Well folks every tenant has way more space than he needs or can hope to utilize. And moving uptown to less space in a new building is a real economic choice. Except you abandon ample space and the Landlord must then attract a tenant.

The real escape is condo conversions for these buildings where possible.

We now know what the final numbers look like and all those AAA buildings are worth a lot less. Understand most are owned by insurance companies looking for a century return. They can last thirty years to see all this work through.

It is just that none of us imagined this happening quite like this.

Older Office Towers In Cities Face "Tsunami Of Trouble"

by Tyler Durden

Wednesday, Aug 28, 2024 - 02:45 AM

https://www.zerohedge.com/markets/older-office-towers-cities-face-tsunami-trouble

Commercial real estate market challenges are more severe for older office towers in downtown metro areas than those outside city centers. The mismatch between funding needs and available credit in a high-interest-rate environment has also intensified the strain on building owners, as elevated tower vacancy rates persist across many markets due to the ongoing trend of remote work becoming the norm.

Bloomberg penned a CRE note on aging business districts from Los Angeles to Chicago to Boston of zombie towers with high vacancy rates that have no use in today's economy.

Big landlords, including Brookfield, Blackstone, and Starwood Capital Group, have walked away from older downtown towers in recent quarters.

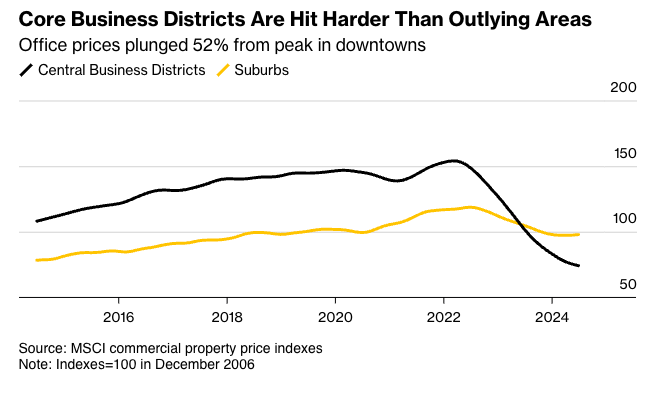

The latest data from MSCI shows office values in metro areas have crashed 52% from their highs. Some of the worst declines have occurred in San Francisco, Manhattan, Washington, and Boston.

Between 2019 and 2023, about $557 billion of value evaporated from US offices due to a multi-year slide in demand, with older towers quickly falling out of favor with companies, according to an estimate by economists at Columbia and New York universities. CBRE Group noted that only 2% of towers in the US are considered top-tier, with rents 84% higher than the rest of the market.

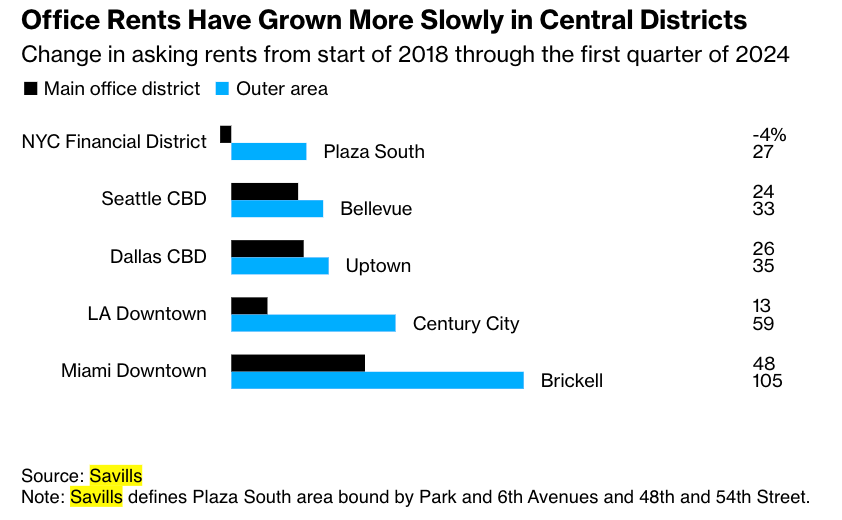

Data from brokerage Savills shows office rents in business districts have grown slower than rents for similar buildings outside metro areas.

The move to new towers highlights how, for decades, the bubbles in legacy downtown districts, fueling economies, have ended for now, and older towers will have to be torn down.

According to Ruth Colp-Haber, chief executive officer of Wharton Property Advisors, a New York brokerage, landlords of old towers are falling under severe pressure because finding financing in today's high-rate environment for renovations is extremely tough.

"What we have left are older buildings, many in AAA locations, but facing a tsunami of trouble," she said, adding, "It used to be there was plenty of business to go around. Now it's a zero-sum game."

X user Triple Net Investor provided color on an office tower in crime-ridden Baltimore City that sold at auction for only $4.4 million. The tower was built in the 1960s in a business district that has seen tower prices collapse over the last several years.

Following a series of our reports highlighting the crash in tower prices in the Inner Harbor area, under the old leadership of the Baltimore Sun, the paper tried to convince everyone, "Drop in downtown Baltimore real estate values not a crisis."

To be very frank. It's a crisis. Democrats running the crime-ridden metro area are delusional and blinded by their woke religion as the city's population recently crashed to a 100-year low, and violent crime remains a major issue.

We've had conversations with multiple folks at wealth management and investment banking firm Stifel Financial about the latest shift of operations outside the dying business district to a new tower in a much safer and newer district. At first, Stifel contemplated leaving the city for the suburbs because far-left Democrats in City Hall could not enforce law and order.

In a recent note, Goldman's Vinay Viswanathan told clients some welcoming news about where the CRE downcycle could potentially be... "From a macro perspective, we think commercial property valuations are getting closer to their bottom."

Let's not forget the comments from Rebel Cole, a finance professor at Florida Atlantic University who advises Oaktree Capital Management, who warned early last month, "Compared with the Savings & Loans crisis and 2008, we're still in the first or second innings" when it comes to distressed CRE assets.

Come on, Jerome Powell, the CRE market needs some sizeable interest rate cuts.

No comments:

Post a Comment