What is true is that decades of effort has lowered operating costs past the real limits caused by diminishing returns. and larger cannot produce cheaper chickens. And off balance sheet costs are coming back to bite like manure removal.

Worse yet sustainable suppliers are using those same political tools to enforce better practise as witnessed by mexico switching to Canadian milk.

cheap chicken has meant caged broilers harvested in weeks. better practise uses movable field chicken cages achieving full growth and producing high quality meat.

what switching has not done is create a market for bugs yet.

Tyson Foods Confirms Protein Switching Underway Amid Record High Beef Prices

Monday, Aug 04, 2025 - 02:20 PM

https://www.zerohedge.com/food/tyson-foods-confirms-protein-switching-underway-amid-record-high-beef-prices

Mega meatpacker Tyson Foods surged 4% in early New York cash trading after posting a surprise quarterly profit and raising its full-year revenue forecast. A boom in chicken demand offset deepening losses in its struggling beef unit, as sky-high beef prices continue to push consumers toward cheaper alternatives.

Tyson Foods reported third-quarter adjusted EPS of .91 cents, beating Goldman Sachs and consensus estimates of 85 cents and 78 cents, respectively. Revenue rose 3.6% year-over-year to $13.88 billion, also topping estimates of $13.61 billion (GS) and $13.50 billion (consensus), driven by strong performance in chicken, offsetting losses in the beef unit.

Tyson Foods (TSN) 3Q Summary: Beat and Raised

EPS Beat: Adj. EPS of $0.91 vs. GS/consensus of $0.85/$0.78

Revenue Beat: Sales rose +3.6% YoY to $13.88B, above GS/consensus of $13.61B/$13.50B

Segment Performance: Strength in Chicken, Beef, Prepared Foods; Pork and International/Other underperformed

Operating Income: Adj. op income of $505M beat GS/consensus of $501M/$462M

Guidance Raised:

FY25 Adj. Operating Income: Now $2.1B–$2.3B (up from $1.9B–$2.3B), led by chicken strength, partially offset by beef

FY25 Net Sales Growth: Now +2–3% (prior: flat to +1%), above GS/consensus of 1.5%/1.2%

"Our third quarter results demonstrate the strength of our multi-protein, multi-channel portfolio and our relentless focus on operational excellence," said Donnie King, President & CEO of Tyson Foods. "Delivering our fifth consecutive quarter of year-over-year growth across sales, adjusted operating income and adjusted earnings per share underscores the resilience of our business model. Looking ahead, we are confident in our ability to meet consumer needs, capitalize on protein demand and deliver long-term value to our shareholders."

"Chicken continues to provide support to the business as the company continues to face beef headwinds," analysts at brokerage Stephens wrote in a note to clients.

Making sense of all this is simple: rising chicken demand alongside sliding beef demand is known as "protein switching." This trend is driven by excessively high supermarket beef prices, prompting low- and middle-income consumers to seek cheaper alternatives like chicken and pork.

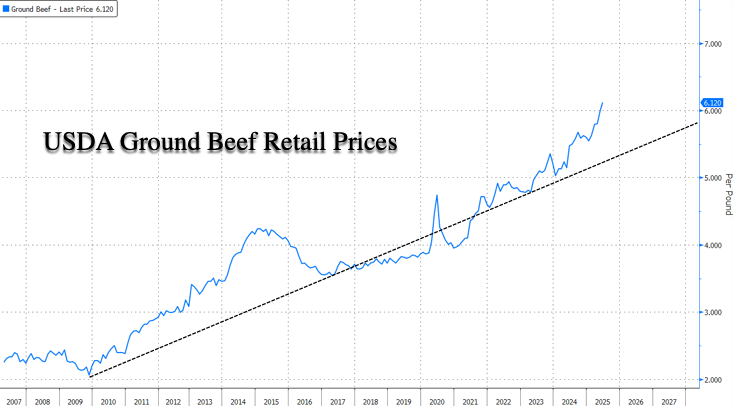

This comes as the latest USDA cattle report shows America's cattle and calves herd population has fallen to 94.2 million, its lowest mid-year level since 1973. The nation's shrinking herd size has pushed USDA retail ground beef prices to record highs...

Related:

No comments:

Post a Comment