The first live problem is that a third of the population can on graduation actually expect to afford to pay at the level required. In the meantime the education infrastructure has expanded and has been financially gamed to send two thirds of that same population through the mill.

What is demanded is a two tier system in which that second tier is first sent through an apprenticeship program that naturally feeds into higher quality knowledge as well. This provides a fall back income stream as well.

.

Even the super talented are better prepared with some access to skill development. Again a four hour shift along with academic effort can work for most.

Here’s Why So Many Americans Feel Cheated By Their Student Loans

A social and financial divide is forming — between those who have student debt, and those who do not — that will have ramifications for decades to come.

Posted on February 9, 2019, at 10:31 a.m. ET +

https://www.buzzfeednews.com/article/annehelenpetersen/student-debt-college-public-service-loan-forgiveness

Jen’s story is like a lot of people’s stories. She’s 35 years old. She and her sister were the first in their family to go to college. She emerged from undergrad with $12,000 in debt, and even though she was making just $30,000 a year at her first job, she made her standard monthly loan payments on time. In 2008, when she was laid off into the depths of the economic crisis, she decided to do what so many other people did then: go back to school.

Jen enrolled in a one-year master’s program in public policy at an Ivy League university, where, despite having small scholarships and participating in work-study programs, she accumulated an additional $50,000 in federal loans. But by the time she graduated, the economy still hadn’t recovered, and she struggled to find work. She deferred her loans (meaning she did not have to make payments, and no interest accrued) and when the deferment period ran out, she put them in forbearance (during which payments are suspended, but interest does accrue). In 2010, she found a job — only to be laid off, again, two years later. She managed to find a contract gig that put her to work three days a week, and consolidated her loans into a single loan that would be easier to manage.

Just months later, Jen, then in her twenties, had a stroke. She didn’t have health insurance, but was able to get on Medicaid, which allowed to her to focus on recovering without incurring additional medical debt. She landed a job in October 2012, but between juggling her new gig, physical therapy, and the day-to-day stressors of her life, she struggled to keep up with her loan payments.

“That’s no excuse,” she said. “I dropped the ball, and I defaulted.” Originally, the loan servicer asked her to get back on a standard repayment plan — one where the payments would be far above what she could afford. “I told them I just didn’t have it,” she said. “And that’s the first time I heard about an Income-Based Repayment plan.” Since then, her loan servicer has auto-debited 10% of her discretionary income every month.

Jen is one of more than 44 million Americans with student loans, and her current balance of $70,000 is just a tiny fraction of our collective $1.5 trillion debt load. The weight of all that student loan debt is markedly different than the feeling of the weight of mortgage or credit card debt — after all, those borrowers can declare bankruptcy, an option unavailable to student loan borrowers. Not even death can absolve you or your loved ones from the responsibility of some student loans.

That Jen defaulted on her loans isn’t uncommon, either — default rates are projected to hit 38% by 2023. Like Jen, most who default don’t do so because they’re lazy, or not out looking for work, but because the loan payment amounts are just too much. Nevertheless, much of the conversation around student loan debt still puts the onus on the borrower.

“A member of my family once said I deserved student loan debt because I chose the unrealistic field of history,” one borrower told me.

“My in-laws believe poor students get everything paid for (they don’t) and that students can all just find jobs that work with their school schedule (they can’t),” another borrower explained.

Such responses are indicative of what writer John Thornton calls “the retributive view,” which assumes “students could have made different choices to avoid or mitigate their debt. They could have chosen majors that pay more or schools with higher rates of success in the market. They could have worked a second or third job. They could have eaten ramen at home instead of going out.” Within this view, student loans become a mark of failure — failure of character, perseverance, or planning — that’s further compounded if and when a payment is missed. “I think there’s this assumption that millennials are spoiled, naive, and entitled,” Jen said. “Growing up a poor black kid, all I heard was college, college, college. Now we’re fools for taking out loans to make it happen?”

Even after making her loan payments steadily for years, Jen was still barely paying down the original principal amount. But she had some hope: Her job in public policy is considered “public service” — one of thousands of jobs, in both the government and the nonprofit sector, that would make her eligible for eventual student loan forgiveness through a program called PSLF (Public Service Loan Forgiveness).

The premise of PSLF, which was passed by Congress and signed into law by George W. Bush in 2007, is straightforward: Working in public service doesn’t pay a lot, and a lot of public service jobs — including teaching and social work — require advanced degrees, which in turn often necessitate hefty student loans. How do you encourage people to train for those jobs, jobs that are essential to society, even when it means taking on massive amounts of debt? You make “loan forgiveness” part of the package. (To be clear, these borrowers aren’t receiving a free education — they’re still paying. Indeed, in many forgiveness cases, what’s really getting “forgiven” after 10 years of repayment isn’t the original loan balance, but all the interest that’s accumulated on top of it.)

Pool

President George W. Bush signs HR 2669, the College Cost Reduction and Access Act, at the White House on Sept. 27, 2007. Public Service Loan Forgiveness is a program created under the CCRAA.

From the beginning, the PSLF program has presented itself as deceptively simple: Get on an income-based repayment plan, work in public service for 10 years while making monthly payments, and the remainder of your student debt will be eliminated. That was the promise, made on behalf of the federal government. Yet the program’s apparent simplicity (and the lack of guidelines on how to implement or monitor the program) has now led to the defrauding of tens of thousands of borrowers. That includes students like Jen, who, after years of believing she’d been enrolled in the PSLF program, was told she’d originally been given incorrect information, and her “10-year” clock would start in 2019, at zero.

The issue came into focus in fall 2018, when the Department of Education released information related to the first round of potential loan forgiveness. Out of 29,000 forgiveness applications that had been processed, more than 98% had been rejected. Of those, 28% of the rejections had to do with filing errors — clerical mistakes that could, with time, be remedied. But more than 70% had to do with not meeting “program requirements”: Applicants’ loans weren’t eligible, their employer hadn’t been “certified,” or their payments hadn’t been counted toward the applicable 120 necessary to receive forgiveness. Either tens of thousands of Americans, many of them with advanced graduate degrees, had totally bungled the process, or the process itself, and the lack of clear information about it, set up those borrowers to fail.

In my reporting for this story, I heard from dozens of borrowers with deep anxiety about the future of the program. If the PSLF is eliminated, as suggested by President Donald Trump’s most recent budget proposal, borrowers currently on track for forgiveness would still theoretically receive it. But that assurance holds little weight with borrowers.

If they had known PSLF was in jeopardy, or that they wouldn’t be approved for it, many borrowers would’ve taken different jobs, or attempted to pay down their loans more aggressively in order to combat ballooning interest.

“I think there is a 4% chance my loans will actually be forgiven,” said Grace, a 33-year-old who’s worked meticulously to stay on top of her PSLF payments. “I think there's a 96% chance that after 10 years of payments I will find out I owe more than I took out and that my current sense of ‘I'm doing things right!’ security is totally baseless and I've been horribly naive once again.”

“If PSLF suddenly vanishes, we have basically been pissing into the wind,” another borrower told me. “Not only is there no end in sight with our loans, but the balance will be so inflated that we will be buried forever. I borrowed $35,000 from the federal government. I’ve now paid back $7,000, but I also now owe them $43,000. So what’s that going to look like in 2025 when the government tells me, ‘No, sorry, you did everything we asked but we aren’t holding up our end of the agreement’?”

For hundreds of thousands of Americans, the promise of student loan forgiveness has either already been broken, or they fear it will be. And while recent investigative reporting from Mother Jones has illuminated massive failures on the part of the private, for-profit companies that “service” both student loans and the PSLF program, like FedLoan and Navient, the question of who’s to blame extends far beyond their bad behavior. To really get at why all of this matters, we have to think about who’s taking out student loans and why, what students do with the money they receive, the actual options available when students enter the workforce, and the larger ramifications of shifting the burden of education away from society and onto the individual.

Much of the reporting on student loans throws around big numbers ($1.53 trillion in debt!). But for those of us who hold some of that debt — and those with no student debt at all — the cold abstraction of that framing can often feel alienating. To the individual, the $1.53 trillion is not the most pressing problem. The problem is the wedge of your salary that disappears each month. The problem is not being able to find work in the field you took out loans to prepare yourself for. The problem is spending hours of your life on hold with call center representatives who can’t answer simple questions. The problem is the growing certainty that you were sold a false bill of goods about the immeasurable value of higher education, and that’ll you’ll be forever paying down the cost of a broken dream.

There’s a reason our current debt situation has been dubbed a “student loan crisis”: It foreshadows radical shifts in the way millions of Americans, most of them still in early adulthood, will be able to participate in the economy, in society, in the workplace. For many of us, student debt means delaying — if not entirely forgoing — homeownership, marriage, and parenthood. This new form of social stratification — between those who have student debt, and those who do not — will have ramifications for generations to come.

I think of a 28-year-old, now in her first year in the PSLF program, with $110,000 in graduate school debt. Her health insurance with a public service employer doesn’t cover specialist visits to the doctor — so she goes without, because she uses her extra income toward covering her student loans. “I basically can’t have children until I’m at least 38, and who knows if my eggs will be dead by then,” she told me. “I have pretty abysmal views that I’ll save much money at all in the next ten, twenty, THIRTY years.”

And if hundreds of thousands of people aren’t even saving for themselves, we’re certainly not saving for our kids’ college tuition, effectively ensuring their future monumental student debt. It’s a slow-motion emergency, but because it is built on two cherished components of the contemporary American dream — the necessity of both debt and education — almost no one has heeded the calls for help.

You might not have student loans. You might not be in a student loan forgiveness program — and, as such, might think that the problems plaguing the thousands who are struggling with their debt have nothing to do with you. You’re wrong. The experience of student debt is isolating, lonely, and often dismissed as the result of individual choices — but its ramifications span generations and demographics. To actually address those ramifications, however, means looking to the larger, societal issues underpinning student loans in general: how we, as a country, came to frame college and “credentialing” as essential and how we shifted from one paradigm of funding college to another. Because the only way to actually fix a problem of this magnitude is to really, clearly, see it: what created it, what continues to fuel it, and who profits from it.

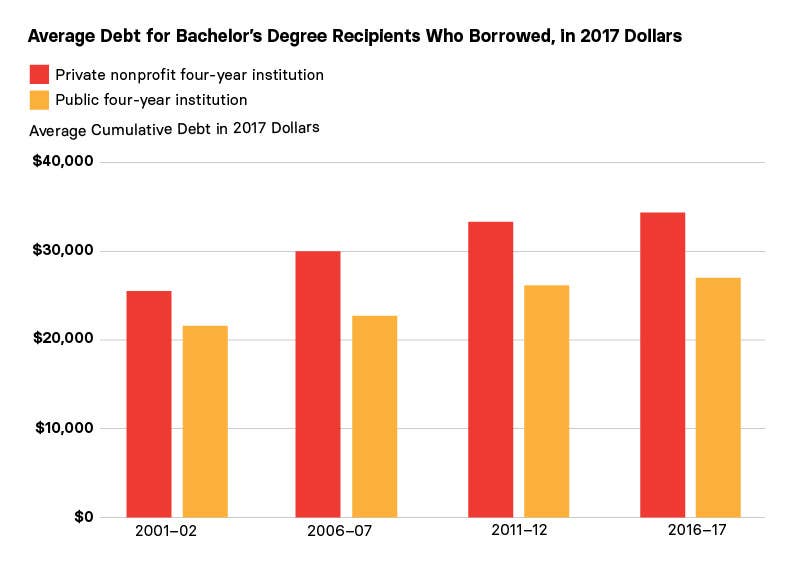

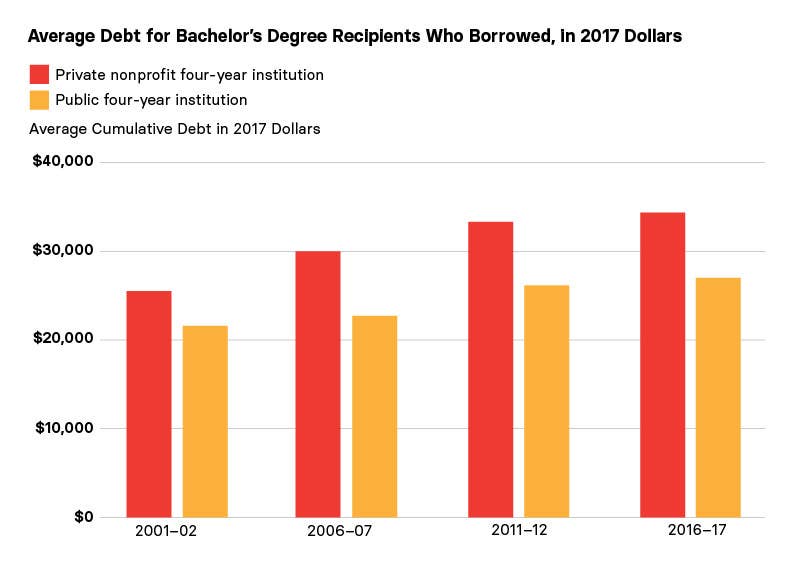

Millennials didn’t adopt new ideas about college. We inherited and internalized the old ones. But the cost of those ideas has risen exponentially in the past few decades. In 1983, the average full-time student borrowed $746 ($1,881 in 2018 dollars) per year. The most recent statistics from the College Board indicate that in 2018, the average annual undergraduate loan is now $4,510, while the average graduate loan hit $17,990. In 2016–2017, the average borrower left college with $37,172 in loans.

This escalation doesn’t just touch millennials: A 2017 study found that 2.8 million Americans over the age of 60 have at least one student loan, a fourfold increase from 2005, largely stemming from grandparents and parents who took out loans to support students in their family. Yet millennials have taken on more than three times as much student debt as our parents’ generation did, in part because college costs keep rising. At a public four-year institution, tuition has risen more than 313% over the last 30 years.

These exponential increases in the cost of college, and the amount of loans necessary to cover that cost, point to why it’s so difficult to talk meaningfully, across generations, about student debt today. Until 1958, “public” student debt didn’t even exist: Some colleges operated small loan programs for enrolled students; some students took out small private loans. But there was no such thing as a federally backed student loan.

In 1947, the Truman Commission issued a sprawling report on the state of American higher education, which recommended, among other things, doubling the number of students who attended college by 1960. Central to increasing college attendance would be providing government assistance, whether in the form of loans or grants, to make enrollment a reality. “The democratic community cannot tolerate a society upon education for the well-to-do alone,” the report declared. “If college opportunities are restricted to those in the higher income brackets, the way is open to the creation and perpetuation of a class society which has no place in the American way of life.”

Ben Kothe / BuzzFeed News

The ideas that the report essentially took as self-evident — that schooling will not only better society, but make it more democratic and equitable, more fundamentally American — were central to what economist W. Norton Grubb and historian Marvin Lazerson call the “the education gospel.” Of course more education is better than less education, that gospel says. Of course you should go to college by any means necessary — even when the costs of college outweigh the benefits, and despite increasing evidence that college is not “worth” its cost for those who drop out or come from lower-class backgrounds.

For society to arrive at the consensus that college was necessary and worthwhile, it had to become far more accessible than it had been during the first half of the 20th century. And for many, the government-funded GI Bill, passed in 1944, provided the first major step toward accessibility.

My paternal grandfather returned home from World War II and spent a semester at the University of Minnesota thanks to the GI Bill, which covered tuition at a college, university, or trade school of the veteran’s choice and provided a monthly living stipend. My maternal grandfather attended a small private college in his hometown in Nebraska in the early ’40s, digging holes for telephone poles during the summer to help cover tuition. He received a fellowship to cover his MBA at the University of Oregon until he was drafted for World War II. He exited the military without debt.

Thirty years later, my mother started undergrad at a private liberal arts college in Minnesota, where her tuition was covered through the combination of a National Merit Scholarship and a work-study program. (Tuition and board at the time was around $3,500, or $14,500 in 2018 dollars; current tuition and board is $55,510.) My father paid for the same college through a combination of grants, work-study, and a small federal loan. When he went to medical school, he took out $15,000 in loans, but paid them off two years after finishing his residency, allowing my parents to start saving for my own college education. That’s a typical story for many white, middle-class families in America, many of which became middle-class through the mortgage and tuition assistance afforded by the GI Bill.

Bettmann / Bettmann Archive

WWII veterans whose college tuition and supplies were covered by the newly passed GI Bill buy books in January 1945.

Yet many of our grandparents’ generation were excluded from the chance at college, regardless of the valor or length of their service. Veterans were allowed to apply the GI Bill to any institution that accepted them, but many colleges and universities didn’t accept black students, especially in the South, where Jim Crow remained the rule of law through the 1960s. This exclusion had long-ranging consequences: A congressional study showed that wages for those who took advantage of the GI Bill went up between $10,000 and $15,000 in adjusted dollars. It was, some economists argue, one of the best investments the US government ever made. But that investment was largely limited to those who were white — and their descendants, who would go on to benefit not only from their fathers’ and grandfathers’ degrees, but also from the lack of debt that accompanied them.

But government funding to double the number of American college graduates didn’t stop with the GI Bill. Congress also passed legislation to fund Perkins Loans (directed toward low-income students), Stafford Loans (government-backed student loans), and the 1972 creation of the Pell Grant. When older generations talk about working their way through college, they’re talking about college made affordable through the nationwide vision to expand college attendance — one that hinged not only on loans and grants, but also on expanded funding, especially on the state level, for public institutions. Funding from state governments helped tuition stay low; funding from the federal government helped students cover those costs. Most graduates through the early ’80s emerged from college with no or little debt, which then allowed them to assist their children when they attended college.

When I asked people about their “debt genealogies” — whether their grandparents and/or parents went to college and how they paid for it — the responses fit this overarching pattern. The vast majority who could trace both a parent’s and grandparent’s college experience were white; the vast majority also accumulated little to no debt.

“My grandpa went to University of Arizona and paid for it by being a farm laborer in the summer,” one woman said. “My dad then went there on an ROTC scholarship, while my mom went there with student loans (tuition was $800 per semester).” Another woman’s paternal grandfather was the first in the family to go to college, working his way through public university in Ohio and graduating without debt. He then paid for the state tuition costs of all eight of his children — allowing each of them to graduate debt-free.

In the 1980s and ’90s, that paradigm began to shift. More students were graduating from high school than ever before — and, having internalized the education gospel, were eager to continue on to college. At the same time, funding for state universities began to decrease substantially as politicians, elected on the promise of slashing government spending, cut state budgets. College costs, both public and private, began to rise; companies that had once paid for on-the-job training — essentially credentialing workers in their fields — began asking applicants to find training themselves, generally through some sort of college.

The cost of education shifted from a societal investment — spread across the tax-paying public, in the name of a thriving society and economy — to an individual one. And no matter how astronomically priced that investment became, we continued to rationalize it as a worthwhile one. Even in a culture that idolizes high-profile college dropouts (Bill Gates, Steve Jobs), to refuse higher education in America has become tantamount to refusing to fulfill your potential. And if you refuse to fulfill your potential, any struggle can and will be blamed on you alone.

Scott Olson / Getty Images

The University of Phoenix Chicago campus on July 30, 2015, in Schaumburg, Illinois. The university was under federal investigation at the time for possible deceptive or unfair business practices.

For decades, well-paying jobs didn’t necessarily require an advanced degree. You didn’t need a master’s in education to be a teacher or a principal. You could be a nurse with an associate’s degree. You didn’t need an MBA to rise through the ranks in business, or in human resources. But over the last 30 years, more and more “good” or steady jobs have begun to demand a post–high school diploma of some kind — and those diplomas, whether from elite private colleges or public institutions, keep getting more and more expensive.

Some students, often with the help of their families, are able to cover the costs of that diploma. Meanwhile, others simply shoulder the cost in the form of debt — increasingly, especially for first-generation college students, at “for-profit” colleges whose advertisements surround us: University of Phoenix, the now-defunct ITT Tech and Corinthian College, Capella University, cosmetology schools, and more.

Sociologist Tressie McMillan Cottom refers to this overarching shift as one toward “lower ed,” in which institutions profit from — and often exploit — the desire and demand for professional credentials. Between 1998 and 2014, enrollment at for-profit colleges more than doubled, to 2.1 million students. Many of the degrees offered by these for-profit colleges sound similar to those offered by community colleges or state institutions — but the acceptance rates are much higher, the recruitment practices are more predatory, and the resultant debt load is far, far higher. Tuition at these colleges is often pegged to just above the maximum amount of federally backed student loan available to each student —and as a result the average for-profit student accumulates $39,950 in debt, compared to $25,550 for the average public college graduate.

“Lower Ed can exist precisely because elite Higher Ed does,” McMillan Cottom argues. “The latter legitimizes the education gospel while the former absorbs all manner of vulnerable groups who believe in it: single mothers, downsized workers, veterans, people of color, and people transitioning from welfare to work.” Half a century before, a wave of first-generation college students, most of them white, had bought the education gospel and walked out of school debt-free. And the subsequent, ever-expanding wave of high school graduates — many from working-class, rural, Latino, and black families — were eager to buy it too.

While some parents warned their children away from student debt, others bought into it as a worthwhile necessity: “Both of my parents only graduated high school, and my dad was the last of a generation to make $80K per year working at a chemical plant in an affordable city,” Danielle, who took out significant loans to cover an MA and an MD, told me. “To them, taking on debt to pay for education was a natural thing you did, because it would all be repaid with a ‘good-paying job.’ Debt is as American as apple pie, so my parents never thought it would be a bad idea to take it on. However, they didn't know anything about what the economic landscape would be like now.”

Like so many others I spoke to for this piece, Danielle knew about the potential risks of taking out loans. But the warnings weren’t powerful enough to drown out the promises of the education gospel. “They make you take these surveys at the outset of every loan for which you apply, trying to make you recognize the heaviness of taking on this debt,” she said. “But I definitely wasn't thinking about that as a desperate 25-year-old trying to get the hell out of Baton Rouge.”

Like Danielle and her parents, most of us, whether seeking a business certification, an associate’s degree, or a master’s in education, have become convinced that more school, regardless of cost, is the way forward — and that student loans, regardless of the size, are the way to get there.

When talking about the failures of loan forgiveness, I often field responses suggesting a loan is a loan — and should always be repaid in full: “Honor your contracts”; “Pay your bills”; “I don't know how it works in your government job, but in the productive sector I'm expected to take ownership and responsibility for myself. Not only do I do that, I'm given the burden of subsidizing people who don't pay off loans. Spare me the pity party.”

But the principles of loan forgiveness aren’t that different from something like military tuition assistance, which has been an uncontroversial federally funded program for decades: That’s how we incentivize military service and attract the talent needed to keep the military running. There’s broad agreement that the value of the military service equals, if not exceeds, the cost of educating the soldier — even if that cost is hundreds of thousands of dollars for medical school. When it comes to other, nonmilitarized quadrants of American society, though, something shifts — even when the student goes on to work directly for the government.

Public service within the military-industrial complex is still widely gendered and conceived of as masculine, good, and — most important — valuable. By contrast, public service outside of the military (in schools, in public health, in legal defense, in nonprofits) is conceived of as feminine, and less valuable. A staggering 77% of public school teachers are women, and women make up 73% of nonprofit workers. When that work is figured as less essential to a functioning society, “investing” in it collectively (through direct government funding, in the form of tax dollars, or indirect funding, in the form of loan forgiveness) is deprioritized or rejected altogether. And that idea extends all the way to the Department of Education — the entity charged with facilitating the disbursement and payment of student loans — which has moved to roll back myriad protections for student borrowers and eliminate PSLF entirely.

“The people running the federal student aid seem to have a cultural resistance to the idea of loan forgiveness,” John R. Brooks, a professor at Georgetown Law specializing in student loans, told me. “They see themselves as bankers: We made you the loan, and we need you to repay it. Their primary job is making sure the government gets its money back and then some, which is not what’s best for students, or higher ed, or society in general.”

This attitude toward student borrowers is a far cry from the original conception of education as a worthwhile investment in America’s future. It conceives of the borrower not as the bearer of the future of the country, but a customer, and a petulant one at that. It also conceives of education as a transaction, in which recipients must pay back every cent, plus interest, in order to make good on the investment that has been made in them. That understanding is mirrored in every corner of the repayment process — and nowhere more so than the Public Service Loan Forgiveness Program.

The first income-based loan repayment plan was implemented in the 1990s — an early acknowledgment of skyrocketing loan amounts. Since then, the Department of Education has introduced a number of variants, but the premise remains the same: If you make monthly payments of between 10 and 15% of your discretionary income for between 20 and 25 years, the remainder of your loan will be forgiven. PSLF is a bolder version of those original repayment plans, and when it was first conceived, its guidelines were straightforward: To obtain forgiveness, you must have the right kind of loan (a public one, as in, owed to the federal government); the right kind of repayment plan (income-based); the right number of qualifying months (120); and the right employer (one that provides public service). The federal government contracted with a private company, FedLoan, to “service” the program. But it never provided a manual, and the servicer — which, like every other loan servicer, is a publicly held, profit-driven enterprise — has little incentive to facilitate completion of the program. When a borrower is granted forgiveness, after all, that loan (and the fees generated by it) disappears.

When I finished my PhD in 2011, I began repaying my student loans on an income-based repayment plan. In a phone call shortly after, I asked my loan servicer, Navient, about Public Service Loan Forgiveness, and was assured that if I was working in public service as a teacher, I would simply need to make consecutive payments for 10 years, at which point I would apply and receive forgiveness for the remainder of my balance. That advice was wrong — and if I had followed it for the next 10 years and applied to the program, I would likely have been told that none of my payments qualified, and I would need to start over again.

The biggest issue with my loans was one faced by hundreds of thousands of other borrowers who believe they are enrolled in PSLF: I was with the wrong servicer. In order to participate in PSLF, you must transfer your loans to FedLoan. But many servicers — including Navient — may be reticent to guide clients toward this option, because if a loan is transferred to FedLoan, they lose their servicing fees.

“You really have to watch your loans like a hawk. You have to be your own relentless advocate.”

In a recent lawsuit funded by the American Federation of Teachers, a group of nine teachers accused Navient of negligence in administering their student loans. (The plaintiffs, who say that their experiences with Navient typify the company’s malfeasance, are seeking to have their suit certified as a class action.) In January 2014, Kathryn Hyland, a teacher in New York, attempted to certify her employment as part of the PSLF program. Instead of informing her that she would need to consolidate her various loans into one “direct loan,” and that she would then need to transfer her loan to FedLoan, Navient repeatedly assured her over the course of three years she was “on track” for PSLF.

The other plaintiffs’ claims are filled with variations on the same sorts of stories: Borrowers were told they did not qualify for PSLF, or incorrectly told PSLF was unavailable to them, or repeatedly placed in forbearance programs — which allowed interest to continue to accumulate — when they had requested to be placed into the PSLF program.

According to AFT counsel Lena Konanova, Navient has admitted ignorance about the actual operation of its call centers, where, according to previous reporting by BuzzFeed News, employees were instructed to keep calls between three and seven minutes, or shorter. “That’s the really insidious part of this,” Konanova said. “Imagine having to pick between giving a person correct information or getting written up. And getting a bad performance review because you took too much time with them? That’s not fair.”

Even if a borrower does figure out that their debt needs to be transferred to FedLoan, it’s only the beginning of the battle. Two years after the 2007 announcement of PSLF, the Department of Education realized the lack of guidelines about what type of employment could be considered “public service” might be a problem, and implemented a “certification” process. Dozens of borrowers who told me they had believed themselves “on track” for forgiveness had no knowledge of this new qualification, and were never notified; one told me she’d been working in public service for five years before learning she needed to certify — and only because a friend had told her. “And I’d read everything I could get my hands on!” she said.

For borrowers working directly for the government, certification can be simple; for others, it’s an endless frustration. “There is absolutely no real guidance and the process is a sham. I recertify my participation every year, and every year I fight with the PSLF people,” one borrower told me.

An employee of a US executive branch agency was told that her employer was not part of the US government. A high school teacher’s application was denied because her “principal’s title was mislabeled.” And even if you get your employer certified, you still have to convince FedLoan to allow your previous and current payments to actually count.

Ben Kothe / BuzzFeed News

Kate, a 39-year-old from Seattle, recalled her difficulties with the company in detail: “FedLoan has miscalculated my payments multiple times and every time I call, it is a different story as to why,” she said. “The customer service people are horrible. I usually end up in tears after the call.” She sought advice on student loan Reddit forums, and demanded an audit of her account from the state’s attorney general, which showed that even though Kate had graduated in 2011, and started to make payments that year, FedLoan insisted she had graduated in 2015 — and refused to count those four years of payments.

The audit surfaced the problem, but it still didn’t force FedLoan to act. “Every time I call, I get a different story again, and it makes me cry again,” Kate said. “I’m hoping I can build up the courage to call them back.”

Kate’s frustration, like so many others’, stems from just how illogical and intractable the system remains. If you pay even one dollar more than your set income-based repayment, the payment doesn’t count toward forgiveness. If you make the payment a day early, it doesn’t count. If you make a payment on the one-day gap between switching from one public service job to the next, it doesn’t count. If, for whatever reason, you cannot make a payment for one month, your loan will then go into forbearance. For many borrowers, though, it can take up to a year of waiting time before the servicer completes the paperwork to transfer you out of forbearance and back to your original payment plan — which means losing time, and payments, that could have been spent working toward forgiveness.

Those who have found themselves on track toward PSLF have only done so with considerable research acumen or outside guidance. Misti, who figured out how to navigate PSLF for her husband, said she was only able to do so because of her training as a librarian. Another borrower told me she realized her payments were ineligible only after a chance meeting with Heather Jarvis, a student loan rights attorney whom various public service employers pay to educate them on how to help their employees obtain assistance.

"There really is a sense of shame that’s cultivated in the system. It’s very dehumanizing and punitive.”

“You have to babysit the company that’s supposed to be managing your loan,” Jarvis told me. “You have to be an expert in what you’re doing. It’s very, very hard for normal people. There really is a sense of shame that’s cultivated in the system. It’s very dehumanizing and punitive.”

When borrowers try to address their concerns to FedLoan employees — asking why a payment hasn’t been applied, asking for advice on how to navigate a job change, or asking them to properly label a payment or adjust an error — their concerns are often dismissed. These customer service agents are not experts in the labyrinthine, bureaucratic processes that guide the company that employs them. They’re working minimum-wage, high-turnover jobs, and have been trained to respond to complaints in a certain way.

“I have to explain to them that when ‘forgiveness day’ comes, any one of these tiny errors could disqualify me,” one borrower told me. “What I’ve found is that you really have to watch your loans like a hawk. You have to be your own relentless advocate.”

These mistakes on the part of Navient and FedLoan are not minor inconveniences. They’re $1,000, $10,000, $20,000 life-altering mistakes — mistakes that sink students further in debt, with financial ramifications that trickle down to the next generation. If research librarians struggle to navigate the system, imagine trying to do it as a full-time teacher, or a single mom working for a nonprofit, or as anyone, really, who doesn’t have the time or wherewithal to slog through misinformation and misdirection. Keeping borrowers confused — and thus paying for longer, while interest and servicing fees accumulate — isn’t a bug in the system. It’s a feature.

All of these factors help explain why less than 2% of applications for loan forgiveness were approved last year. While hundreds of those rejections may eventually be overturned, given Navient and FedLoan’s lack of incentive to place borrowers on track toward forgiveness, it’s unlikely the percentage will change in a meaningful way.

“Putting public attention on that misconduct is the only way for others to know they’re not crazy, they didn’t just mess up — it’s a systemic problem,” Konanova told me. Lawsuits like the one she’s working on “are the only way that Navient is going to be incentivized to change. They’re a publicly traded corporation, they have contracts with the federal government. The only way to move forward is to keep them accountable.”

In the past, borrowers could file complaints against servicers with the Consumer Federal Protection Bureau, or CFPB, which was established after the financial crisis in 2008. (If you search “PSLF” or “FedLoan” in the CFPB complaint database, you’ll find the most recent set of complaints concerning the program.) In 2017, the CFPB issued a report summarizing the overarching problems with the PSLF, consolidating the complaints individual borrowers had voiced for years: Job certification is a nightmare, applications are often grossly mishandled, and inaccurate information about the program leads to months and years of loan payments beyond the 120 officially required, costing borrowers thousands of dollars.

Chip Somodevilla / Getty Images

Office of Management and Budget Director and acting White House Chief of Staff Mick Mulvaney

The report should have prompted immediate action to crack down on the industry. Instead, the departments of Education and Justice began actively working to block a lawsuit from the Massachusetts attorney general to address the abuses. (Congress did allocate $700 million to facilitate the management of PSLF; it remains to be seen if that funding will make a meaningful difference to borrowers.)

In December 2017, Trump appointed Office of Management and Budget Director Mick Mulvaney — who’d previously called the CFPB a “sick, sad joke” and sponsored legislation to get rid of it — to serve as the agency’s acting director. In June 2018, Mulvaney (now also the acting White House Chief of Staff) fired the entirety of the CFPB advisory board; two months later, CFPB ombudsman Seth Frotman made a very public exit from the bureau, saying, in his resignation letter, that it “has turned its back on young people and their financial futures.” Along with a handful of other former CFPB employees, Frotman launched a new organization that aims to provide the same sort of protectorate function for student borrowers, only from outside the system — and outside the influence of the business-friendly Trump administration.

As Frotman told me, “We have to ask ourselves: Are we gonna recognize that this isn’t just a considerable impact on borrowers’ lives, but raising much larger systemic questions about American society?”

“From income inequality to racial inequality, we’re seeing student debt play a significant role in all of that,” he said. “There’s an older generation that’s arguing that the status quo is fine. But if you grew up post-financial crisis, and you’re bearing the brunt of this, you just understand it viscerally. It’s difficult to explain that: what student debt is doing not just quantitative, but qualitative.”

Alex Wong / Getty Images

Protestors in front of the Consumer Financial Protection Bureau office on Nov. 27, 2017, in Washington, DC, after Mick Mulvaney was appointed acting director.

When I first spoke to Jen, she was dismayed that none of her payments had been counted toward forgiveness. She’d attempted to contact FedLoan to rectify its mistake, but did not have private space in her workplace to make calls — and the helpline only operated during her work hours. An online help chat resource disappeared from the website some months ago. A rep at the company told her a review would take 60 to 90 days. Then they told her it would take a year. But after we first spoke, she got “fired up,” in her words, and decided to try again.

She took a day off work to handle the phone calls. She created a spreadsheet of her past payments to provide as evidence to FedLoan. She contacted the Department of Education’s Federal Student Aid Ombudsman Group, which then escalated her complaint. Two weeks later, her account record reflected that she had, in fact, made 38 payments toward the 120 necessary for forgiveness.

She still has to fight for the payments made over the last year, but it’s a start. “I will do this every year until I hit that magical 120,” she told me. “What other choice would I have?”

This might seem like a happy ending, or at least a passable one. But it’s not. “I’m a black, first-generation college graduate who majored in sociology,” Jen told me, “and despite my background and literal coursework about structural racism and inequality, I’ve held this very romanticized view of higher education for most of my life. In my mind, it was the only way I could escape from the stress of how I’d grown up — with the constant threat of not being able to pay rent, buy groceries, or pay bills — and the only way I’d be able to find a job where I could make a difference. That view inevitably changed as I’ve gotten older, but I’m still sometimes amazed at just how many rungs there are on the ladder to the middle class, and how, even as I (finally) make a decent salary, how precarious it still feels.” Her student loan debt, Jen says, is one of the greatest reminders of that.

Jen’s words reminded me of something Frotman had told me — that we often think the only people suffering under student debt are those who have defaulted on their loans, or have fallen behind on payments. “But that’s not true,” he said. “You have people who had to get a degree, had to get a graduate degree to stay in their job. They have no savings. They have no retirement. They’re not putting away any money for their kids to go to school. And the cycle just keeps perpetuating itself.”

I think of Kathryn, a 35-year-old with $118,000 in debt from a degree in museum studies, which she said, as a “naive working-class kid,” she didn’t realize was a professional field that’s “basically closed to poor folks.”

“I am so far in debt that will never go away,” she told me, “and all those things people do in life — marriage, travel, homes, a career, not living with your elderly mom who you don’t get along with in a one-bedroom apartment, not being scared all the time — will never come my way. I miss insurance. I have been to the dentist once in 15 years. I’m pretty sure that if I ever get diagnosed with cancer, I’ll just let it take me. What could I do? I couldn’t afford to fight it.”

Kathryn’s despair is visceral, but that doesn’t mean that it’s rare, or atypical. “I don’t think about my debt without also thinking of suicide,” a 30-year-old with $43,000 in debt, told me. “At first I felt a great a deal of anxiety about my debt, and a sense of shame about being a failure and a parasite for being unable to afford the loans. I still feel shame and anxiety, but the sense of failure has been replaced with anger. Anger about being lied to, pressured, and exploited. We were told that we were making an essential, basically non-optional investment in our futures. Instead we are now indentured servants.”

Like so many others in this story and across the US, these students believed in the education gospel — an ideology that remains as robust as ever, with little room to accommodate ambivalence and regret. Education is still a wonderful thing. But the contemporary parameters surrounding it — in which the individual takes on the whole of the risk for their education, with little faith that programs intended to ameliorate the debt load will work, or that they will be able to seek recourse when they don’t — are broken.

People talk about “free college” like it’s a radical idea, but for many, the central appeal of the proposal isn’t the lack of tuition; it’s the lack of debt. That’s not radical. That’s what millions of Americans — mostly white, mostly middle class — have enjoyed for decades. Which is part of why it’s so hard for those same Americans, many of them now in or moving toward retirement, to fathom why subsequent generations have accumulated so much more debt than they did. It’s also why those whose families have long been excluded from higher education feel increasingly ambivalent about the sacrifices necessary to join their ranks.

“I can't describe emphatically enough what a heartbreak student debt has been,” one borrower told me. She’d gone to undergrad on a full-ride scholarship, excelled in her classes, and was encouraged by her advisers to apply to grad school, where she then took on $40,000 in debt. “I was brought up to believe that if I worked hard and had a good education, I would do well,” she said. “I worked as hard as I could and spent more time in school than most people and I honestly believe it ruined my life. My parents wanted the best for me and, because of their social class, weren't able to adequately help me navigate what student debt would become during my lifetime, and I know they feel horrible about that as well.”

Like so many in this story, she’s spent years fighting FedLoan to count her payments toward forgiveness. “The stats [on forgiveness] have been totally demoralizing,” she said, “and have pretty much eliminated the last vestiges of hope I had for building a life anything like what my parents have.” If education doesn’t elevate you, and your children and grandchildren, to the middle class — instead saddling you with debt — is it actually worth it? Or, if education is so valuable in and of itself, and shouldn’t be tethered to or contingent on one’s class status, then why is it so prohibitively expensive?

Tressie McMillan Cottom proposes that “at heart, higher education is both a means of redressing socioeconomic inequality and perpetuating socio-economic inequalities in new guises.” For so many of us, it is our salvation and our damnation. It gets us everywhere and nowhere. It is our pride and our shame. It is invaluable and worth nothing at all. American life is rife with contradictions. But in our current moment, few such contradictions feel as isolating, as disproportionate, as insurmountable and heavy, as attempting to reconcile the education gospel and the student loan industrial complex.

“I feel so scammed and betrayed by the government, which is honestly so naive,” Kathryn told me. “How did I ever trust they would do the right thing? I never should have dreamt about meaningful work. I should’ve settled for clerical work and been happy with it. I feel stupid for reaching for anything in life.”

No comments:

Post a Comment