In case you have not noticed. Bitcoin has not gone away. nor has gold and for the same reason. No one can swamp the market. It is also true that Bitcoin is way more convenient to work in than gold. All the obvious negatives have worked out of the markets as well.

Thus long term conversion into bitcoin must continue as nothing else really matters least of all market volitility.

Sooner or later this will all become generational and Gold can slide back to been a preferred commodity.

What i do know now is that i can dump earnings into bitcoin in Zimbawe when earned and then at my leisure recover the earnings anywhere else as needed without fighting with the banking system too much..

The Other Rotation - Gold-To-Crypto Flows Accelerate

WEDNESDAY, JAN 06, 2021 - 11:49

https://www.zerohedge.com/crypto/other-rotation-gold-crypto-flows-accelerate

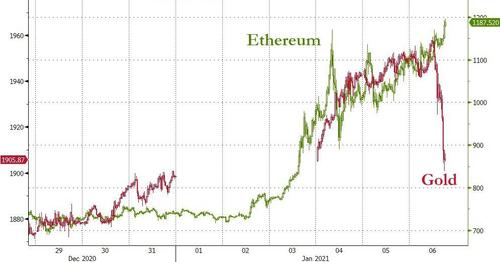

A rebound in real yields (as nominal rates surge) has slammed the brakes on precious metals (even as the dollar dives)...

Source: Bloomberg

Gold surged up to pre-vaccine levels last night on the Dems win but has been monkeyhammered lower this morning...

Will Bitcoin Bubble Burst?

And as PMs suffer, cryptos are surging higher with Ethereum now back above $1200...

Source: Bloomberg

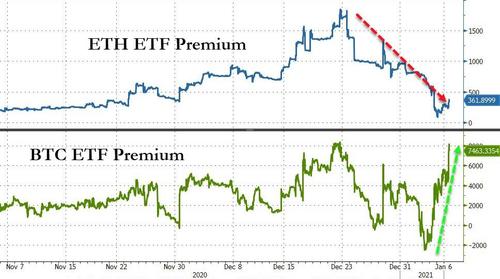

Notably the ETF premia for Bitcoin and Ethereum (GBTC and ETHE) are diverging as the former is trading at an increasing premium while the latter's premium is compressing as spot catches up...

Source: Bloomberg

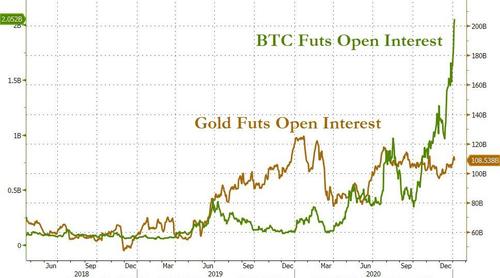

And, as JPMorgan previously noted, the 'structural' flow from gold to crypto continues...

Source: Bloomberg

we believe that the valuation and position backdrop has become a lot more challenging for bitcoin at the beginning of the New Year. While we cannot exclude the possibility that the current speculative mania will propagate further pushing the bitcoin price up towards the consensus region of between $50k-$100k, we believe that such price levels would prove unsustainable.

In other words, bitcoin may well triple from here, but it could also drop.

Finally, we note that Rabo suggested this morning that cryptocurrency is an entirely *political* play. The market is suddenly full of naive neoclassical economists who can’t model politics who are now embracing elements of Austrian economics without wanting to accept their whole intellectual package. Let’s do the heavy lifting for them then:

if one believes Bitcoin is going to go soar, then one must also believe the entire fiat system, including US geopolitical hegemony, is going to ultimately collapse.

How bullish for just about everything else, right? Talk about “disruption”! And who still has all the biggest guns and jails before that happens? What did the Fed do to gold in the 1930s?

On which further note, the first ‘Mad Max’ film was set all the way in the future in….2021.

At what point this year will it be acceptable to walk the streets in a combination of studded leather hot pants and a bondage facemask shouting “Gasoline!”? (Some might say it already is – if one was allowed to leave the house while under lockdown.)

No comments:

Post a Comment