The reality of agricultural price distortion in the USA is a sight to behold and drives equally imaginative countermeasures by trading partners. None of this looks like a free market.

The fact is that agriculture demands monopoly selling in order to manage supply. This means exclusion to access for farmers nnot with the bprogram. This leads to cooperative marketing boards or monopoly selling.

Alternately a single buyer dom9nates the market as monopoly called agribusiness. These are typically messy at least but again manage market access.

How Agriculture Bureaucrats Are Manipulating Food Prices—and Our Diets

03/21/2022

Sammy Cartagena

https://mises.org/wire/how-agriculture-bureaucrats-are-manipulating-food-prices-and-our-diets

With inflation at a forty-year high, it is the topic on everyone’s mind. US core inflation has reached 7.5 percent year over year, and the prices of certain goods, such as used cars and steak, are up as much as 50 percent over the past year. This is a major threat to the current administration, with a recent poll showing that 70 percent of Americans disapprove of Joe Biden’s handling of inflation. Inflation is incredibly unpopular with voters, and there is a strong political incentive to ease the public’s perception of rising prices, either through policies or through modifying the inflation statistics themselves.

One method government has historically used for easing the perception of inflation is to push for the consumption of low-cost goods through government recommendations and subsidies. This strategy has been used especially frequently in the agriculture industry, since food comprises a major variable expense in people’s everyday budgets. In the 1970s, during a period of high inflation, Secretary of Agriculture Earl Butz pushed for policies that would encourage the mass production of low-cost monocrops such as corn and soy. He famously told farmers to “get big or get out” and urged farmers to plant commodity crops “from fencerow to fencerow.”

Getting consumers to substitute lower-cost goods in their consumption can have a masking effect on Consumer Price Index (CPI) inflation, since a change to the consumption of lower-cost goods offsets the general rise in price level. As Saifedean Ammous writes in The Fiat Standard: “By subsidizing the production of the cheapest foods and recommending them to Americans as the optimal components of their diet, the extent of price increases and currency debasement is less obvious” (114).

This scenario is exactly what has played out in the US since the 1970s, with the US government’s health guidelines showing a “continuous decline in the recommendation of meat and an increase in the recommendations of grains, legumes, industrial oils, and various other nutritionally poor foods that benefit from industrial economies of scale,” as Ammous notes (114). In fact, the original version of the food pyramid was developed amid high food prices in Sweden in 1972, with an express goal of promoting cheap and basic foods that would provide adequate nutrition. This shift in dietary recommendations during the seventies coincided with the rapid rise in US obesity rates, a trend which continues to this day.

In addition to government dietary recommendations, farm subsidies have also played a significant role in the manipulation of agricultural production and consumer diets. The majority of farm subsidies are given to large-scale farms, especially to those producing corn, wheat, and soybeans. Between 1995 and 2020, total US farm subsidies for these three crops alone exceeded $200 billion. Farms producing these monocrops are subsidized, leading to these crops' relative overproduction. The prices of these already cheap foods are thus artificially lowered at the expense of everything else, which in turn causes an increase in their consumption, lowering recorded inflation.

This phenomenon helps to explain at least in part the motivation for federal organizations to push for a low-meat or entirely meat-free diet. Meat has always been a more expensive food source per calorie, and for the past several decades it has been increasing in price at a faster rate than most other foods; this is likely because meat, especially when pasture raised, is harder to mass produce, so its production benefits less from industrialization.

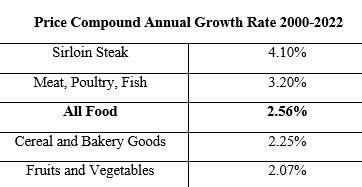

The above illustration shows the percent change in prices of certain foods from January 2000 to today. Although the average inflation of core food prices over this period was 2.56 percent annually, the category of meat, poultry, and fish increased at the higher rate of 3.20 percent, and specific foods such as sirloins, ribeye, and other cuts of beef increased at an even higher rate of 4 percent or more per year over this period. As one would expect, the categories of baked goods, fruits, and vegetables increased in price at a slower pace, due in part to the fact that their inputs include crops such as wheat, soy, and corn—the very crops that the US tends to subsidize and recommend.

It is also important to note that the subsidization of crops such as corn has led to a decrease in the prices of grain-fed meat and poultry relative to their pasture-raised counterparts, further skewing the American diet toward a foundation of industrial monocrops of dubious nutritional value. Those who choose to consume organic or pasture-raised meats face even higher price inflation that is not recorded in CPI numbers.

The fact that meat and poultry have tended to have a higher rate of inflation means that all else equal, the less meat Americans consume, the lower the price inflation of food will register. This is what has happened over the past couple of decades, with a continuous decline in the weighting of the meat, poultry, fish, and eggs category in the “food at home” CPI basket. This category represented 31 percent of the basket in 1989, 27 percent in 2000, and only 22 percent in 2020.

The reason for the decrease in meat and poultry consumption is likely a combination of meat becoming less affordable for low-income consumers and plant-based diets being increasingly recommended by federal institutions. Either way, the effect is a decrease in official recorded inflation. That goods that have become too expensive for consumers are phased out of the CPI basket is one of the numerous issues with the metric.

The increasing recommendation of plant-based diets has led to some ridiculous moments, such as a tweet from the St. Louis Fed suggesting that people could substitute their Thanksgiving turkey with soybeans.

The Federal Reserve’s loose monetary policy, combined with government policy such as agriculture subsidies, has caused a great deal of harm when it comes to consumer choice in food. In response to rising food costs, government has prioritized making certain foods affordable at the expense of everything else. Government may be able to bring CPI inflation under control, but this comes with the caveat of a government-prescribed diet, which has historically had disastrous results for this country’s health. Many Americans are being priced out of eating the traditional pasture-raised-animal diet that many would argue is optimal for our health.

The agriculture industry is largely running as a planned economy, with government having huge influence over what foods people consume. When the power to make decisions is delegated to bureaucrats rather than to those who will be impacted, mismanagement is a given. No one is better equipped to decide their own diet and lifestyle than themselves, yet bureaucratic management has permeated even this level of our lives. Whether agriculture and diets are being manipulated to hide inflation, benefit lobbying groups, or with sincerely good intentions, it is high time that Americans demanded control of their own health choices again.

Author:

Sammy Cartagena is an undergraduate student attending Rutgers Business School studying finance. He has a particular interest in monetary theory and financial markets. He is a Mises University 2021 alumnus.

No comments:

Post a Comment