Everyone forgets that leverage drives out of control liquidation whose climax can be bottomless and that is why all the modeling in the world fails. simply put, buyers do not have to buy and there is no end of excuses.

curiously, what largely secures the banking industry is that bankers have to put money out to loan. This can only be stopped by regulation which must be watched carefully.

At least the chinese keeps funding those busted state enterprises.

China Stocks Crash Through 'Snowball Derivatives' Trigger Levels Overnight

BY TYLER DURDEN

MONDAY, JAN 22, 2024 - 06:00 AM

Who could have seen this coming?

Last week we exposed the ugly reality sitting just below the headlines of the Chinese stock market - the massive liquidation threat from so-called 'snowball derivatives'.

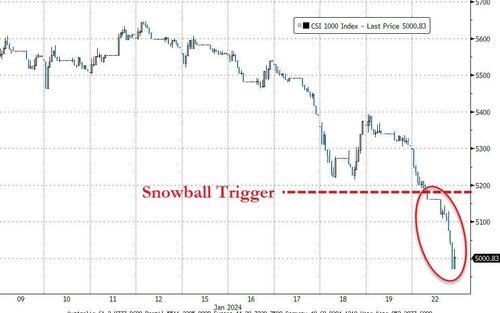

Specifically, we warned that for those looking for the tipping point, pay especially close attention to the CSI 1000 Index dropping below the 5,300 level, where a wave of knock-ins triggers could accelerate exponentially.

According to Guotai Junan Futures, there are about 30 billion yuan ($4.2 billion) of snowball derivatives products tied to the CSI 1000 Index are near levels that trigger losses at maturity, according to Guotai Junan Futures Co, as the stock rout in #China's stock market pushes the derivatives to near knock-in levels.

Another 60 billion yuan of the derivatives are 5%-10% away from their knock-in thresholds!

Finally, as Sino Market points out, most Snowball derivatives were opened from Feb to April 2023.

Since the downside knock-in put barriers are set to 75% or 80% of the spot price, dealers estimate that most of those are set at 5,180 points on the CSI 1000 index.

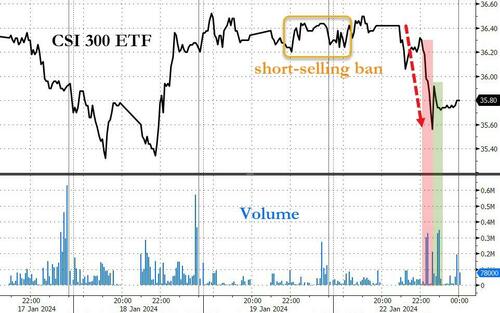

Additionally, we highlighted Beijing's series of desperation moves to support the flailing stock market, from The National Team (plunge-protectors) stepping in to the idiocy of short-selling bans (that have always worked so well in the past).

Sure enough, after the short-selling ban, we saw - as we always do - heavy selling pressure (long-selling) hit overnight since such trading prohibitions impede investors from determining accurate prices of assets and reduce market liquidity.

Research has consistently shown that banning short selling during stretches of particularly volatile equity market activity intensifies the volatility.

But, again, as Chinese stocks began freefalling, Bloomberg reports a sudden and sizable bidder emerged. Turnover on a handful of ETFs tracking the CSI 300 Index and the SSE 50 Index jump in afternoon trading, a sign that state-led buying continues.

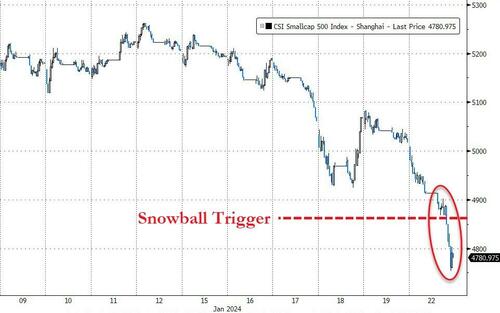

But The National Team could not hold back the waterfall of liquidations from the snowball derivatives that smashed through trigger levels in both the CSI 500 and CSI 1000...

In other words, we are this close to a Chinese market crash... and with it the collapse of yet another wealth source for the 'average jao'... and the potential threat that the CCP fears most - revolution.

Everything that Chinese authorities have tried has failed to convince money managers that the worst is behind us.

“China is a waiting game and we continue to be waiting,” said Mark Matthews, head of Asia research at Bank Julius Baer & Co., which is mostly avoiding Chinese equities.

How much longer can Beijing wait?

While no one really knows what Xi and his pals are thinking, some are wondering if the knock-in liquidation cascade will be the trigger that crashes the market and finally wakes up Chinese officials, forcing it to trigger the stimulus bazooka?

No comments:

Post a Comment