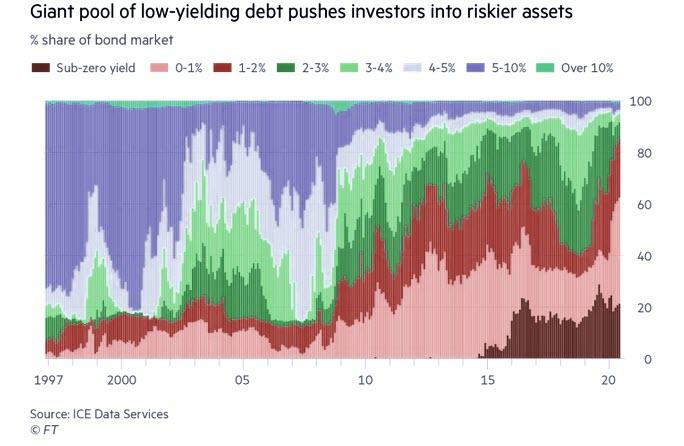

More Than 60% Of Global Debt Now Yields Less Than 1%

by Tyler Durden

Sun, 08/02/2020 - 22:25

https://www.zerohedge.com/markets/more-60-global-debt-now-yields-less-1

For all its monetary generosity, despite injecting $3 trillion reserves into the banking system (if not the economy), the Fed remains stuck with two big problems. The first one, as we touched on earlier, is that the newly printed money is unable to make its way into the broader monetary plumbing and spark the much needed inflation that will do away with the trillions in debt, although as we also noted, the Fed now has a plan to deposit digital funds directly into individual US accounts (using a "household app" in the words of former Fed economist Julia Coronado).

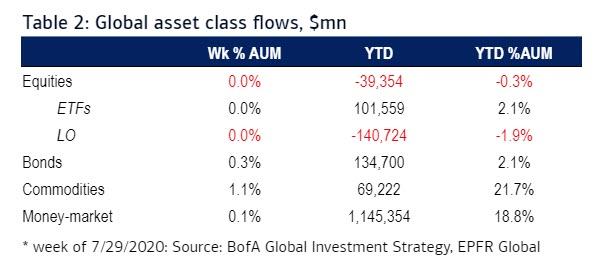

The other problem is that despite all its attempts to stimulate equity animal spirits, the bulk of new fund has flowed into bonds, not stocks. In fact, YTD equity outflows amount to $39BN while inflows to bonds and commodities are over $200BN, with a whopping $1.145 trillion going to cash via money-markets.

And so with so many investors stubbornly buying the one asset class the Fed does not want to be in wide demand (even as it monetized some $3 trillion of it), and even with trillions more in new debt to be paradropped by the US Treasury - something which has failed to taper demand for 10Y Treasurys whose yields just hit an all time low - the hunt for yield is getting harder than ever for fixed-income investors.

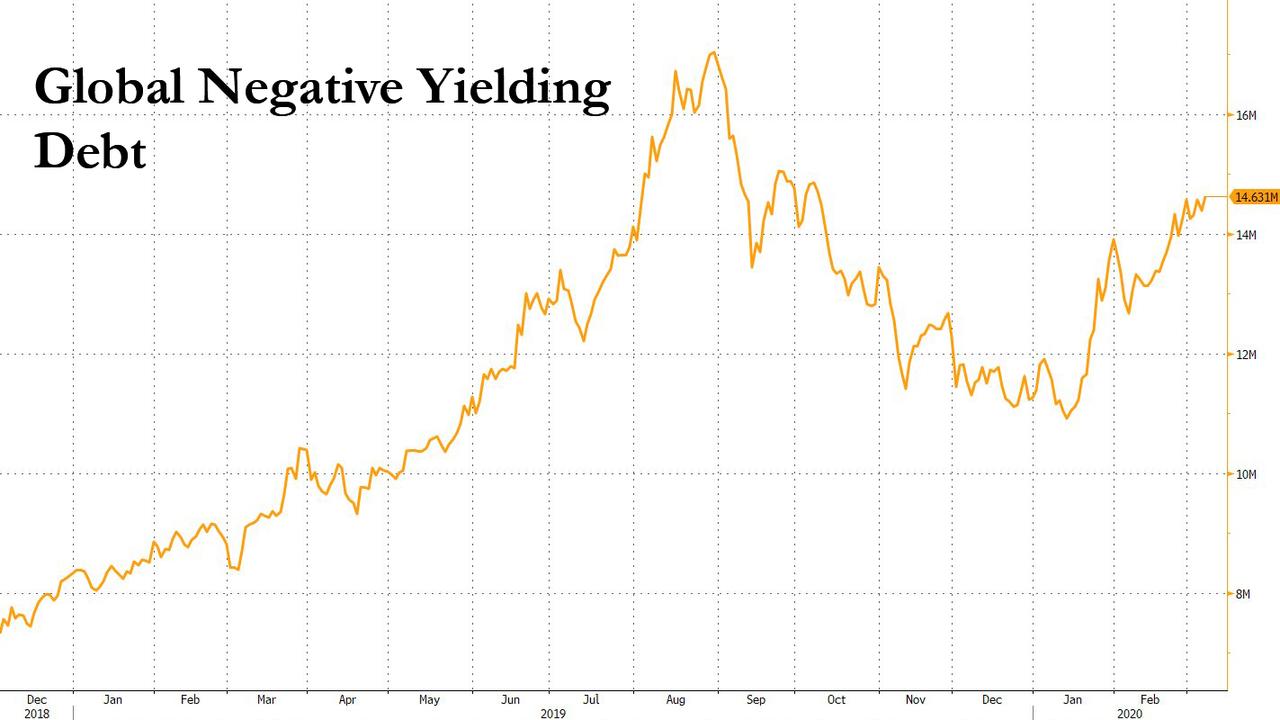

At the same time, global negative yielding debt has soared to $14.6 trillion, from $11 trillion in January, and rapidly approaching the all time high of $17 trillion hit one year ago.

Meanwhile, just 3% of the investable bond universe today yields more than 5%, a share that is close to an all-time low, and represents a precipitous drop from levels seen roughly two decades ago. Consider that in the late 1990s, nearly 75% of bonds traded with yields above 5 per cent, while sub-2% yields comprised under 10% of the market. That was before central banks took over capital markets, and responded to the a series of financial crises by slashing interest rates to ever lower, and eventually negative rates, and launching trillions in bond-buying programs that fundamentally altered the investing landscape.

This has pushed investors into riskier segments in search of income, compelling them to lend to lower-quality companies and countries.

"Yield-chasing behavior has become much more pronounced,” said Matt King, Citi's legendary credit strategist. "If you are a pension fund or an insurance company, you are forced to go down in quality and take extreme risk."

It all came to a head in this year’s Covid-19 crisis, when the Fed again cut interest rates to near zero, and pledged to buy an unlimited quantity of government debt (and has been doing so, monetizing all gross Treasury issuance in 2020). The central bank also launched a number of emergency programs to shore up an unprecedented range of securities — including IG, junk bonds and municipal debt - which sent investment grade prices to all time highs and disconnected them from fundamentals. Investors expect additional stimulus measures to be announced at either this week’s Fed meeting or the next one in September.

After the latest round of interventions, real yields on US Treasuries — which strip out expectations for inflation — have dropped to all time lows of -1%.

This move “is the direct consequence of all of the central bank support”, said King. "It is the main force driving investors to pile into risky assets" such as gold and cryptos, both of which are at or near all time highs.

No comments:

Post a Comment