This story has not received much coverage, but it is centered around the reality that the industry has actually priced itself out of their market. The bulk has been funded by student loans and to an extent that makes repayment highly questionable.

Worse than all that is that the loan debt cripples the new graduate financially for years even if he gets a good paying job. And then you cannot go bankrupt if you fail to get that job.

This is called the prelude to crash and burn. Now imagine if we actually look at the economics of all these programs and decide that funding is now limited to STEM and trade apprenticeship while cutting out the padding there as well.

Better yet, establish a two year mandatory training program not unlike the military, but not exclusively and ensure every individual has learned a set of useful skills as well.

All graduates should exit with a minimum level of physical fitness, a number of core technical skills, and even basic leadership skills. The military does this all the time for folks in the top third and even the top two thirds. My point is that it is then that everyone can benefit most and their employability can skyrocket...

College Enrollment Skids For 8th Year In A Row, But Student Loans Skyrocket

Tue, 12/17/2019 - 14:04

Authored by Wolf Richter via WolfStreet.com,

The stunning decline of men in the student headcount.

https://www.zerohedge.com/personal-finance/college-enrollment-skids-8th-year-row-student-loans-skyrocket

With college costs blowing through the roof, with “luxury student housing” and not so luxury “student housing” having become asset classes – including, of course, CMBS, now in rough waters – for global investors, with textbook publishers gouging students to the nth degree, and with the monetary value of higher education questioned in more and more corners, the inevitable happened once again: College enrollment dropped for the eighth year in a row.

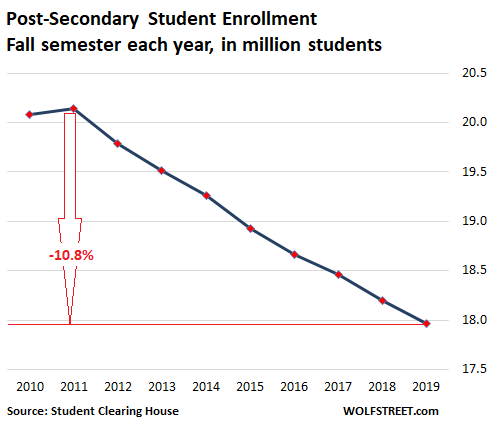

The post-secondary student headcount – undergraduate and graduate students combined – in the fall semester of 2019 fell 1.3% from the fall semester last year, or by over 231,000 students to 17.97 million students, according to the Student Clearing House today. In the fall of 2011, the peak year, 20.14 million students had been enrolled. Since then, enrollment has dropped by 10.8%, or by 2.17 million students:

This is based on enrollment data submitted to the Student Clearing House by the schools. It does not include international students, which account for just under 5% of total student enrollment in the US. Duplicate headcounts – one student enrolled in two institutions – are removed from the data to eliminate double-counting.

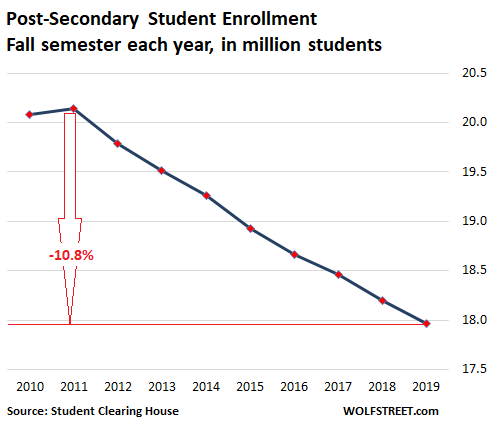

The 10.8% decline in enrollment since 2011 comes even as student loan balances have surged 74% over the same period, from $940 billion to $1.64 trillion:

Enrollment in for-profit colleges collapses.

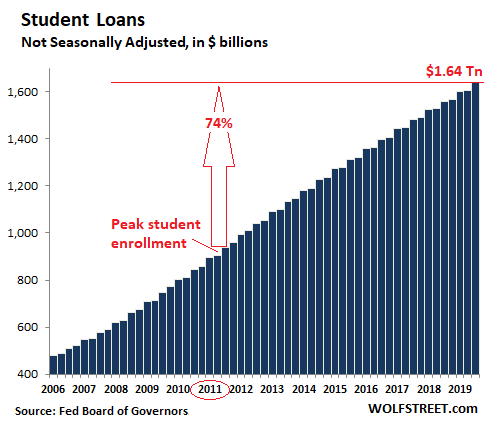

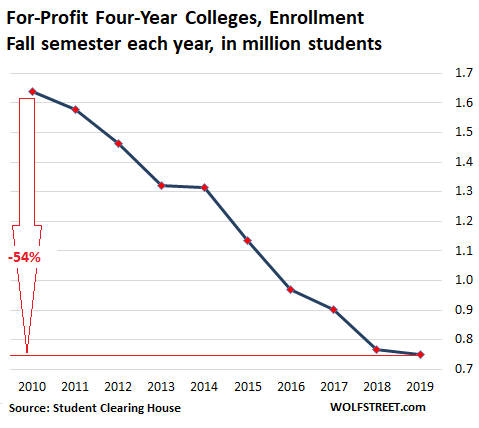

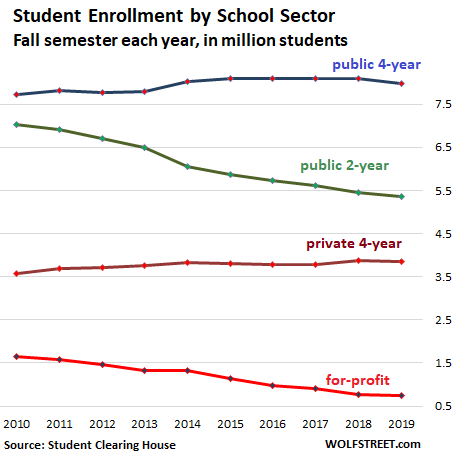

The overall decline in enrollment hasn’t been spread evenly across the board. After myriad scandals, lawsuits, government action, and government inaction, enrollment in for-profit four-year colleges has plunged by 54%, from 1.64 million student in the fall of 2010, as far back as the data series is available, to 750,000 now.

The current year-over-year decline of 2.1% pales compared to the plunges of 15% in 2018, of 7% in 2017, of 15% in 2016, and of 14% in 2015. Despite the relatively small share of total enrollment – by 2019, the share has withered to just 4% – these for-profit colleges account for 41% to the total decline in enrollment since 2001:

Enrollment at public two-year schools, such as junior colleges, has plunged by 22% since 2011, to 5.37 million (green line in the chart below).

But enrollment at private nonprofit four-year colleges has ticked up 3.9% since 2011. Yet, even these schools saw enrollment decline by 0.6% over the past year, to 3.84 million (brown line in the chart below).

And public four-year schools too had been hanging in there and the student headcount remains up 2.2% from 2011 though it too declined 1.2% over the past 12 months, to 7.82 million. At public schools, the peak was in 2016 with 8.1 million students (blue line):

Where the heck are the men?

Women by far outnumbered men in total enrollment in the fall semester of 2019 with 10.63 million women enrolled and just 7.61 million men, meaning that overall there are now 40% more women in college than men:

At public four-year schools, there were 30% more women (4.51 million) than men (3.48 million)

At private non-profit four-year schools, there were 50% more women (2.32 million) than men (1.54 million)

At private for-profit four-year schools, there were more than twice as many woman (508,000) than men (241,000).

At public two-year schools, there were 38% more women (3.11 million) than men (2.26 million).

Over the past three years, enrollment has declined for both men and women, but faster for men (-5.2%) than for women (-1.4%). Since 2011, enrollment has declined by 13% for men and by 9.4% for women.

Enrollment by state.

Of the big four states, California had by far the most students, at 2.45 million. Over the 12-month period, enrollment ticked down by 0.8%, and over the three-year period by 2.7%.

In Texas, with 1.49 million students, enrollment inched up by 0.3% this year, and by 0.7% from three years ago.

In New York, at 1.04 million students, enrollment declined 1.8% year-over-year and fell 4.4% over the three-year period.

In Florida, with 933,000 students, enrollment fell by 5.3% year-over-year, or by 52,328 students, the largest headcount decline among the states. And it fell 7.0% over the three-year period.

Enrollment in 35 states declined. Here are the states with largest enrollment declines by percentage change this year:

Alaska: -10.6% year-over-year to 22,300 students; -14.3% from 2017

Florida: -5.3% year-over-year to 933,000 students, -7.0% from 2017

Arkansas: -4.9% year-over-year to 144,000 students; -7.2% from 2017

Missouri: -4.4% year-over-year to 323,400 students; -6.9% from 2017

Vermont: -4.4% year-over-year to 38,200 students; -4.5% from 2017

Wyoming: -4.4% year-over-year to 27,600 students; -5.8% from 2017.

Receive a daily recap featuring a curated list of must-read stories.

And in 15 states, enrollment increased. Here are the biggest gainers:

Utah: +4.9% year-over-year to 362,000 students; +13.8% from 2017

New Hampshire: +3.4% year-over-year to 157,200; +6.4% since 2017

Arizona: +1.8% year-over-year to 456,543 students; +1.1% from 2017, having dipped in 2018

Georgia: +1.5% year-over-year to 518,800 students; +5.5% from 2017

Kentucky: +1.5% year-over-year to 243,300 students; +1.8% from 2017

The overarching theme is the horrible expense of getting a higher education, as each layer element in the University-Corporate-Financial Complex extracts its pound of flesh, largely funded by parental sacrifices and by student loans, which are a mix of taxpayers funds when the loans default and students’ future sacrifices when the loans don’t default. The vision of a pile of student loans for years to come act as a discouragement to students who spend more than two minutes thinking about it.

But clearly, there are more factors at work. The collapse of enrollment in for-profit colleges is a result of numerous scandals and scams that left students with huge student loans and either no degree or with a degree that’s utterly worthless. It is likely that these for-profit schools marketed to people that would otherwise not have gone to university and enticed them with government-funded student loans.

The declining proportion of men among students has long been observed. That women flock to higher education is a great thing, but why did men bail on the system in such large numbers? This is subject to endless and wide-ranging discussions. One explanation that has been offered, and only a partial one, and only covering the past few years, is the relatively good job market where young men decided for forgo a higher education and instead enter the workforce after high school – and that makes sense in many cases, especially if it involves learning a trade.

Whatever the explanations may be, for most parents and students it has become a daunting task to pay for higher education and feed the University-Corporate-Financial Complex.

And so student loans have become the biggest problem area of consumer loans. Read… The State of the American Debt Slaves, Q3 2019

No comments:

Post a Comment