This is a discussion on the search for cobalt.Intruth, as an old student on mining, i know we have far more cobalt than easily understood. Copper Nickel deposits tend to have cobalt, but in hte past the cobalt had a limited market, easily handled out of hte Congo.

That changing brings other mothballed deposits into the limelight. They are out there and one of the great copper camps in hte world in Noth West British Columbia is cobalt rich.

Forty years ago I laughed when Falconbridge pitched their cobalt reserves there in order to help place a bond issue. Now it is a different time.

The Energy Future Needs Cleaner Batteries

To deal with climate change and power the cars of tomorrow, we’ll have to solve the cobalt problem.

By Drake Bennett for Bloomberg Green

September 23, 2021, 2:00 AM PDT

From September 23, 2021, 2:00 AM PDT

https://www.bloomberg.com/news/features/2021-09-23/future-of-energy-requires-cleaner-electric-batteries-to-solve-cobalt-problem?

Late in August, at a precisely specified point in the low Arctic, a geologist named Dave Freedman stood in a raw wind and a limitless expanse of tundra and began to thwack with a sledgehammer at a rock outcrop jutting up from the soil. Freedman, 29, works for a company called KoBold Metals, and the process that had brought him to this pair of GPS coordinates in Quebec’s far north was complex. But the rock had had its own journey. Before it was rock, it had been magma in the Earth’s mantle, part of a molten tongue tens of meters wide that had welled up as two tectonic plates spread apart 1.85 billion years ago. At first the magma had melted and eaten the layers of crust it flowed through, but, cooling as it rose, it eventually ran into resistance. The liquid pooled, like smoke along a ceiling, and then as the last of its heat bled out, solidified into a shelf of an igneous rock geologists call peridotite. Over the eons, it was lifted by tectonic collisions, tilted, folded, and broken. Glaciers ground it down. And then one day a helicopter descended from the sky and out jumped a slim, bearded man in Gore-Tex, with a high-visibility vest, a backpack, and a hammer.

After two ringing blows, a scone-size chunk of the outcrop broke off. Freedman hefted it up and blew on it. He grabbed the hand lens dangling from his vest and peered at the rock’s freshly exposed face, holding it a few inches from his own. The coarse grain was a good sign. So were the seaweed-green crystals of olivine. Evidently the magma had cooled slowly here, giving it time to react with neighboring rocks and to dyspeptically exsolve out the metals it had carried up from the mantle. “When you change the composition of a melt,” Freedman explained, “everything just goes haywire. Everything’s boiling, and things are unhappy, and it’s just a really chaotic environment.”

In the middle of the face shone a cuprous M&M-size dot. Freedman, pointing to it, called it a “bleb.” Somewhere nearby, within the confines of KoBold’s 280-square-mile block of exploration claims, he was hoping there would be a much bigger one: an ore deposit the size of a car, maybe, or a house, rich with extractable nickel, copper, and, most valuable, cobalt. KoBold’s existence is predicated on the idea that it can find high-grade ore such as that in places where others can’t—and the idea that, once it does, the company will be feeding an exploding global demand.

Twenty-five hundred miles south of KoBold’s claims in Quebec, the other side of that bet was brewing up in a glass tank with the rough dimensions of an office water cooler, housed in a metal frame and fed by thin plastic tubes. Graduate students at the University of Texas at Austin, working under a materials chemist named Arumugam Manthiram, were flowing various dissolved metal sulfate salts into the solution in the tank to get them to combine into a solid with a specific microscopic structure. Processed further, the resulting material would power a rechargeable battery cell. But this one, unlike those currently used in both Teslas and iPhones, would need no cobalt at all.

There is a grandly prosaic term for what needs to happen to prevent the planet’s climate from growing ever warmer, more extreme, and bizarre. That term is “the energy transition.” This year’s apocalyptic summer vividly illustrated the stakes of the energy transition, with unprecedented heat, unprecedented drought, unprecedented fires and storms and floods. All of that is because of the carbon we’ve already released into the air. But the grim news of the day has obscured that in the past few years there’s also been dramatic technological progress in the effort to replace fossil fuels. Some of the greatest advances have come in batteries. Over the past decade improvements in energy density and reductions in manufacturing costs have combined to bring the price of electric vehicle batteries down almost tenfold. Analysts at Bloomberg New Energy Finance predict that within three years, the cost will drop below $100 per kilowatt-hour—the price at which electric vehicles become as cheap as gasoline-powered ones—and continue dropping. Those same advances have made it feasible to store the intermittent energy from solar cells and wind farms in “grid-scale” batteries, making renewable energy even more competitive, on price alone, with coal and natural gas power plants.

Because batteries are a technology like a microchip, rather than a commodity like oil, it makes sense that the trajectory of their capacity and cost will be closer to the former’s steady exponential improvement over time. But batteries also rely on the specific qualities of certain elements to work. The highest-performing lithium-ion batteries on the market today require cobalt, and cobalt is hard to come by. Most of the known reserves lie under Congo, a country plagued by corruption and frequent wars, where mining often occurs in dangerous, deadly conditions, and not infrequently is done by children. Chinese companies own most of Congo’s mines—clean energy, like dirty energy, has its geopolitics. The metal’s price has fluctuated wildly in recent years.

“There’s enough cobalt in the upper 1 kilometer of the Earth’s crust on the continents to build a million electric vehicles for every person on the planet”

Even if the electric vehicle industry stayed the size it is today (there are a little more than 12 million EVs on the road), it would behoove battery makers to find alternatives. Replacing the world’s 1.2 billion internal combustion vehicles—as we will need to do in the coming decades to have any hope of cutting greenhouse gases—will require something much more dramatic. Solving the climate problem requires solving the battery problem, and solving the battery problem requires solving the cobalt problem.

Among the companies springing up to do that, some are focusing on recycling cobalt out of spent batteries. Others are rethinking ore processing to make once-marginal deposits more cost-effective. A few are trying to mine the ocean floor. But on the most basic level, the approaches are about finding more metal, as KoBold is attempting to do, or figuring out how to use less, like the Manthiram lab. They’re complementary, of course, but they also rely on different conceptions of the future and different diagnoses of the problem. Balkanized, in parallel and at occasionally cross purposes, they’re working against the same clock.

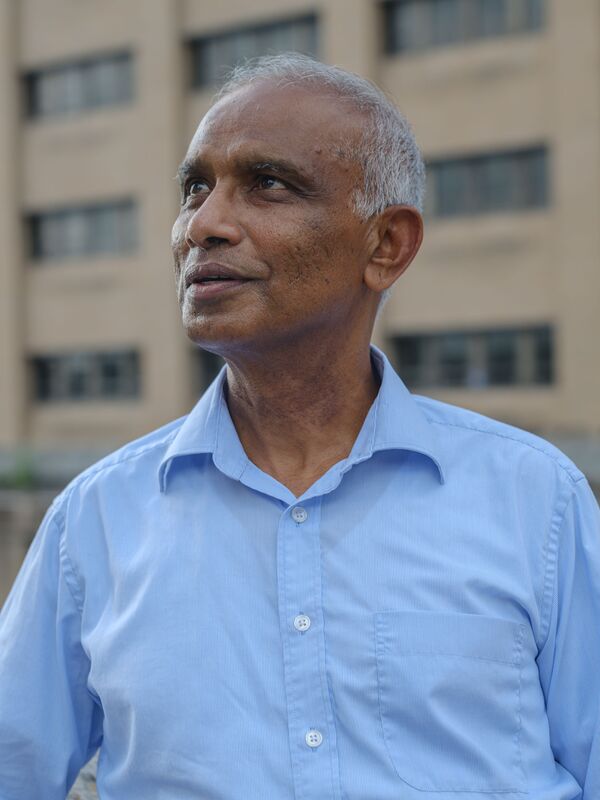

“My story is that I should not be here,” Manthiram says, sitting in his ninth-floor office in Austin, below a bank of framed patents and bookshelves colorful with toylike, wood-and-metal models of molecules. Manthiram was born in 1951, to parents with no formal education, in a tiny village called Amarapuram, in Tamil Nadu, near India’s southern tip. His father, who sold firewood for a living, died two months later—Manthiram doesn’t know of what—and his mother never remarried. Instead she focused her energy on her only child. She heard about a Catholic school in the next village and sent him there. “Two miles going, two miles coming back, through the jungle!” Manthiram recalls. “There was no road. There was no weather forecast.” When he graduated high school, his mother’s ambition was for him to open a general store in Amarapuram. One of his teachers convinced her that her son had the potential for a different future. The three of them—teacher, mother, and son—took the bus to a small college 40 miles away where the teacher arranged for the gifted young man to be accepted.

In the late 1970s, when Manthiram was getting his doctorate in chemistry from the Indian Institute of Technology Madras, he focused on metal oxides, a class of materials whose molecular structure makes them useful across a wide spectrum of practical applications. At around that time, a young American physicist named John Goodenough was just starting to think metal oxides might be useful in a rechargeable battery. Goodenough happened to be one of the examiners on Manthiram’s Ph.D. thesis and a few years later hired him as a post-doctoral researcher in his lab at the University of Oxford. When the University of Texas hired Goodenough away from England, Manthiram went with him.

One way to think about chemical reactions is as the trafficking of electrons. Elements that tend to shed electrons (sodium, for example) react with others that tend to gain them (like chlorine) and are transformed (in that case, into table salt). A battery is a technology for getting in the middle of a reaction like that and detouring the electrons to do work. The battery cell’s negative end, or anode, is made of materials looking to get rid of electrons, and the positive electrode, or cathode, is made from materials looking to acquire them. Between the two is an electrolyte-soaked separator that, impervious to electrons, frustrates the two materials’ desire to react. But when the battery is snapped into a flashlight or TV remote, that device’s circuitry forms a loop placing the battery cell’s two ends in contact. Electrons flow out from the anode and through the wiring, powering the device as they make their roundabout way to the battery cell’s other, positive end. The now ionized atoms that lost those electrons make a parallel trip, migrating directly through the electrolyte membrane to balance out the charge of the cathode’s accumulating electrons. (Otherwise the process would grind to a halt.)

When you recharge a phone, that process is reversed. Current from the charger forces the electrons back to the anode, and that draws the ions back through the electrolyte to reunite with them—ready to react once again, be separated, and sent on their different paths. The electrodes, both cathode and anode, are central to all of this. They have to deal with electrons and lithium ions, in the quadrillions, as the battery charges and discharges, while remaining chemically unchanged. And they have to do this over and over and over again.

In 1977 an English chemist named M. Stanley Whittingham, then at Exxon Research and Engineering Co., patented a rechargeable battery using lithium as the active mobile ion. Among the discoveries made by Goodenough and protégés such as Manthiram was that the sturdy layered crystal lattice cobalt forms when bonded to oxygen is almost uniquely effective as cathode material. Layered nickel oxide works similarly, but it’s much harder to work with and will degrade more quickly. And cobalt-based cathodes have a further advantage: Thanks to the element’s thermal stability, they’re less likely to light themselves on fire. Sony Corp. adapted Goodenough’s cobalt-oxide design and, in 1991, released a camcorder that was the first of many consumer electronic devices to run on it. (It’s difficult to imagine the iPhone ever catching on if you had to keep replacing the batteries.) In 2019, Whittingham, Goodenough, and Sony’s Akira Yoshino shared the Nobel Prize in chemistry for their battery work. Goodenough, who was 97, asked Manthiram to give his Nobel lecture for him.

Manthiram, for his part, has been worrying about cobalt since the early 1990s, when he took over his own lab at the University of Texas. That lab is now considered one of the world’s leaders on lithium-ion battery research. That list also includes Jeff Dahn, a physicist at Canada’s Dalhousie University, and Yang-Kook Sun, a chemical engineer at Hanyang University in Seoul. Their work has already made its way onto the road: Different electric vehicles use different battery chemistries, but in general the amount of cobalt in them has declined with each new design. Customers less concerned about power and range can buy electric cars with a different cathode design using lithium iron phosphate, a concept Manthiram and Goodenough developed in the ’80s. For years, though, attempts to remove cobalt entirely without degrading battery performance failed.

Before it was sought out, cobalt was feared. Medieval miners in Saxony found an ore that, on first glance, resembled silver but gave off toxic fumes when smelted. Technically those were from the arsenic and sulfur that cobalt combines with, but the miners can be forgiven for eliding the distinction. They named the worthless, poisonous rock after the kobold, a type of goblin believed to haunt the mines. In the 1730s, when the Swedish chemist Georg Brandt isolated the metal, he borrowed the name. When Kurt House and Josh Goldman, who first met as physics doctoral students at Harvard, founded their company in October 2018, they, too, borrowed the name. The price of cobalt, which had approached a value of $100,000 per metric ton earlier that year, was in the midst of collapsing by two-thirds before eventually climbing back to around $50,000. The startup raised money from the venture capital fund Andreessen Horowitz, as well as Breakthrough Energy Ventures LLC, the Bill Gates-founded clean energy fund whose investors include Jeff Bezos, Ray Dalio, and Michael Bloomberg (owner of Bloomberg LP, the parent of Bloomberg Businessweek and an investor in Andreessen Horowitz). KoBold hasn’t disclosed how much capital it’s raised, but researcher PitchBook puts the number at about $23 million. House, KoBold’s chief executive officer, says the company has “funded and committed funds well in excess of $100 million.”

House is at pains to emphasize that his company isn’t only looking for cobalt. Doing so wouldn’t make any sense. Cobalt is almost always mixed in with larger deposits of other ores, including nickel, copper, and sometimes platinum group elements. And though cobalt is currently the most valuable battery metal, and the one with the most concerning supply chain, building enough powertrains for a global post-internal-combustion car fleet is going to require a lot more of a lot of metals: nickel and lithium for the cathodes, copper for the wiring, rare earths for the powerful magnets that turn the battery’s electrical energy into torque. Add up all of that, and subtract the world’s known reserves, and you get $10 trillion in what House calls “missing metals.”

It’s important to understand exactly what that means. Cobalt isn’t actually rare. “There’s enough cobalt in the upper 1 kilometer of the Earth’s crust on the continents to build a million electric vehicles for every person on the planet,” House points out. But processing the trace amounts in which almost all of that exists would be economically ruinous. Minerals exploration is about finding the places where the twists and turns of geology have created ore concentrations freakishly large enough that it’s profitable to mine them at today’s metal prices and with today’s extraction and refining methods. “What you need is that nature goes and scavenges the copper and cobalt from a large volume of rock, then creates new rocks that are more like 1% copper or 1% nickel or 1% cobalt,” says Goldman, who serves as both KoBold’s chief financial and chief technology officer. “That’s a really unusual thing.”

“Every new mine’s a good mine because you haven’t seen the impacts yet”

What makes finding those deposits difficult is the same fundamental problem metal hunters have faced since the Bronze Age, namely that the Earth’s surface is opaque. Up until modern times, mineral discoveries were made by spotting deposits that were sticking out of the ground: outcrops colored red from oxidized iron or malachite green from copper. Such finds are still in production. North central Europe’s massive Kupferschiefer deposit has been continuously mined since at least 1200 A.D. and likely for thousands of years before.

Today’s explorers have an arsenal of newer tools for divining what lies underground, whether it’s fleets of satellites gathering spectral imagery and gravitational field data or giant metal detector coils towed by helicopters. Even with all that, however, the vast majority of discoveries up until now have been at or near the surface. And in recent years, no matter how much money has been spent on exploration, the trend in discoveries has been steadily downward. “We’re just at this point,” Goldman says, “where the exploration methodologies that allowed us to discover the easy-to-find ore deposits have been nearly exhausted.”

The limited resource, in KoBold’s diagnosis, isn’t ore but human cognitive power. As deposits get farther from the surface, the signals from below get too sparse and faint to be pieced together by even the best geologists. Metal deposits tend to be in remote, hostile places, and existing information about the subsurface is fragmented, inconsistent, and frequently wrong. Collecting new data by sending up an airplane with a magnetometer or shipping a drill rig to the Arctic to drill exploratory boreholes can be slow and very expensive. “These are sparse data environments,” House says, even for a data science company. “This is hugely different from a social media company where people just give them information all the time and they’re awash in it.”

KoBold’s approach is to take the kind of geologists who traditionally lead exploration efforts and yoke their expertise to the methods of data science. The company has created a database for itself out of geological information hoovered up from public and private sources all around the world: everything including academic papers, drill hole chemistry results, airborne and satellite measurements, and barely legible hand-scrawled field reports deciphered by optical character recognition. “People aren’t trying to make these easy to mine for data or easy to consume,” says Joanne Wood, the company’s director of data engineering. “Because essentially if they found something interesting, they would prefer not to share that with the general field.” The trove is searchable by KoBold’s geologists and data scientists, and it forms the corpus on which the company is training a powerful machine-learning algorithm to look for ore.

To a data scientist, these kinds of problems have a special appeal. KoBold’s 35 employees come from places like Google, Microsoft Corp., and Slack and tend to be coders who also have doctorates in the physical sciences. Asked why they joined the startup, they mention the satisfaction of speeding the energy transition, of course, but they also mention the opportunity to see if they’re really right about something. KoBold isn’t making software to sell to someone else. It’s staked claims, either solely or in joint ventures, in around 20 areas across Australia, Canada, the Central African Copperbelt, Greenland, and the U.S. In early September it announced an exploration alliance with BHP Group Ltd., the world’s second-largest mining group. Those ventures will either turn up ore or they will not. “What I love about KoBold,” says Jef Caers, a Stanford geophysics professor who is a research partner and shareholder in the company, “is that they will face the consequences of their machine learning.”

Caers has worked with KoBold to develop an algorithm for determining the size and shape of an ore body using the fewest possible drill holes. Jake Edman, an atmospheric physicist who’s the company’s director of machine learning, has developed a similar algorithm to choreograph the flyovers of its airborne electromagnetic surveys (the helicopter with the giant metal detector), based on what it does or doesn’t find as it goes. “I know their approach works, because I’ve done it by hand,” says M. Stephen Enders, a 45-year industry veteran who heads the department of mining engineering at the Colorado School of Mines. “I’ve gone into parts of West Africa and South America and other parts of the world with teams of geoscientists and all this data. It’s just really labor-intensive that way.” The speed and scale at which KoBold can explore, he argues, “is potentially very powerful.”

The second-to-last full day of Freedman’s summer in northern Quebec dawned with a dense fog. Neither of KoBold’s chartered helicopters—one for the geologists, the other for the electromagnetic coil—could go up. Freedman spent most of the day in the second-floor conference room of the small hotel KoBold had rented out in the Inuit village of Kangiqsujuaq. From time to time the fog would thin for a few minutes, revealing the snow-flecked highlands across the bay. Laptops and handheld magnetic-susceptibility meters were strewn around the conference table, and a box of Energizer alkaline batteries occupied one chair. (Zinc anode, manganese dioxide cathode, if you’re wondering.) Sledgehammers rested on the floor. Jagged, dark rock samples were everywhere: on windowsills, under a microscope, along the walls in the white grain bags in which they would be sent south to be chemically analyzed.

Early in the evening, Freedman was speaking with Mark Topinka, KoBold’s principal scientist, about the latest predictions from the company’s machine-learning algorithm, “the ML,” as they called it. Topinka was in the Bay Area, like many of the employees of the now fully remote company (others are spread all over the U.S. and as far afield as Zambia), and the Zoom conversation was stilted by a latency lag created by the Auberge Kangiqsujuaq’s spotty internet. The two were discussing a ragged sickle on the map that the algorithm had highlighted as promising.

“Yeah, I think it’s an esker,” Freedman said. An esker would not be promising; as a formation created by a glacier dumping out rocks carried from elsewhere, it would have little to divulge about what was under the earth where it currently sat. Topinka thought it was worth checking out, if only to see why the ML had zeroed in on it.

Late the next morning, the fog lifted. The geologists’ helicopter went up, pounding west along a river toward an area of the claim block 60 miles away. The landscape below was wrinkled, dun-colored, and dotted with meltwater lakes. Caribou had been everywhere a couple weeks before, but now they had migrated south. Keeping an eye out for polar bears, Freedman dropped off two members of his team to traverse a long ridge. A few miles away, the pilot set down near a small lake rimmed by ice floes. Not long ago, it might have stayed frozen all summer. Freedman worked his way around it, squinting at samples through his hand lens and entering the details into a Samsung tablet.

The next stop, over a low pass, was a wedge -shaped patch of ground that had befuddled the ML; Freedman examined and bagged rocks there to try to determine why. After that was a hillside that glowed a promising red in the ML’s predictive map. When Freedman got there, he grew excited. Multiple samples he took had metallic ore minerals in them—dusted in among the grain or gathered into blebs. In the afternoon, he had the pilot fly by the formation he and Topinka had discussed. “Definitely an esker,” he said into his headset.

The last stop of the day—and the summer—was within sight of an outcrop that Freedman had previously confirmed as “prospective” for ore. He wanted to see how far the formation went. He walked down and back up a shallow slope, his GPS readings forming a polygon that would be fed back into the algorithm, one more data point among billions. Two arctic fox pups emerged from their den to watch, drawn by the incongruous noise of human activity.

Should KoBold find what they’re looking for, that noise will increase. The company would either form a partnership with or sell its find to a mining giant; the biggest, Glencore Plc, is already mining nickel and cobalt in the region. Canada’s mining regulations are far stricter than Congo’s, but the process is similar. The mine would be an open pit if the ore is close enough to the surface, or a deep hole if not, ringed by an industrial village and fed by roads cut through the tundra. Extracting the ore would leave a lake of highly acidic tailings that could poison the surrounding soil and water if not carefully sequestered. “Every new mine’s a good mine because you haven’t seen the impacts yet,” says Payal Sampat, the mining program director at the environmental watchdog Earthworks. “Digging mines is actually a massive enterprise.”

Back in Kangiqsujuaq that night, the team packed up, and late the next morning they flew out to the city of Saguenay, Quebec, 900 miles due south, where they’d go their separate ways. One chartered King Air turboprop took the researchers, another took the rocks. It had been a successful month: Freedman and the ML had found lots of prospective rock. House says it’s almost certain that next summer they’ll be back up there drilling algorithmically optimized boreholes through the softening permafrost.

If all goes perfectly, metal from KoBold’s Quebec claims might find its way into its first battery within a few years of discovery. But often that span is more like a decade or two. “It takes a very long time, even in a success case, to convert a discovery into an operating mine,” says Enders at the Colorado School of Mines. By then, Manthiram says, he hopes to have helped change the fundamental chemistry of cathodes. In July 2020 the chemist, along with a graduate student of his, Steven Lee, and a postdoctoral researcher, Wangda Li, published a paper showing they could make cobalt-free cathodes—from nickel, manganese, and aluminum—that performed as well as the nickel-cobalt-aluminum and nickel-manganese-cobalt models widely used today. The cobalt-free batteries stored as much energy, charged as quickly, and had the same thermal stability. “This study,” the authors wrote, “opens a new space for cathode material development for next-generation high-energy, cobalt-free Li-ion batteries.” Manthiram has started a company, TexPower, to try to commercialize the chemistry.

The new design replaces the remaining cobalt in the cathode with nickel. To do so, Manthiram had to figure out a way to compensate for the latter’s stubborn limitations. At the most fundamental level, the metal oxides that go into cathodes aren’t constructed so much as grown. To the naked eye, a few precursor powders go into the mixing tank, then a different powder settles out. But seen through an electron microscope, each grain of the new powder is an aggregate of smaller particles. Zoom in further, and the porous structure of those particles emerges. That’s what allows the lithium ions to come and go, while also forestalling, for as long as possible, the degradation that comes with repeated charging and discharging. Getting the multiple elements to precipitate out of the tank at the same time, in exactly the right proportion and shape, is devilishly hard. It took years of tinkering with every aspect of the process to get it right—how fast the ingredients were fed in, how fast they were stirred, the temperature and pH balance of the solution, what reagents were added. And, of course, what mix of metals to use in the first place.

Once it’s dried, the cathode precursor salt goes into a furnace with lithium and oxygen. But whereas cobalt is easy to “cook,” nickel is more finicky. The temperature has to be precisely monitored and the oxygen flowed over the powder at just the right rate and pressure for it to react properly. When it does, it forms still another powder (now black) that, pasted onto aluminum foil, forms a cathode. “Lithium nickel oxide was known in the ’80s when Goodenough did lithium cobalt oxide,” Manthiram says. “But everybody discounted it, saying we can’t make it, it doesn’t work. It’s taken 40 years to slowly learn.”

Because cobalt and nickel are found and extracted together, replacing one with the other wouldn’t much hurt KoBold. Manthiram’s ultimate ambition might, however. What the world really needs, he says, are batteries made from elements that don’t have to be mined at all. The oceans are full of sodium, and sulfur is a ubiquitous industrial byproduct. There are batteries on the market whose two electrodes are made with those materials, but their temperature sensitivity and tendency toward corrosion make them impractical for many uses, including cars. Manthiram may not have another 40 years to figure that out, but he’s patient.

Ultimately, the difference in the two approaches comes down to which limits one believes are vulnerable to human ingenuity and which are not. “Cobalt is really good,” House says. Speaking into his laptop camera from his backyard in California’s North Bay, he holds up his iPhone. “There’s no nickel in there at all,” he points out. Given the liberty not to worry about battery costs—unlike in an electric vehicle, they’re a tiny fraction of the overall cost of a phone—Apple Inc. chose an all-cobalt cathode. “They’re clearly going to optimize for performance, for energy density, longevity, charging rate capability, all that kind of stuff,” House says. “We should by all means try to find substitutes,” he concludes, “but the physics are what they are. It’s still better.”

“Really the bottom line is it would be highly helpful for us to have a new periodic table with some more elements to choose from,” says Dahn, Manthiram’s fellow battery researcher, with a laugh. “You have to think about, ‘OK, what elements can I work with that are on the planet at the scale required?’ ” Dahn says. “And then the periodic table that you can actually use becomes pretty darn small.”

Of course, a future where we run down the world’s currently known reserves of cobalt—and nickel and lithium—to build billions of electric cars is, in many ways, the best-case scenario. It assumes an ability for rapid, sweeping, concerted adaptation that our species has not always demonstrated. And it sounds particularly optimistic coming from the ruthlessly probabilistic minds at KoBold. When I mention this to House, he responds, “I don’t know whether we will fully electrify the vehicle fleet, or fully electrify the economy. I know we absolutely have to if we’re really going to solve climate change.” He would like to be part of that. Still, he points out, “I don’t have to solve global warming to be a successful company.” KoBold is going to fail more than it will succeed, but if it is really right just once, “we make billions of dollars.” Of that, he is more confident. —With Akshat Rathi and Danielle Bochovelity.

No comments:

Post a Comment