Of course this is true. No risk lending earns almost zero. Any corporation is earning plus three percent on their capital. Thus the easiest place to dump surplus cash is in your own shares and industry consolidation. All the same.

This explains the fundamental natural driver for the present uncanny bull market. This is a natural consequence of cheap money. It also means million dollar lots hosting run down shacks.

40% Of The Bull Market Is Due Soley To Buybacks

BY TYLER DURDEN

FRIDAY, OCT 29, 2021 - 08:00 AM

https://www.zerohedge.com/markets/40-bull-market-due-soley-buybacks

What If I told you that 40% of the bull market rally over the last decade was from buybacks alone? That may not be as crazy as it sounds.

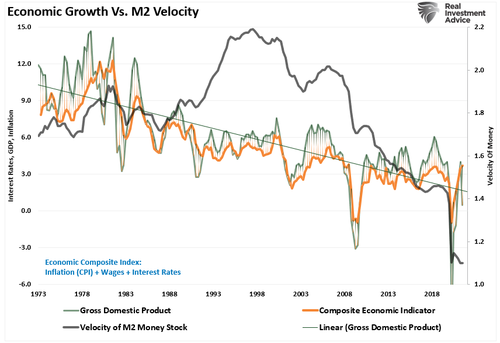

We previously discussed the misuse and abuse of stock buybacksover the last decade. Such is not surprising given the low interest rate environment. But, as we now know, there is a point where low rates deter economic activity. Companies become unwilling to “invest” due to the low return environment. The chart shows the problem of economic growth rates and monetary velocity.

The decline in monetary velocity is clear evidence the “economic transmission” system remains broken. One of the essential drivers of economic activity are banks lending money to support economic activity. As shown, the bank loan/deposit ratio has collapsed along with velocity. As a result, there is little benefit to loan money at ultra-low rates relative to the risk of default.

The problem for companies in a weak economic environment is the lack of topline revenue growth. Given higher stock prices compensate corporate executives, it is not surprising to see companies opt for a short-term benefit of buybacks versus investment.

Understanding Buybacks

While it may seem like “share repurchases” are a non-event, they are more insidious than they appear. Let’s start with a simplistic example.

Company A earns $1 / share and there are 10 / shares outstanding.

Earnings Per Share (EPS) = $0.10/share.

Company A uses all of its cash to buy back 5 shares of stock.

Next year, Company A earns $1 again, however, earnings are now $0.20/share ($1 / 5 shares)

Stock price rises because EPS jumped by 100% on a year-over-year basis.

However, since the company used all of its cash to buy back the shares, they had nothing left to grow their business.

The next year Company A still earns $1/share and EPS remains at $0.20/share.

Stock price falls because of 0% growth over the year.

Yes, this is an extreme example but shows that share repurchases have a limited, one-time effect on the company. Such is why once a company engages in share repurchases, they get inevitably trapped into continuing to repurchase shares to keep share prices elevated. The problem is the continued diversion of ever-increasing amounts of cash from productive investments that could create long-term growth.

The reason that companies do this is simple: stock-based compensation. Today, more than ever, many corporate executives have a large percentage of their compensation tied to company stock performance. As a result, a “miss” of Wall Street expectations can lead to a hefty penalty in the companies stock price.

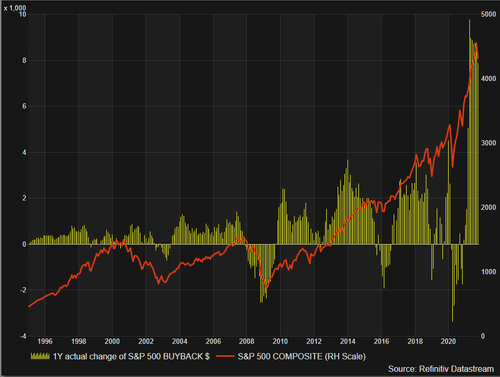

In a previous Wall Street Journal study, 93% of the respondents point to “influence on stock price” and “outside pressure” as reasons for manipulating earnings figures. Such is why the use of stock buybacks has continued to rise in recent years. Following the “pandemic shutdown,” they skyrocketed.

Not A Return Of Capital

Share buybacks only return money to those individuals who sell their stock. Such is an open market transaction. If Apple (AAPL) buys back some of their outstanding stock, the only people who receive any capital are those who sold their shares.

So, who primarily sells their shares?

As noted, it’s the insiders, of course, as changes in compensation structures since the turn of the century have become heavily dependent on stock-based compensation. Insiders regularly liquidate shares “granted” to them as part of their overall compensation structure. Such allows them to convert grants into actual wealth. As the Financial Times previously penned:

“Corporate executives give several reasons for stock buybacks but none of them has close to the explanatory power of this simple truth: Stock-based instruments make up the majority of their pay and in the short-term buybacks drive up stock prices.”

A recent report on a study by the Securities & Exchange Commission found the same:

SEC research found that many corporate executives sell significant amountsof their own shares after their companies announce stock buybacks, Yahoo Finance reports.

What is clear is that the misuse and abuse of share buybacks to manipulate earnings and reward insiders has become problematic. As John Authers recently pointed out:

“For much of the last decade, companies buying their own shares have accounted for all net purchases. The total amount of stock bought back by companies since the 2008 crisis even exceeds the Federal Reserve’s spending on buying bonds over the same period as part of quantitative easing. Both pushed up asset prices.”

In other words, between the Federal Reserve injecting a massive amount of liquidity into the financial markets, and corporations buying back their shares, there have been effectively no other real buyers in the market.

Exactly how much are we talking about?

The Market Should Be 40% Lower

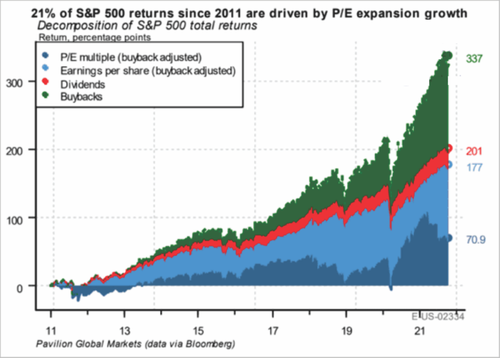

The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The decomposition of returns for the S&P 500 breaks down as follows:

21% from multiple expansion,

31.4% from earnings,

7.1% from dividends, and

40.5% from share buybacks.

In other words, in the absence of share repurchases, the stock market would not be pushing record highs of 4600 but instead levels closer to 2700.

To put that into context, the high water mark for the S&P 500 in October 2007 was 1556. In October 2021, after 14-years, the market would be 2700 without share buybacks. Such would mean that stocks returned a total of about 3% annually or 42% in total over those 14 years.

Conclusion

Before you scoff at a 3% annualized return, such equates to an economy growing at 2% with a 1-2% dividend yield. Moreover, that calculation aligns with historical norms going back to 1900.

While share repurchases by themselves may indeed be somewhat harmless, it is when they get coupled with accounting gimmicks and massive levels of debt to fund them in which they become problematic.

Michael Lebowitz noted the most significant risk:

“While the financial media cheers buybacks and the SEC, the enabler of such abuse idly watches, we continue to harp on the topic. It is vital, not only for investors but the public-at-large, to understand the tremendous harm already caused by buybacks and the potential for further harm down the road.”

Money that could get spent spurring future growth, benefitting shareholders, instead got wasted benefitting only senior executives.

As stock prices fall, companies that performed un-economic buybacks are now finding themselves with financial losses on their hands, more debt on their balance sheets, and fewer opportunities to grow in the future. Equally disturbing, the CEOs who sanctioned buybacks are much wealthier and unaccountable for their actions.

For investors betting on higher stock prices, the question is what happens if “stock buybacks” reverse?

No comments:

Post a Comment