Understand that key economic stats have been manipulaterd for decades. It was always too easy a target and also open to later correction as well in order to put the numbers back in order. My argument is that they could and they did.

all that becomes a serious problem when the economy experiences a serious shock which the pandemic delivered. Now everything is out of whack and you are trying to set it right.

now we have clearly rising unemployment arriving because of sharply jacked interest rates. They are now too high. this means the jobs market is getting squirrally. We are starting to feel the pain and higher prices are also unsustainable as well. and of course thyey continue to game inflation rates as well

US Job Openings Far Lower Than Reported By Department Of Labor, UBS Finds

BY TYLER DURDEN

TUESDAY, JAN 31, 2023 - 04:24 PM

https://www.zerohedge.com/markets/us-job-opening-far-lower-reported-department-labor-ubs-finds

When it comes to labor market data (or rather "data"), Biden's labor department is a study in contrasts (and pats on shoulders). One day we get a contraction in PMI employment (both manufacturing and services), the other we get a major beat in employment. Then, one day the Household survey shows a plunge in employment (in fact, there has almost been no employment gain in the past 9 months) and a record in multiple jobholders and part-time workers, and the same day the Establishment Survey signals a spike in payrolls (mostly among waiters and bartenders). Or the day the JOLTS report shows an unexpected jump in job openings even as actual hiring slides to a two year low. Or the straw the breaks the latest trend in the labor market's back, is when the jobs report finally cracks and shows the fewest jobs added in over a year, and yet initial jobless claims tumble and reverse all recent increases despite daily news of mass layoffs across all tech companies, as the relentless barrage of conflicting data out of the Bureau of Labor Statistics (which is the principal "fact-finding" agency for the Biden Administration and a core pillar of the Dept of Labor) just won't stop, almost as if to make a very political point.

But while one can certainly appreciate Biden's desire to paint the glass of US jobs as always half full, reality is starting to make a mockery of the president's gaslighting ambitions, as one by one core pillars of the administration's "strong jobs" fabulation collapse. First it was the Philadelphia Fed shockingly stating that contrary to the BLS "goalseeking" of 1.1 million jobs in Q2 2022, the US actually only added a paltry 10,000 jobs (just as the Fed unleashed an unprecedented spree of 75bps rate hikes).

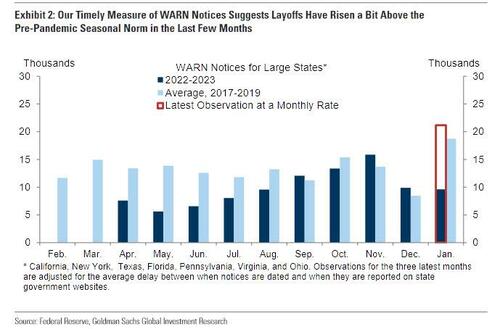

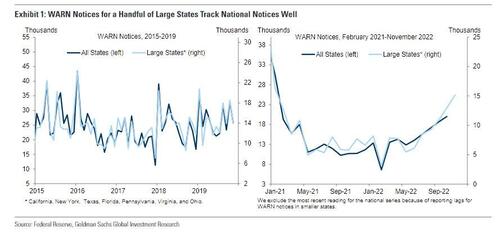

Then, it was Goldman's turn to make a mockery of the "curiously" low initial jobless claims, by comparing them to directly reported state-level WARN notices (mandatory under the Worker Adjustment and Retraining Notification (WARN) Act) which no low-level bureaucrat and Biden lackey can "seasonally adjust" because there they are: cold, hard, fact, immutable and truly representative of the underlying economic truth, and what they show is that - as the Goldman chart below confirms - layoffs are rising far faster than what the DOL's Initial Claims indicates.

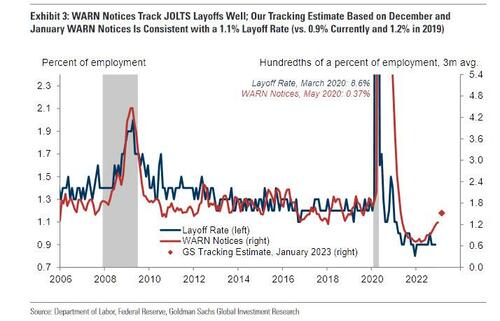

More importantly, Goldman also found that WARN notices also track the JOLTS layoff rate: WARN notice counts remained elevated in late 2020 even as the layoff rate declined, but this likely reflects unusual reporting delays during the pandemic and the exclusion of layoffs at closing establishments in the JOLTS survey, which WARN notices capture provided firms remain in business. Not surprisingly, Goldman's tracking estimate based on December and January WARN notices for the large states covered not only shows that the recent drop in initial claims is unlikely, but that it is also consistent with a layoff rate of around 1.1%, higher than the 0.9% in the November JOLTS report.

And now, another core pillar of the US labor market is being dismantled, and it has to do with the Fed's favorite labor market indicator: the JOLTS report of job openings.

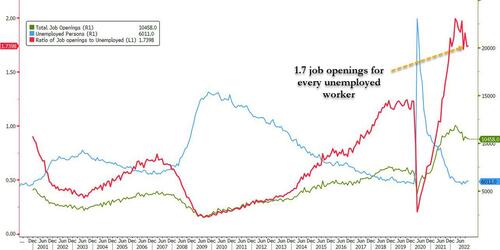

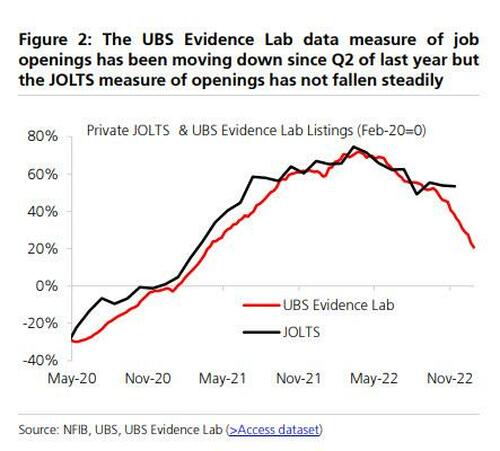

As UBS economist Pablo Villanueva writes in a recent report by the bank's Evidence Lab group, Job openings in the JOLTS survey have not declined much since the March peak. Indeed, the BLS reports that openings were only 12% below the March 2022 peak in November and remain 48% above the pre-pandemic, 2019 average. This slight move downward has, as we noted recently, led to only a small decline in the vacancies-to-unemployment ratio, from 1.99 in March to 1.74 in November, still well above the 2019 average of 1.19.

Of course, such a high level of job openings is alarming to the Fed for the simple reason that it means Powell has failed at his mission at cooling off what appears to be a red hot jobs market; no wonder the Fed Chair has frequently flagged the high level of job openings as a sign of ongoing strength in the labor market. The bottom line, as UBS notes, is that "the BLS measure, although it has declined, remains historically high."

However, as in the abovementioned case of unexpectedly low jobless claims, there may be more here than meets the eye. According to Villanueva, "a range of other measures of job openings suggest normalization in the labor market—softening much more convincingly, often to pre-pandemic levels" - translation: whether on purpose or accidentally, the BLS is fabricating data. Also, the UBS economist flags, job openings are not a great indicator of current labor market conditions—they lagged the last two downturns in the labor market.

So what's the real story?

Well, as usual there is BLS "data" and everyone else... and as UBS cautions, other measures of openings tell a very different story: "Our UBS Evidence Lab data on job listings is weekly and more timely than the BLS series. The last datapoint is for the week of December 31. It shows openings down 30% from the March 2022 peak and only 25% higher than the 2019 average."

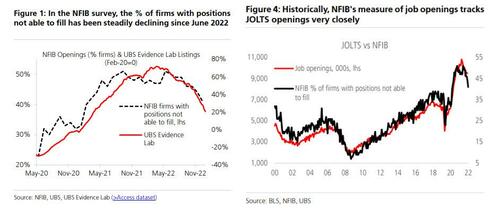

While BLS bureaucrats and Biden sycophants can argue UBS data is inaccurate, other longer dated series also indicate weaker openings. Take for example the NFIB Small Business Survey includes labor market measures that have correlated strongly with the JOLTS data over time but have weakened more sharply than the JOLTS measure in recent months. The percentage of small firms unable to fill open positions has a correlation of 0.95 with JOLTS openings since 2000. This series has declined 20% relative to the peak in May 2022 and is only 13% above the 2019 average. The NFIB series on percentage of firms with few or no qualified applicants tells a similar story.

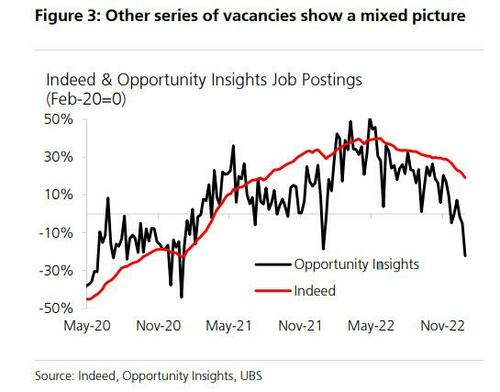

Finally, the "Opportunity Insights" measure of openings (see here) is also below pre-pandemic levels.

So what's going on here?

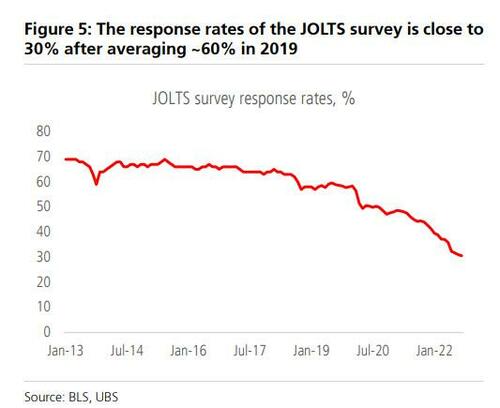

As the UBS economist puts it, "in short, other surveys of job openings generally suggest that the BLS measure may be overstating labor market tightness. One reason to think the accuracy of the JOLTS data may have declined is that the sample shrank noticeably at the start of the pandemic. In 2019, the survey response rate was 60%. In December, it was 30%."

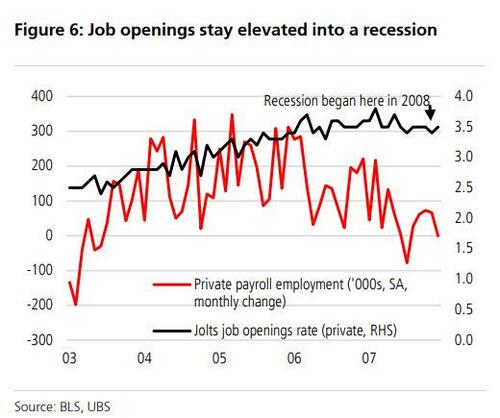

Or perhaps it's not gross BLS incompetence (or propaganda): maybe it's just a data quirk at key economic inflection points. As UBS observed in August, job openings tend to lag other labor market indicators. Ahead of the 2001 recession, the private sector job openings rate was still rising as private employment peaked and started printing negative. Again in 2007, as job openings were peaking, payroll employment in the revised data had slowed considerably, and job openings remained near their peak as employment was beginning to contract outright.

Whatever the reason for the discrepancy in this latest labor series, the bigger picture is getting troubling.We already knew that the employment as measured by the Household survey has been flat since March even as the Establishment survey signaled 2.7 million job gains since then. Shortly thereafter the Philadelphia Fed found that contrary to the BLS "goalseeking" of 1.1 million jobs in Q2 2022, the US actually only added a paltry 10,000 jobs in the second quarter of 2022. As such, the validity and credibility of the US nonfarm payrolls report is suspect at best.

A few weeks ago, Goldman also put the credibility of DOL's weekly jobless claims report under question, when it found that initial claims as measured at the state level without seasonal adjustments or other "fudge factors" were running far higher than what the DOL reports every week.

And now, we can also stick a fork in the JOLTS report, whose accuracy has just been steamrolled by UBS with its finding that job openings - a critical component of the US labor market and the Fed's preferred labor market indiator - are far lower than what the Dept of Labor suggests.

Bottom line: while it is obvious why the Biden admin would try hard to put as much lipstick as it can on US jobs data, the same data when measured with alternative measures shows a far uglier picture, one of a US labor market on the verge of cracking and hardly one meriting consistent rate hikes by the Fed.

Which, considering that in less than 24 hours the Fed will hike rates by another 25 bps, is extremely important, and we wish that we weren't the only media outlet to lay out the facts as the negative impact of continued policy error and tightening by the Fed will impact tens of millions Americans, not to mention the continued errors - whether premeditated or accidental - by the US Department of Labor. Alas, as so often happens, since nobody else in the "independent US press" is willing to touch the story of manipulated jobs data with a ten foot pole, it is again up to us to explain what is really going on.

The full UBS report available to pro subs.

No comments:

Post a Comment