What is missing in all this analysis is that we have entered a world of cheap money and this is driving household worth higher than any other time in history. With burgeoning advent of bitcoin and its natural clones, i do not see this changing soon.

Yes Bitcoin really matters because it is dumping cash back into the economy at an accelerating rate outside of central bank control. In short savings are safely been recycled back into the economy for reinvestment.

All Good and add in the impact of the overall tax cut and the liquidity is exceptional.

.

The 30-Years Bubble---Why America Ain't That Rich

By David Stockman. Posted On Monday, December 11th, 2017

http://davidstockmanscontracorner.com/the-30-years-bubble-why-america-aint-that-rich/

The entire financial and economic narrative in today's Bubble Finance world is virtually context- and history-free; it's all about the short-term deltas and therefore exceedingly misleading and dangerous.

So when a big trend or condition is negative and unsustainable, you generally can't even get a glimpse of it from the so-called "high-frequency" weekly, monthly and even quarterly data on which the financial press and its casino patrons thrive. And that's not merely because most of the data from the government statistical mills is heavily massaged and modeled and often "adjusted" beyond recognition over 3-5 year intervals of statistical revision.

Beyond that, however, even medium term trends get largely ignored. That's because the purpose of economic and financial data today is to facilitate daily (and hourly) trading in the casino---not inform long-term investors about underlying trends, conditions and prospects.

The investor class of yore, in fact, has largely been destroyed by the last 30-years of monetary central planning and the Wall Street deformations it has fostered----meaning that, increasingly, headline reading algo-traders and trend-following speculators are the main consumers of the "incoming data".

For instance, scratch a talking head today and you get the "strong economy" meme as purportedly reflected in two back-to-back quarters of 3% real GDP growth. Yet there is absolutely nothing "strong" about the picture below or compelling about the last two quarters.

After all, during Q2 and Q3 2014 there were back-to-back growth quarters of 4.6% and 5.2%, respectively. But that didn't last long----nor did the 3.1% and 4.0% growth rates of Q3 and Q4 of 2013 or the three-quarter average of 3.0% in Q2-Q4 of 2010.

All of those "strong" quarters seem to have disappeared from the groupthink narrative, as well as the punk quarters strewn in-between. In part, that's because most of them were reported at far lower or higher levels at the time, meaning that the underlying trend has simply disappeared from the high-frequency narrative about good deltas and excuses for ones which are not.

Still, the heart of the problem is the foolishness of annualizing 90 days worth of preliminary data with seasonal adjustment factors that are rarely up to the task.

Moreover, the large aggregates like GDP are inherently buffeted by short-term shocks ( e.g. severe hurricanes not embedded in the seasonals), inventory stocking and destocking mini-cycles and the ebb and flow of global trade, exchange rates and credit impulses. These, in turn, reflect the machinations of what has now become a worldwide convoy of hyper-interventionist Keynesian central banks.

Even modest adjustments to deal with some of these disabilities give a starkly different picture. For example, consider what happens when you remove the inventory contribution to quarterly GDP----which washes to essentially zero over time---and also set aside the highly volatile impact of net import/export trade, which has actually averaged a -0.28% contribution to GDP growth over the last 11 quarters.

What remains might be termed "core GDP" and includes consumer spending, fixed investment and government output. On that basis, growth was 2.4% in Q4 2016; 2.4% and 2.8% in Q1 and Q2 2017, respectively; and just 2.0% in Q3 2017. That is, the latest quarter showed the weakest annualized expansion rate in the last year and there was no "3" in it or any of the previous three periods.

In fact, a true long-term investor would only need to know whether the trend of year-over year growth in real final sales---which removes the volatile inventory component---is accelerating or decelerating and where the economy stands in the business cycle.

The chart below answers that question and there is no awesome 3% about it: Real final sales growth during the current so-called recovery peaked 10 quarters ago; has always been exceedingly weak given the unusual depth of the Great Recession; and is now constrained by an expansion cycle that is exceedingly long in the tooth by all historic standards at 102 months.

Even on a near-term basis, it's pretty hard to say that the 2.3% year-over-year expansion of real final sales in Q3 2017 was meaningfully different from the 2.2% year-0ver-year rate of gain recorded in Q1 2016.

Indeed, the contrast between the alleged "strengthening" direction of the last four green bars in the chart above (quarterly GDP SAAR) and the actual "weakened" position represented by the last fourblues bars on the chart below (Y/Y real final sales growth) highlights why the Wall Street narrative is so chronically incomplete and misleading. The stock peddlers who moonlight as "strategists" and "economists" at Goldman, Morgan Stanley etc are essentially selling a short-term trading "edge" to fast money clients, not proffering fundamental analysis about the state of the business cycle and its implications for PE multiples and stock prices.

That's more than evident in the fact that when the real final sales growth trend peaked at 3.8% in Q1 2015, the S&P 500 stood at 2070 and was valued at 20.8X LTM reported earnings, compared to 2660 today, which represents 24.9X reported earnings.

That is, there has been a 40% downshift in the real final sales growth rate accompanied by a 400 basis point expansion of the PE multiple---and from what was already the nosebleed section of history. And the current PE inflation is occurring at a point when the business expansion is approaching the longest one in recorded history.

Indeed, this late cycle PE expansion is all the more ludicrous when the current condition of the US economy is placed in full historic context. Given the depth of the 2008-09 downturn and the tepid cumulative gains since then (there should have been a strong rebound), the handwriting is on the wall, emblazoned in red letters.

To wit, even if the current expansion should last another 12 or even 24 months, there still is no conceivable set of quarterly gains that could significantly elevate the 1.2% peak-to-peak real final sales growth rate for this cycle to date (i.e. it already embodies 108 months of actual results). But as shown below, that's just half the level of the Greenspan housing boom, and barely one-third of the 1980s and 1990s expansions.

So why are PE multiples (i.e. honest ones based on reported GAAP, not Wall Street ex-items forward hockey sticks) rising to historic highs, when the US economy's trend growth capacity has succumbed to Ross Perot's famous "sucking sound to the south", and when on top of that profit margins are at all-time highs and will eventually also succumb to mean-reversion towards the south?

We think the answer is patently obvious: Namely, the casino is not capitalizing the true facts of the US economy or even of reported earnings. The latter came in a $107 per share for the September LTM period----exactly $1 thin dollar above the $106 per share level recorded 36 months ago in September 2014 when the US economy was entering its cyclical high (blue bars above).

Instead, the stock market is essentially deliriously chasing the price action and pure momentum. So doing, it is implicitly capitalizing an omnipotent central bank that has purportedly vanquished the business cycle and ushered in an era of endless full employment and low bond yields, world without end.

But that gets us to the 30-years bubble. Stock market capitalization of perpetual full employment is another way of saying that the economic and financial foundation of the US economy is rock solid; and is capable of sustained expansion like no other time in history---while also being completely immune to external shocks such as, say, a crash of the Red Ponzi or the bankruptcy of Italy and consequent break-up of the Eurozone and collapse of the euro.

That presumption is preposterous, of course, but is nonetheless embedded in the Wall Street/Washington narrative. Otherwise, they would not be celebrating the chart below and last week's news that household net worth in Q3 2017 posted at a breathtaking historic high of $97 trillion. Yes, with a "T"!

The excitement, of course, was that the number was up by $7.3 trillion or 8.1% from Q3 2016 (i.e. the eve of Trump's election), and by $42 trillion from the post-crisis low in Q1 2009.

Who would have thunk it? A whopping $42 trillion of new national riches that absolutely no one could have imagined in the dark days of a purported near-armageddon 100 months ago.

Then again, the reason that the impossible has morphed into a quarterly celebrati0n on bubblevision is that no one is paying attention to the trend, its implications for the future and the economic logic embedded therein.

As to the latter, consider this. During the 30 years of halcyon prosperity in America between Q2 1957 and Q2 1987, real GDP grew at a 3.54% compound annual rate, while real household net worth rose at a nearly identical 3.42% annualized rate.

The one tracked the other, of course, because during any sustained period of time, the real wealth of a society cannot grow any faster than the growth of production and income. Not surprisingly, therefore, household net worth weighed in at 3.70X GDP in 1957 and the very same 3.68X GDP on the eve of Alan Greenspan's arrival at the Fed.

But that's where the skunk in the woodpile comes in. In a word, the regime of Keynesian monetary central planning or Bubble Finance ushered in by the Maestro, and then aggravated by Bernanke and Yellen during and after the Fed induced Great Financial crisis, caused the iron linkage between long-term growth of production and wealth to be temporarily suspended.

Consequently, household wealth---which soared from $18 trillion to $97 trillion between Q2 1987 and Q3 2017, as shown in the orange bars below, grew far faster than GDP. Accordingly, it now stands at an off-the-charts 5.0X nominal GDP of $19.5 trillion.

Stated differently, even though the trend growth rate has fallen sharply during the last 30 years, the wealth capitalization rate of the household sector has soared into the wild blue yonder compared to all prior history.

These ratios are both expressed in nominal numbers, of course, but when the chart below is re-priced into constant dollar terms by the GDP deflator, the disconnect is made all the more dramatic. Namely, even as the thirty-year real GDP growth rate fell from 3.54% during 1957-1987 to 2.54% during the last thirty year period, the real growth rate of household net worth actually accelerated.

Since the Greenspan instigated era of Bubble Finance commenced in 1987, real household net worth has nearly tripled in today's dollars (from $33 trillion to $97 trillion), representing a 3.6% annual growth rate.

\

Then again, the chart below suggests why these staggering gains in purported household wealth are not what they are cracked-up to be.

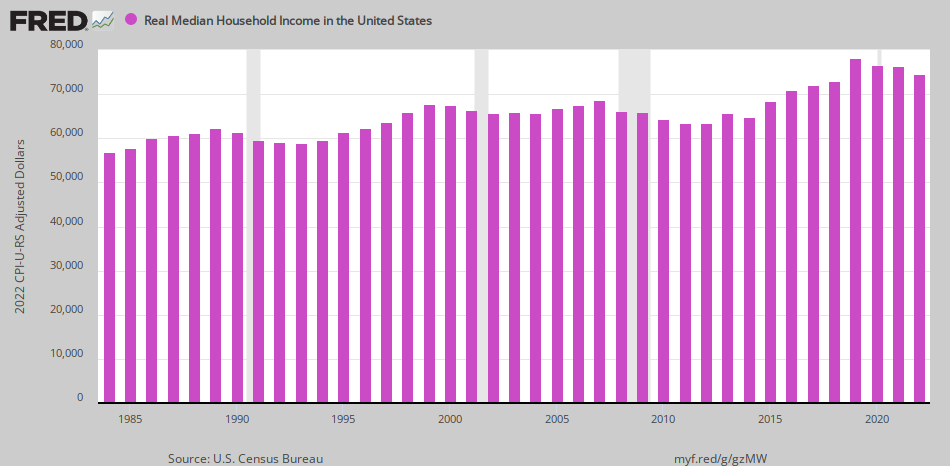

To wit, real median household income during the same 30-year period has crept higher at just a 0.4%annual rate. That means, in turn, that real wealth, as reported by the Fed's flow-of-funds series, has grown nine times faster than real median household incomes in America.

To be sure, on the surface that reflects the reverse Robin Hood effect of Bubble Finance at work. The inflation of financial and real estate assets have overwhelming gone to the top 1% and 10% of households.

But at the end of the day, that giant gap cannot be explained away by the notion that there has been a permanent redistribution of the wealth to the top of the economic latter.

To the contrary, the truth of the matter is that the $97 trillion of household wealth reported last week is neither real nor sustainable; it's merely another flashing red warning sign that financial asset inflation has reached dangerous asymptotic heights.

For instance, if the household net worth-to-GDP ratio had remained at its historic 3.7X level through the present, household net worth today would be just $72 trillion, implying that the Fed has generated at least $24 trillion of bottled air since 1987.

In fact, the overstatement of household net worth is far larger than even that. The burgeoning demographic/fiscal crisis in America will actually grind economic growth toward the zero bound during the decade of the 2020s as massive public sector borrowing forces bond yields dramatically higher.

And that will reveal the ugly underside of last week's flow-of-funds report. To wit, the nation is now saddled with $68 trillion of public and private debt compared to $10.7 trillion when the era of Bubble Finance incepted back in October 1987.

In combination with 85 million retirees (by the end of the next decade), this debt albatross will smother American capitalism in high taxes, high interest rates and battered balance sheets in both the household and business sectors. As that outcome unfolds, the current absurdly inflated stock market PE multiples will get monkey-hammered by the reality of stagnant growth and struggling profits.

That is to say, America ain't nearly so rich as the Fed's fantasy figures suggest.

And that's a truth you can take to the bank by getting out of the casino now!

No comments:

Post a Comment