Yes it was, but what really happened is that the first superwave of Baby Boomer Computer Scientists graduated to deliver year one of the necessary brain power to hte digital revolution. Slo Mo came to an end and change took place against the backdrop of MOOREs Law.

Other technologies not so lucky as you may imagine. They mostly waited for the information revolutuon to catch up and lift them. There is little about the hardware of all of Space X that was not fully imagined in the sixties. What we now have is accelerated design and fabrication allowing us to safely build these things.

So yes it was really 1971 that the manpower necessary started flooding the system.

..

1971: The Year That Changed Everything

Sun, 09/27/2020 - 10:30

https://www.zerohedge.com/political/1971-year-changed-everything

The year 1971 saw the trajectories of nearly every major trend relative to our way of life shift massively.

That year is such a noticeable inflection point in so many data sets, that an intriguing website WTFHappenedIn1971.com has been created to drive the point home.

The website is a parade of data series visually showing how the world changed that year.

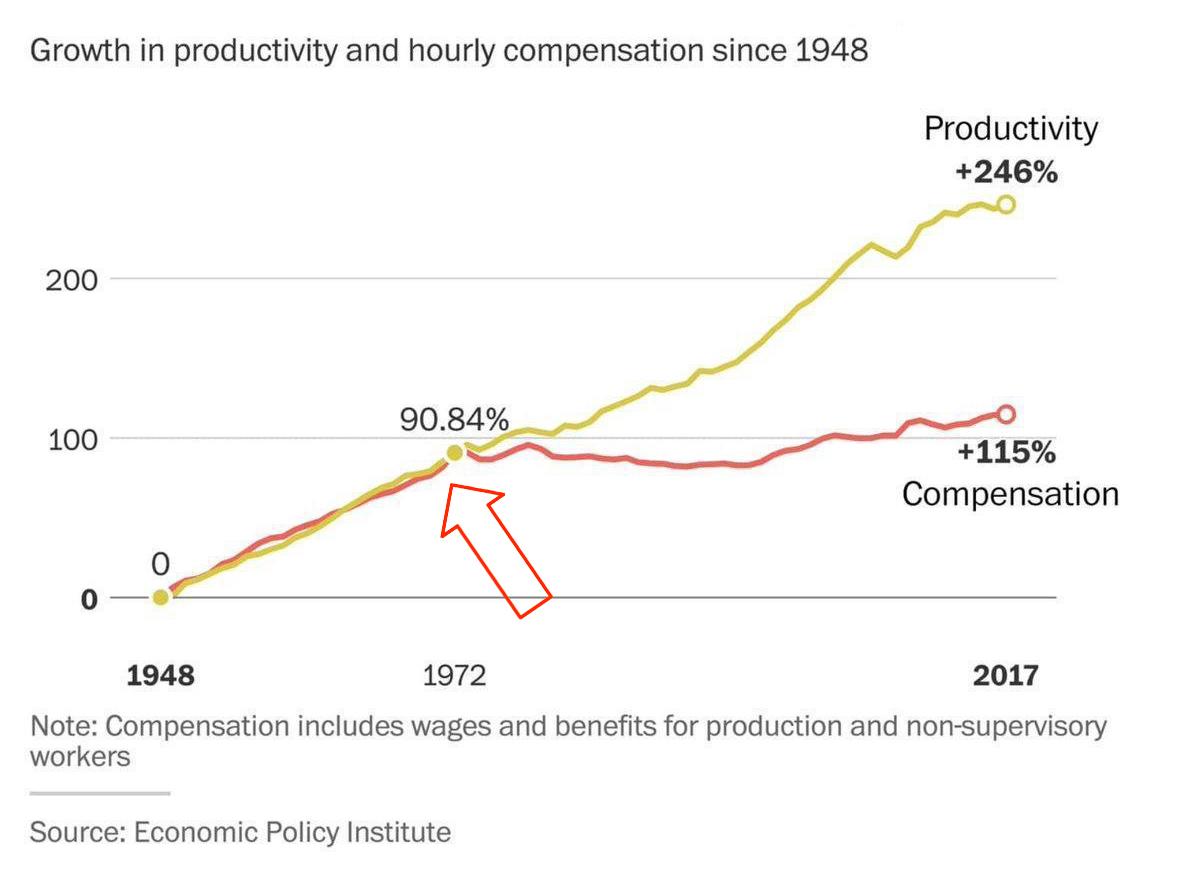

Be it income…

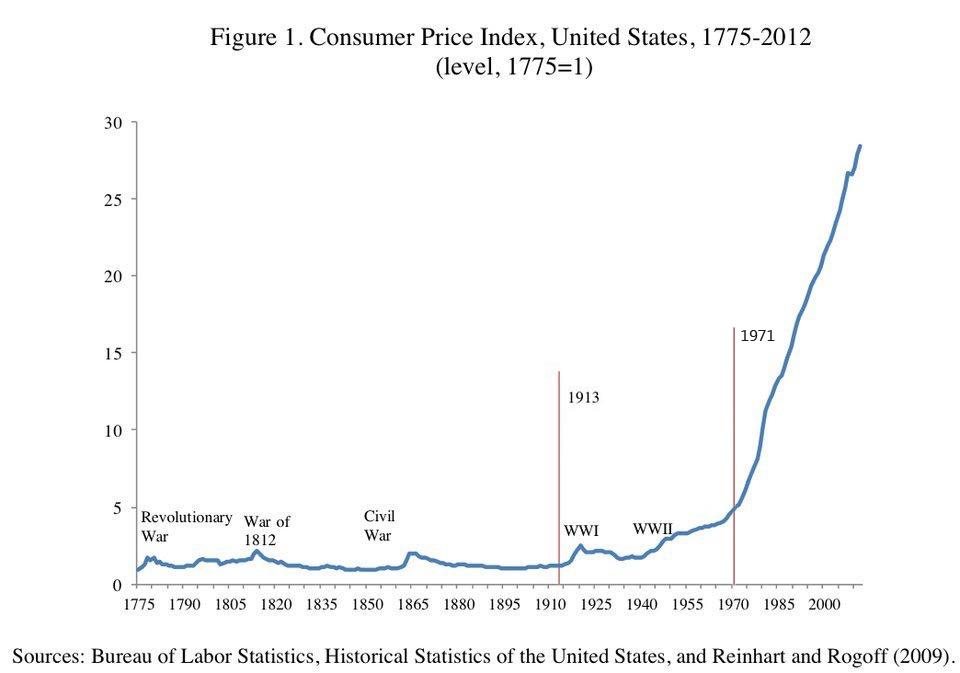

…the cost of living…

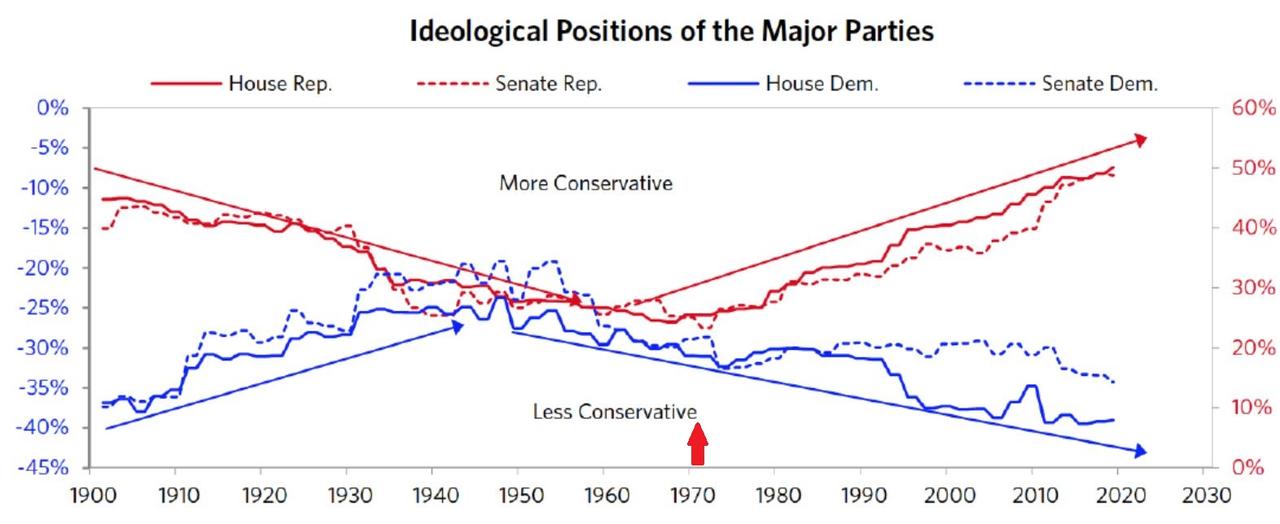

….political polarization…

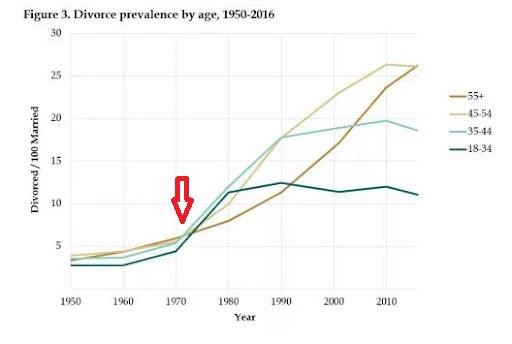

… the divorce rate…

…and a kitchen sink’s worth of other statistics — from the national debt to deficit spending, childhood obesity, the incarceration rate, energy use per capita — pretty much all aspects of life as we know it changed materially and permanently in the early 1970s.

This week’s guest experts, Ben Prentice and Collin, founders of WTFHappenedIn1971.com, explain how virtually all of these changes are a direct or indirect result of the monetary system “breaking” that year with the Nixon Shock and the end of the Bretton Woods System.

On a personal note, interviewing Ben and Collin was an unexpected pleasure, as I found it encouraging to discover that members of the Millennial generation are engaging with the shortcomings of our modern debt-based fiat currency system with the same passion and critical thinking as we older cohorts. Perhaps the future might just turn out OK in their hands after all…

That said, Ben and Collin echo similar concerns and advice as our previous experts. The system is unfair, unsustainable, and in desperate need of reform. The prudent investor shouldn’t expect any real positive change until a painful enough shock forces an abandonment of the status quo — so it’s best to use the time now to position prudently in advance for that inevitability:

That was the year the U.S. entered into its 3rd monetary system, taking the U.S. totally off the gold and silver standard, agreeing to allow gold and silver prices to float against all the fiat currencies, including the USD. I'm pretty sure it was negotiated by the Central Bankers in Basil, Switzerland at the Bank of International Settlement as part of a United Nations mandates. The U.S. had run up huge deficits from the VietScam War, the Pentagon papers have uncovered and the weakening $USD was affecting international trade and commerce.

ReplyDeleteIn 1973, the Opec Oil cartel finally forced the U.S. to let the $USD weaken by refusing to offload oil at existing prices, until they raised the price they would pay. Oil Tankers were literally offshore of U.S. ports, causing fuel lines all across America. I was In Korea and we had our fuel supply reduced by about 75%. It took the U.S 7 months to negotiate a new pricing system showly allowing prices of oil imports to rise. By the early 1980s prices had more than doubled despite, the FRB putting the U.S. into a recession by raising interest rates into double digits. That was nothing compared to what is going to happen this time around. The government and central bankers have been very bad boys and girls, unwilling to correct the governments overspending, over-taxing, and ending the massive number of redistribution of wealth schemes to special interests, in exchange for campaign contributions. As an example, the IVY League Colleges get more in Federal grants, subsidies, and other government benefits then they receive from student tuition, despite collectively having $billions in endowments. Harvard's endowment specializes in placing their graduates in apprentice positions of political and economic power. Clerking for Judges, U.N positions, Goldman Sachs, etc. They have overtaxed the majority so hard the lower socio-economics levels are starting to rebel.