Slowly but surely Trump is getting control of Central Bank policy. This was completely necessary in a world in which China particularly and just about everyone else has weaponized their central banks.

Actual reform of the whole global central bank system and of the US central bank in particular has been talked about for decades and has gone nowhere because of political ignorance. No one knew what to do or even who to trust for advice either well meaning or correctly informed. It was always easier to leave it alone.

This is no longer true. Worse, those who have held control are largely stupid as can be perceived from the promotion of the NWO MEME. This is quite natural to the process of inheritance.

Ending the NWO means the end of CABAL family control once and for all.

.

Rabobank: "All The Experts Who Were Mocking Trump Are Suddenly Quiet"

Wed, 06/12/2019 - 08:50

Submitted by Michael Every of Rabobank

https://www.zerohedge.com/news/2019-06-12/rabobank-all-experts-who-were-mocking-trump-are-suddenly-quiet

The latest on the trade war is that US President Trump claims he is personally standing in the way of a deal being done by insisting Beijing returns to the terms the US felt they had agreed a few months ago; the editor of China’s Global Times has tweeted in response: “Will there be a breakthrough at the G20? I dare not be optimistic at this moment.” That’s all as the manufacturer of a mobile phone taken as the symbol of neoliberal/liberal globalisation has publicly declared it can supply the entire US market without relying on China.

Meanwhile, US PPI data yesterday showed no sign of imported inflation on the back of tariffs to date, and the NFIB survey stated “Optimism among small business owners has surged back to historically high levels, thanks to strong hiring, investment, and sales. The small business half of the economy is leading the way, taking advantage of lower taxes and fewer regulations, and reinvesting in their businesses, their employees, and the economy as a whole.” No signs of any trade war strain there – presumably the Fed is looking at multinationals then as it now talks of the need to cut rates(?)

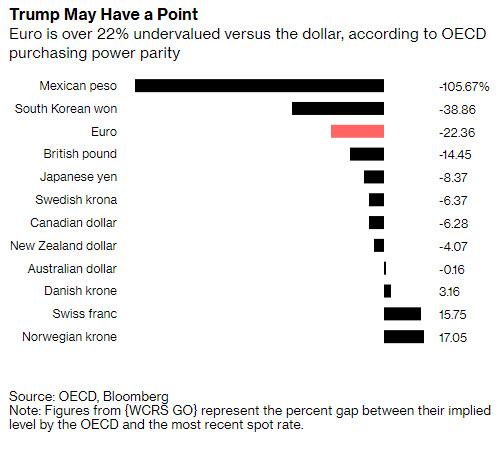

On which front Trump came out swinging against the Fed again: “They don’t have a clue!” he claimed in a tweet, knocking them for having raised rates too far and for undertaking Quantitative Tightening. I must confess I was on Bloomberg TV several hours before Trump spoke discussing the same topic: if I recall correctly my opinion was “They don’t know what they are doing” - who wore it better? Trump also claimed European tourist attractions have queues round the block because the USD is too high due to Fed policy error, and Bloomberg noticed the OECD agree EUR is 22% undervalued on at least one basis.

So, yes, it’s easy to mock Trump for his misunderstanding over who pays US tariffs or whether the moon is part of Mars; but apart from that EUR admission above, all the experts who rolled their eyes and said you could never shift mobile-phone production out of China without prices hitting the roof, and at his “Don’t hike! Cut rates now!” outbursts against the Fed last year, are as quiet as the president is voluble.

Indeed, we live in interesting times. The Fed seem set to cut several times even as stocks are close to record highs and small businesses are booming; and markets are selling the USD as a result on the assumption that this is a US-centric issue and not a global one,…even as global data are far worse than in the US and the US remains the end-consumer for much of global production; or they believe a trade war will cause a recession (led by US blue chips firms?) ignoring the fact that the US will break some fingers and China/Asia will break an arm and a leg.

In short, nothing is black and white – except that rates are heading lower and are staying there.

Day Ahead

Today markets will be looking at politics again. There will be two debates and votes in two different legislatures on two different continents. On the surface, both of them sound innocuous. However, both have potentially enormous ramifications for us all. First up, although with a final voting date now perhaps as late as 20 June, is the second reading of the extradition bill in Hong Kong. Proponents of this legislation say it will allow for smoother international cooperation in the transfer of dangerous criminals; opponents say it will fatally undermine Hong Kong’s one-country-two-systems status. Already this morning looking out of the office window here one can see crowds of very young protestors all wearing black. Likewise, while now everything is very, very grey, dark black clouds are likely to gather over the course of the day, as they did yesterday here….let’s all hope no storms break in any sense of the term. However, with the US already warning if this legislation passes it could potentially mean a change in its recognition of Hong Kong as a separate entity from China, with the next annual review due before the end of the year, surely it’s a matter of when we are hit by something more the ‘T-8s’ that can batter the city at this time of year.

Second is the UK, where today will see Parliament vote on an opposition motion to block the possibility of a No-Deal Brexit on 31 October. It appears to be a close call whether enough Tory rebels will side with Labour and the Lib-Dems to pass the motion. If the government wins then there is a very real risk that Hard Brexit is less than six months away under a future PM Boris Johnson (who a recent opinion poll shows would see the Tories on 37%, Labour on 22%, the Lib-Dems on 20%, and the Brexit Party on 14%). Yet even if the motion passes the UK alone cannot guarantee no Hard Brexit if it keeps wasting time, as it is now: the decision to extend (and pretend) is then passed back to the EU once again.

In terms of data, we already saw a healthy Japanese print for core machine orders, which soared 5.2% m/m vs. -0.8% expected, a very welcome change from the gloomy regional picture of late: is it a one-off or a harbinger of better times? Slumping Korean exports would say the former unless Japan is cannibalising Korea’s market share!

No comments:

Post a Comment