping-factory-construction-boom-in-the-us/

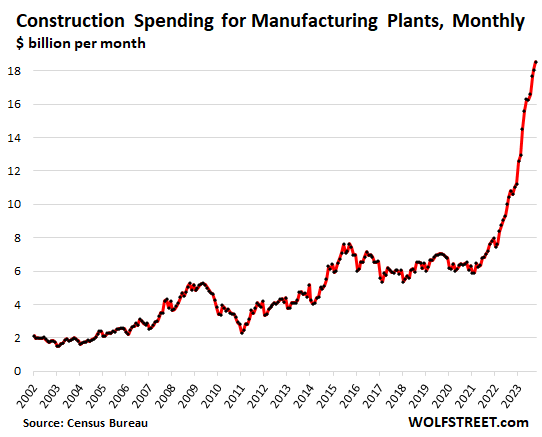

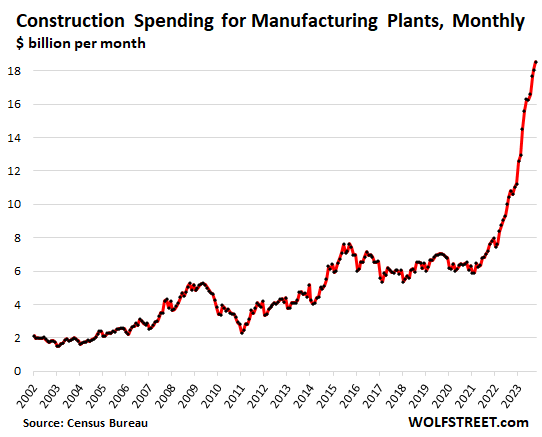

In October, $18.5 billion were plowed into construction of manufacturing plants in the US ($246 billion annualized), up by 73% from a year ago, by 136% from two years ago, and by 166% from October 2019. The relentless pace of the month-to-month increases is what’s amazing – from $12.5 billion spent in January to $18.5 billion in October.

The construction boom started in early to mid-2021, and since then, spending has tripled. About a year later, in July 2022, Congress passed a package of subsidies for select manufacturing industries to build factories, such as semiconductor makers (they’ll get $52 billion) and EV battery makers.

But the wheels of government turn slowly, approvals take their time, disbursements of funds for large projects takes time, so the flow of these government funds would just be the first trickle in 2023. The bulk is still coming.

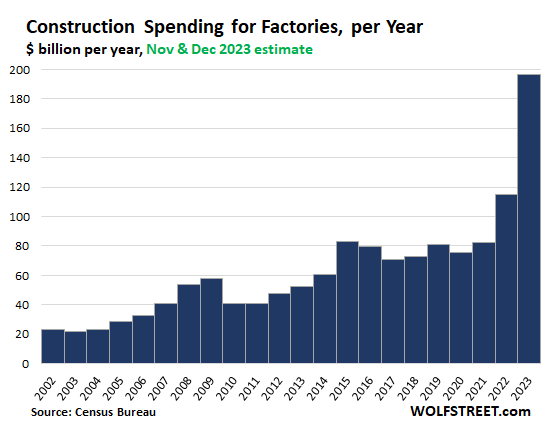

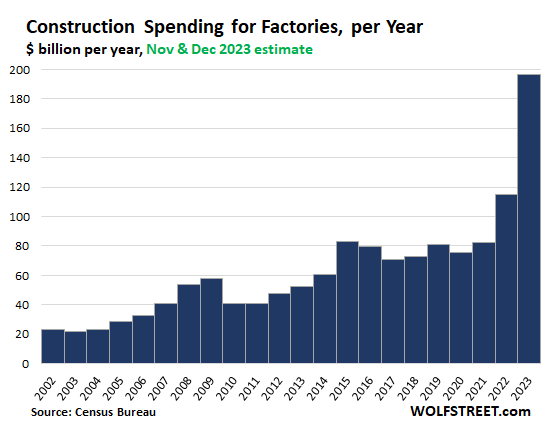

For the calendar year 2023, spending on factory construction will likely get close to $200 billion. For the first 10 months, the ever-larger monthly amounts already reached $159 billion. If November and December are only flat with October, spending will reach $196 billion by year-end.

The stagnation of factory construction through 2021 is a testimony to corporate chieftains in search of cheap labor.

But the supply-chain and transportation catastrophe they ran into during the pandemic, the edgy relationship between the US and China, and the scary dependence of US companies on Chinese suppliers have triggered a big corporate rethink.

It’s not like the US “isn’t making anything anymore,” but… The US is the second largest manufacturing country by output, behind China and has a greater share of global production than the next three countries combined, Germany, Japan, and India.

But the US, as the largest economy in the world, has fallen far behind China in manufacturing and many sectors have become brutally dependent on China – and the shortages and supply-chain chaos of 2020-2021 were a wakeup call.

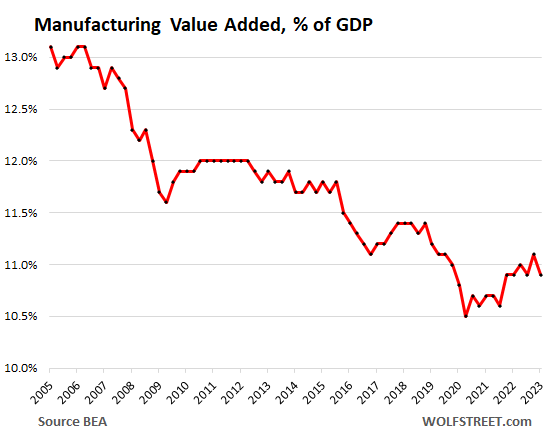

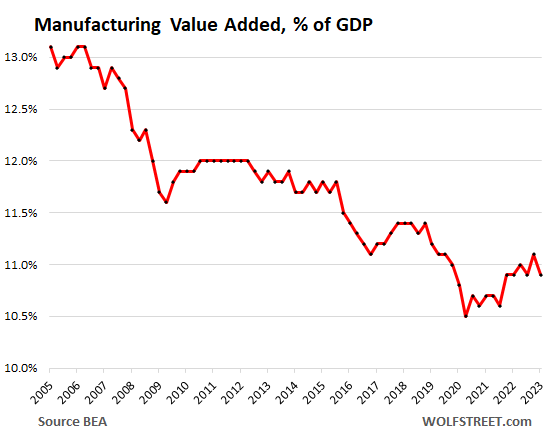

Manufacturing’s share of GDP had been on a long downward trend in the US. The data by the Bureau of Economic Analysis only goes back to 2006. Back then, manufacturing accounted for over 13% of GDP. By early 2020, manufacturing was down to 10.5% of GDP. Since then, the share has been wobbling higher.

This year’s construction spending boom will add to manufacturing’s share of GDP in the future when the plants are up and running and producing at scale, which takes time. In other words, this is a slow process, and it has a long way to go:

Manufacturing has a large-scale impact on the economy, for decades to come, with its secondary and tertiary effects. Construction spending is just the one-time activity to get the building and infrastructure in place. What comes afterwards – actual production with its secondary and tertiary effects on the local economy – is far more important.

Companies invest in factories in the US to make high-value technologically advanced products such as semiconductors and motor vehicles. Makers of computer, electronic, and electrical equipment are big drivers behind the surge of factory construction, according to an analysis by the Treasury Department.

Industrial robots reduce China’s cost advantages. Automation and industrial robots – key in mass production – cost roughly the same in the US as in China. US labor costs are far higher, but other costs are reduced by bringing manufacturing onshore: Transportation costs are lower, lead times are shorter, there is less geopolitical uncertainty, less risk of losing or having to surrender the IP via technology transfer, etc.

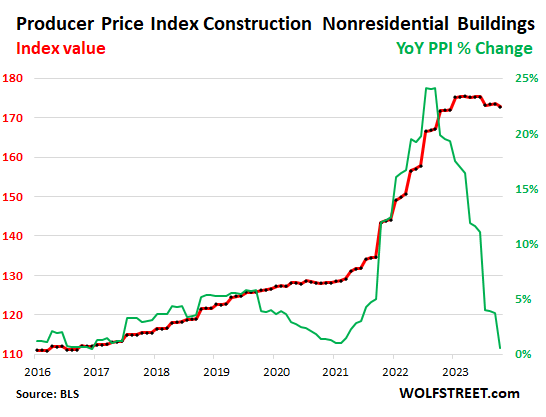

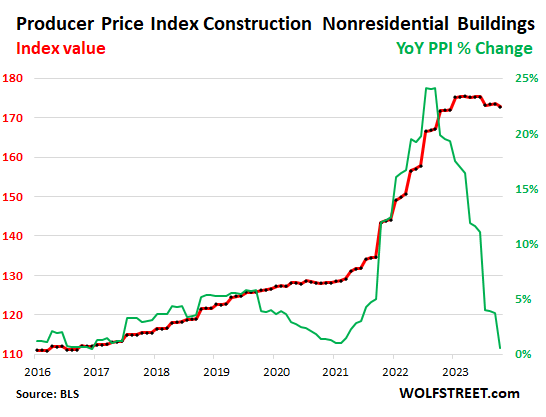

Construction cost inflation is not the driver – it has ended this year. The Producer Price Index for construction of nonresidential buildings hit a peak in January. Since then, prices declined by 1.4%. So construction cost inflation was not a factor in the 2023 surge of construction spending, though it was in 2022. This makes the boom in factory construction spending in 2023 that much more amazing.

No comments:

Post a Comment