These charts really tell the story rather well. The convenience of oil and natural gas will maintain market share even in the face of zero cost electrical power. The advent of the EV shill shift a portion of that energy demand to electrical which will drive major adjustments globally.

right now though, natural gas is ideal for heating homes while all that transitions to more effciency and geothermal. Geothermal is also a backup for necessary grid power.. And so far it looks like the EV crowd is drawing off peak power from that same grid which is excellent sense. Making the Grid efficent is literally free power.

My point though is that oil is necessary because electrical is not nearly as convenient and that applies to just about everything else. I expect the EV concversion to eliminate perhaps twenty percent of demand at the time when the last twenty percent of the global population exits poverty.

Today i can watch a punjabi farm boy crank up hist tractor to do something stupid. I was that boy in 1955. today two thirds of our global population can do all this for a can of diesel fuel. No one is going back to using a bullock..

We will likely keep using oil in particular forever even if a super battery comes along just because it is easy and convenient. We are slowly reducing coal here because we have natural gas. Anywhere else not so lucky.

Again the highest and best use of nuclear just happens to be as a heat engine and a static one at that. Geothermal is also static and all this takes wasyteful power conversion.

We can build static cooling tower like stacks to produce grid powert, but no one has done this yet. Same is true for fusion energy. The best skips the hest engine.

The take home tnough is that we will all be electrified at least and Evs will move us about. everything else can be solved in multiple ways. imagine giant airships taking containers point to point folks. Two handling steps and even at 60 mph, that is 1500 miles per day and it is drone operated as well. .

Future Of Oil Demand Is Brighter Than You’ve Been Told

FRIDAY, JUL 14, 2023 - 12:00 PM

By Julianne Geiger of OilPrice.com

Oil demand’s future is rosier than the common narrative would have you believe, according to a report released today by Energy Outlook Advisors.

According to energy analyst and the report’s author Anas Alhajji, the hope that oil demand will decrease as the world transitions to clean energy is built on a lot of hype and wishful thinking.

China—the world’s largest investor in renewable energy—and India still use coal as the primary source of electricity generation. As these countries add green energy, it will have minimal effect on oil demand, if any at all, the report suggests.

Countries like China and India may have plans to continue adding solar, wind, and other clean energy sources, but economic growth continues to lap up the additions, meaning oil and even coal are unlikely to be displaced anytime soon.

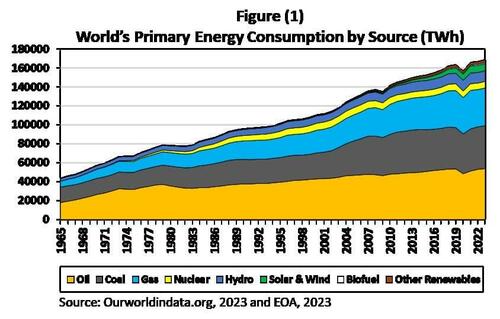

As seen in the report’s chart below, as global energy consumption increases—and even as solar, wind and other renewable energy sources increase their share of the total consumption—oil and gas demand continues to increase, with historical demand blips seen courtesy of high prices, not green energy policies.

According to the report, 82% of the energy consumed in 2022 came from fossil fuels, despite the trillions thrown at renewable energy since 2010. For China specifically, the report estimates that it would take China 211 years at the current rate of renewable spending to achieve carbon neutrality. India will take even longer, at more than 400 years.

In May, the IEA estimated that $2.8 trillion would be invested globally in energy this year, with more than $1.7 trillion of it headed clean energy’s way. Still, more than $1 trillion was thought to be spent on fossil fuels, including coal. At the time, the IEA estimated that clean energy investment would rise 24% between 2021 and 2023, compared to a 15% increase in fossil fuel investments. The IEA’s overall stance was that investments in clean energy is “significantly outpacing spending on fossil fuels”.

Nevertheless, economic and population growth continues to drag down the rate at which renewable energy is snapping up marketshare, and the data shows that little headway is being made.

According to Energy Outlook Advisors, most countries will fail to reach their net-zero or carbon neutrality targets 2050.

No comments:

Post a Comment