I completely agree with this and i have gone further in understanding how it needs to be done which is rather important. His first sentence is precisely what i mean as well.

It is necessary to enable wealth creation at the bottom of the income pyramid. Wealth creation demands leveraging. The management of such leveraging must occur at the natural community level. in a way that ensures community participation.

A simple example will suffice. Charley needs to buy a tractor. Charley puts up a certain amount say x. This sum is matched by the community and funds are then borrowed to complete the transaction. This decision is approved by the established leadership under the rule of twelve. Lending is determined by the community reserves. Everything follows from this rather naturally and in a natural community, you soon have several thriving enterprises and everyone fully engaged..

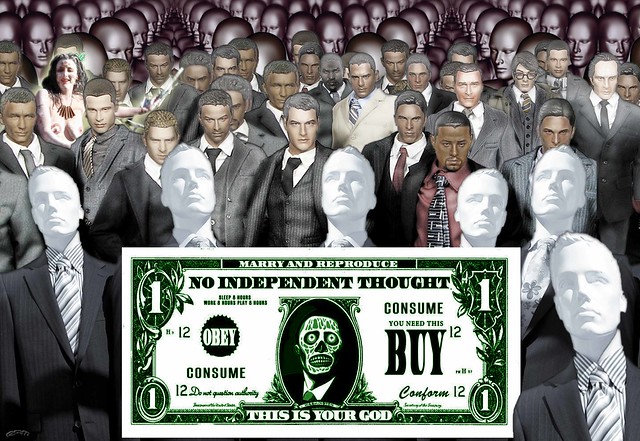

If We Don't Change the Way Money Is Created and Distributed, We Change Nothing

The only real solution in my view is to create and distribute money at the base of the pyramid rather than to those in the top of the pyramid.

http://nexusilluminati.blogspot.ca/

Many well-intended people want to reform the status quo for all sorts of worthy reasons: to reduce wealth inequality, restore democracy, create good-paying jobs, and so on.

All these goals are laudable, but if we don't change the way money is created and distributed, nothing really changes: wealth inequality will keep rising, governance will remain a bidding process of the wealthy, wages will continue stagnating, etc.

If the money creation/distribution system isn't transformed, "reform" is nothing more than ineffectual policy tweaks that offer do-gooders the illusion of progress.

Mike Swanson of Wall Street Window and I discuss the The Future of Currencies and CHS's New Book A Radically Beneficial World (33:21)

Few are willing to admit that the way we create and distribute money at the top of the wealth pyramid necessarily generates increasing wealth inequality because once we admit this, we realize

1) the money system itself is the source of inequality and

2) we have to change the money system if we want to stave off the inevitable rise of wealth inequality to the point that it generates social disorder.

In the current system, money is created by central and private banks at the top of the wealth/power pyramid, and distributed within the top of the wealth pyramid. The only possible output of this system is rising wealth inequality and debt-serfdom for three reasons:

Those with first access to nearly free money can outbid savers and serfs who must borrow at much higher rates of interest to snap up income-producing assets. In effect, borrowing unlimited sums at near-zero rates guarantees that those with this privilege have a built-in advantage in buying income-producing assets. The only possible output of this system is the rich get richer as they buy up all the most profitable and lowest-risk income-producing assets.

Those who can borrow virtually unlimited sums at less than 1% interest skim vast wealth by loaning the money out to everyone below the top of the pyramid at 4% (mortgages), 8% (other loans), and 18% (credit cards). This funnels much of the national income stream to those who can borrow cheap and lend the money at much higher rates.

Since the wealthy already own most of the income-producing assets, the easiest way to boost their wealth is to bid up those assets with cheaply borrowed money. For example, borrowing $100 million and using it for stock buybacks leverages the value of the shares by far more than $100 million.

Three different perspectives of the wealth pyramid illustrate how our money system generates wealth inequality as the only possible output of the system:

The system of central banks, private banks and fractional reserve lending is global. The net result is that globally, the vast majority of wealth is owned and controlled by those at the very apex of the wealth/power pyramid: the top 8% own 85% of global wealth.

In the U.S., the wealth-income pyramid can be represented by an inverted pyramid: the bulk of wealth and income are in the hands of the top 5%. The bottom 80% own an essentially trivial percentage of the national wealth.

This pyramid illustrates how the money creation and distribution pyramid works:

There are a number of proposed alternatives to this the rich can only get richer and the rest of us can only get poorer system. The only real solution in my view is create and distribute money at the base of the pyramid, to those generating useful goods and services in the community economy, rather than to those in the top of the pyramid. This money isn't borrowed into existence, so there is no interest to be skimmed by its creation.

I explain how this works in my new book A Radically Beneficial World: Automation, Technology and Creating Jobs for All.

The World of Work Has Changed, and It's Never Going Back to the "Good Old Days”

Wishful thinking is not a solution.

The world of work has changed, and the rate of change is increasing. Despite the hopes of those who want to turn back the clock to the golden era of high-paying, low-skilled manufacturing jobs and an abundance of secure service-sector white collar jobs, history doesn't have a reverse gear (tm).

The world of work is never going back to the "good old days" of 1955, 1965, 1985, or 1995. Jason Burack of Wall Street for Main St. and I discuss these trends in a new podcast, Radical Changes in the Job Market, Now & in the Future (47:37).

Those hoping for history to reverse gears place their faith in these wishful-thinking fantasies:

1. That automation will create more jobs than it destroys because that's what happened in the 1st and 2nd Industrial Revolutions. The wishful thinkers expect the Digital / 3rd Industrial Revolution to follow suite, but it won't: previous technological revolutions generated tens of millions of new low-skill jobs to replace the low-skill jobs that were lost to technology.

Millions of farm laborers moved to the factory floor in the 1st Industrial Revolution, and then millions of displaced factory workers moved to sales and clerk jobs in the 2nd Industrial Revolution.

Even white-collar jobs that supposedly required a college degree could be learned in a matter of hours, days or at most weeks, and little effort was required to stay current.

The Digital/3rd Industrial Revolution is not creating tens of millions of low-skill jobs, and it never will. Even worse for the wishful thinking crowd, the 3rd Digital Revolution is eating tech jobs along with the full spectrum of service-sector jobs.

Those expecting to replace low-skill service jobs with armies of coders will be disappointed, because coding is itself being automated.

The new jobs that are being created are few in number and highly demanding.Jobs are no longer strictly traditional boss-employee; the real growth is in peer-to-peer collaboration and what I term hybrid work performed by Mobile Creatives, workers with highly developed technical/creative/social skillsets who are comfortable working with rapidly changing technologies, who enjoy constant learning and are highly adaptive.

The work that is being created in the Digital/3rd Industrial Revolution is contingent and thus insecure. The only security that is attainable in fast-changing environments is the security offered by broad-based skillsets, great adaptability, a voracious appetite for new learning and a keenly developed set of "soft skills": communication, collaboration, self-management, etc.

I cover all this in depth in my book Get a Job, Build a Real Career and Defy a Bewildering Economy.

The problem is the number of these jobs is far smaller than the number of jobs that will be eaten by software, AI and robotics. The number of workers who can transition productively to this far more demanding and insecure work environment is also much smaller than the workforce displaced by software/robotics.

In short, we need a new system; wishful thinking isn't a solution.

2. That the U.S. can unilaterally demand the right to export its goods and services to others at full price while refusing to accept competing imports. In effect, the fantasy is to return to 1955, when the U.S. could export goods at full pop to the allies who were rebuilding their war-shattered economies. Imports were few because those economies were busy focusing on their own domestic needs.

Trade is a two-way street. Fair trade is a moving target, depending on which side of the trade you happen to be on. Everybody wants to export their surplus at top prices, but competition lowers prices and profits. This forces global corporations to seek cost advantages by lowering the cost of components and labor.

3. The wishful thinkers want strong corporate profits to prop up their stock market and pension funds, but they don't want corporations to do what is necessary to reap strong profits, i.e. move production of commoditized goods and services overseas or replace human labor with cheaper automation.

You can't have it both ways.

Wishful thinkers choose to ignore the reality that roughly half of all U.S. based global corporate sales and profits are reaped overseas. It makes zero financial sense to pay a U.S. worker $20/hour, and pay the insanely expensive costs of sickcare/"healthcare" in the U.S. when the work can be done closer to the actual markets for the goods and services at a fraction of the cost.

Memo to all the armchair wishful thinkers: if you want to compete globally with a high-cost U.S. work force and no automation, be my guest. Put your own money and time at risk and go make it happen. Go hire people at top dollar and provide full benefits, and then go out and make big profits in the global marketplace.

The armchair pundits and ivory tower academics would quickly lose their shirts and come back broke. That's why they wouldn't dare risk their own security, capital and time doing what they demand of others.

4. The wishful thinkers decry the lack of "good-paying" jobs yet they refuse to look at the reasons why employing people in the traditional boss/employee hierarchy no longer makes sense. The armchair pundits and ivory tower academics have never hired even one person with their own money. These protected privileged are living in a fantasy-world of academia, think tanks and foundations, where workers are paid with state money, grants, venture capital, etc.

As I have often noted here, Immanuel Wallerstein listed the systemic reasons why labor overhead costs will continue to rise even as wages stagnate. This means employers see total labor costs rising even if wages go nowhere: it gets more and more expensive to hire workers.

Then there's the staggering burden of liability in a litigious society, the costs of training and supervising ill-prepared employees and the hard-to-calculate costs of increasingly complex regulations.

5. We can solve the decline of the traditional work model with more education.This is also wishful thinking, as not only is higher education failing to produce workers with the requisite range of skills, the emphasis on higher education has produced an over-supply of people with college diplomas.

In the real world, even wages of the most highly educated are stagnating.

The structural changes in the world of work are visible in these charts:

The civilian participation rate is plummeting, despite the "recovery:"

The civilian participation rate for men is in a multi-decade decline:

Part-time jobs do not provide enough income to have an independent household or raise a family, nor do they pay enough taxes to fund the Savior State. The only jobs that count are full-time jobs, and they haven't even returned to 2007 levels despite a higher GDP and a rising population.

As a percentage of GDP, wages have been declining for decades.

Self-employment is the wellspring of entrepreneurs and small business. As you can see, it has also been declining for decades.

It's time to get real, people. Wishful thinking is not a solution. We need a new system for creating paid work and money, and here's my proposed alternative system: A Radically Beneficial World: Automation, Technology and Creating Jobs for All.

The Most Profitable Work Will Be Automated: The Rest Will Be Left to Us

A new system is self-organizing before our eyes. We just have to stop obstructing its rise and start facilitating its expansion in self-evident ways.

What's abundant and what's scarce? The question matters because as economist Michael Spence (among others) has noted, value and profits flow to what's scarce.What's in over-supply has little to no scarcity value and hence little to no profitability.

What's abundant is unprofitable work, commoditized goods and services, and conventional labor and capital (which is why wages are declining and yields on capital are near-zero).

What's scarce is profitable work, highly profitable niches that are immune to commoditization/ automation, and meaningful work.

Drew Sample of the samplehour.com and I discuss scarcity and profit in the contexts of Decentralization, Entrepreneurship, Bike Paths, Craft Brew, Automation & more (1:12)

The conversation is not between two ivory-tower types who have never started an enterprise in their life; it's a conversation between a young mobile creative(Drew) who is establishing a hybrid work career of multiple micro-enterprises and paid work and a grizzled veteran of multiple careers and businesses (me--with plenty of failures that gave me the necessary experience to learn how to accumulate all forms of capital and own my own means of production).

In other words, this is a conversation between people who are walking the walk, not just jawjacking about abstractions that somebody else is supposed to make real with their own money and time.

So let's get started.

Everyone wants an abundance of "good paying" jobs, but employers can only afford to pay employees if the work being done is profitable. Paying people to do unprofitable work is a one-way street to bankruptcy.

Those who want the government to fund "good paying" jobs forget that government tax revenues depend on profitable enterprises and the private-sector wages they pay.

(Borrowing from our grandkids to pay public-sector wages today is immoral and financially unsustainable.)

If we look at urban slums and impoverished rural communities, we find the problem isn't a lack of work that needs to be done--it's a lack of paid work and a lack of profitable work.

Businesses have pushed unprofitable work onto the customer. Paying people to pump customers' gas is not profitable (if it was, some corporation would be doing it). Rather than lose money by paying employees to pump gas, the industry shifted that unprofitable labor onto customers.

A great amount of useful work is not profitable and can never be profitable. We need to differentiate useful work from profitable work. One example that illustrates the difference is building and maintaining bikeways to serve commercial areas. (By this I mean bikeways not devoted to leisurely rides through parkways but bikeways that one can use to reach grocery stores, banks, post offices, cafes, childcare centers, etc.)

The work of building and maintaining safe bikeways is clearly useful. Safe bikeways have multiple benefits for commerce, communities, the environment and for individuals: safe commuter bikeways cut traffic congestion, improve the health of the bicyclists, lower healthcare costs, boost small businesses along the bikeways and reduce air pollution.

Safe bikeways (i.e. those which are dedicated to bikes so riders aren't sharing the road with semi-trucks and autos wandering over the pavement while the driver is texting) are win-win-win, yet they can never be profitable unless bicyclists are charged a toll, which defeats the entire purpose of the bikeway.

Impoverished areas are impoverished because there are few highly profitable scarcities to fill and few people with the surplus income to pay for profitable services. Taking money from one community to fund make-work jobs in another community (the essence of government redistribution schemes) deprives one community of income while providing a temporary injection of income in the other community--income that is controlled by a government that is itself controlled by lobbyists and privileged elites.

Redistribution schemes act as bread and circuses to suppress social disorder, but they don't address local scarcities in a sustainable way or foster the expansion of long-term solutions to a lack of work.

There are two fundamental solutions to a lack of profitable work. One is to pay people to do useful work that is not profitable and do so with a labor-backed crypto-currency that isn't borrowed or taken from some other community, and the second is to nurture community-economy entrepreneurship that works within decentralized networks and groups rather than through central states and global corporations.

I explain how these solutions work in my new book A Radically Beneficial World: Automation, Technology and Creating Jobs for All.

Slums get government transfers and remain slums. Communities that rely on global corporations sink quickly into impoverishment when those corporations pull up stakes and move to cheaper locales or automate the profitable work.

Communities that foster small-scale entrepreneurship, local efforts to address local scarcities and paid useful work thrive in ways that contrast sharply with communities dependent on bread and circuses and global corporations.

The model of expecting global corporations and Big Government to solve the scarcity of paid work is broken. Paul Mason does an excellent job of explaining why in this article from mid-2015: The end of capitalism has begun: the rise of non-market production, of unownable information, of peer networks and unmanaged enterprises.

We need a new system. A new system is self-organizing before our eyes. We just have to stop obstructing its rise and start facilitating its expansion in self-evident ways.

No comments:

Post a Comment