Whoever is in control of the liquidation obviously has a plan and that plan means setting a price for closing out positions. so off course you have to liquidate the entire long side to actually complete and that looks over. It cannot be done in pieces.

then set the price and close it out. voila, it is a done deal.

it just shows us the obvious, that bitcoin is like physical gold. Selling what you do not own is obviously dangerous. And the royal road to bankruptcy is bucketing. Off course we will never get the whole story but it is the same problem we had liquidating broker dealers back in the thirties.

Bitcoin Slide Driven By Bankrupt FTX Liquidating, Shorting Billions

SATURDAY, JAN 27, 2024 - 01:55 PM

https://www.zerohedge.com/markets/bitcoin-slide-driven-bankrupt-ftx-liquidating-shorting-billions

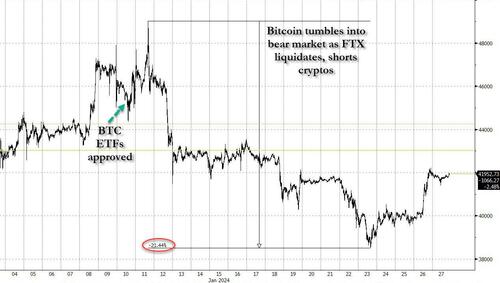

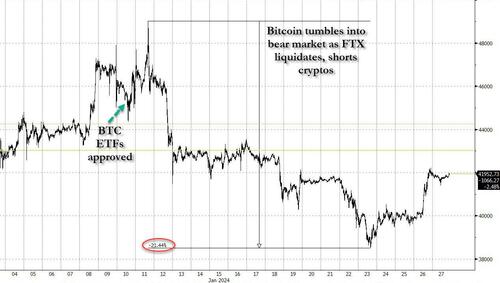

Earlier this week we reported that the primary reason why bitcoin has been sliding ever since the arrival of bitcoin ETFs on Jan 10 - an event that had been lauded as very bullish for the crypto space but instead promptly sparked a bear market...

... has been the relentless liquidation of residual bitcoins by the bankrupt FTX estate which has been aggressively building up cash - and selling bitcoin into every market meltup - to maximize recoveries for stakeholders.

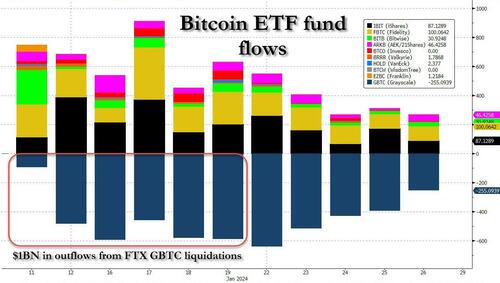

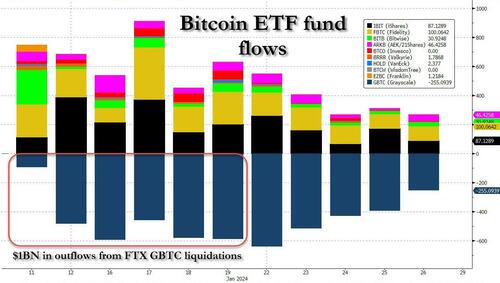

Specifically, as CoinDesk reported first, whereas legacy bitcoin vehicle GBTC had seen aggressive outflows at the time when the pack of new ETFs were pulling in new cash to convert into bitcoin, a large chunk of the exodus from GBTC was FTX's bankruptcy estate dumping 22 million shares, or about $1 billion of the $2.5 billion in GBTC outflows through Jan 22. And, as we pointed out, it also meant that instead of the GBTC outflows being recycled and netted off, a large portion of them was FTX liquidations - a one-off event, and not a systemic pressure on the underlying crypto asset, contrary to what some bears had said.

Well, today we got confirmation that it was indeed the bankrupt FTX (or rather Mike Novogratz' Galaxy which was picked last summer as advisor on managing the estate's holdings) that was responsible for much of the selling in crypto in the past two weeks. According to Bloomberg, FTX is "unloading cryptoassets and hoarding cash as bankruptcy advisers look for a way to repay customers whose accounts have been frozen since the platform collapsed in 2022."

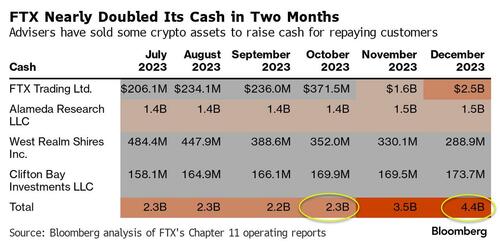

The fraud-tainted crypto firm’s four largest affiliates — including FTX Trading Ltd. and Alameda Research LLC — together nearly doubled the group’s cash pile to $4.4 billion at the end of 2023 from about $2.3 billion in late October, according to Chapter 11 monthly operating reports. The company’s total cash is likely higher including the rest of its affiliates.

As shown in the chart below, FTX was furiously dumping assets during the crypto meltup that started in October and which sent the price of the digital currency from $27 in October to $45K by the end of 2023 .

Indeed, FTX said in a court filing last month that FTX raised $1.8 billion through Dec. 8 by selling off some of the firm’s digital assets. Of course, we also now know that FTX had continued raising cash by liquidating about $1 billion in GBTC-tied assets.

But wait, there's more: as we showed on Jan 23, all the major downward moves in bitcoin in the past week had been due to liquidations in perpetual bitcoin futures, and had little to do with sales of ETFs or underlying tokens.

We can now also blame FTX for those sudden, jerky bitcoin futures liquidations because as Bloomberg adds, "FTX also said it’s conducting Bitcoin derivative trades to hedge exposure to the coin and generate additional yield on its digital holdings." Translation: FTX (via Galaxy or otherwise) has been shorting bitcoin to "hedge" its substantial exposure and minimize risk to stakeholders.

To be sure, stakeholders in the bankrupt FTX are delighted with the results: customer claims worth more than $1 million traded at around 73 cents on the dollar as of Friday, almost double from around 38 cents on the dollar in October, according to investment firm and bankruptcy claims broker Cherokee Acquisition.

The flipside are all those investors in bitcoin, whether spot, ETFs or futures, who expected the rally into the ETF launch to continue. Instead they were rugged by the relentless FTX selling.

The good news for bitcoin bulls is that FTX has almost nothing left to liquidate (not that its customers will even benefit: as a reminder, dozens of FTX customers are challenging a company proposal that would peg the value of their digital assets at the time the company filed bankruptcy, meaning they’d miss-out on a yearlong Bitcoin rally and rebound for other tokens.) FTX also doesn’t expect customers will be fully repaid, which means that almost all of the "cashing out" has been concluded.

The question therefore is if not FTX customers, then just who is benefiting from the FTX liquidations of legacy crypto assets and its aggressive shorting of bitcoin futures. And, continuing down that train of thought, what will happen to FTX if one or more aggressive market players decided to squeeze whoever is pulling the FTX strings and has built up a major bitcoin short.

No comments:

Post a Comment